Map from www.weather.com

The East Coast battened down the hatches this week, as severe winter weather looms over the most densely populated part of the country. Thousands of planes have been grounded, and New York Mayor Bill de Blasio has ordered city streets closed to all but emergency vehicles tonight. Even NBA games have been postponed, with blizzard warnings in effect throughout the Northeast.

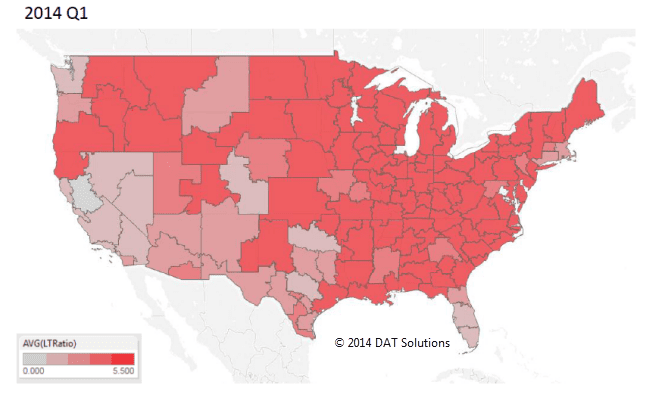

The heavy snow and ice could have many in the trucking industry feeling déjà vu, as winter storms in the same region wreaked havoc on the nation’s supply chain not so long ago. A quick comparison of the load-to-truck ratios in Q1 of 2013 and Q1 of 2014 shows how big an impact last year’s winter had on truckload freight:

The snarled supply chains, coupled with a rebounding economy, led to strong demand for freight transportation throughout 2014, with load posts on the DAT Load Boards up 54% over the previous year. This most recent storm shouldn’t have as drastic an effect on freight movements, though, as a few things should mitigate the impact.

For one, the storm materialized over the weekend, giving businesses a chance to plan ahead. And last year, the storms hit all over the country, over and over in a span of a few months. If the disruption is limited to a couple of days, freight can be postponed. Expect an increase in Northeast rates next week, as supply chains backup and then high demand takes hold once goods can move again, but the rest of the country looks calm, which also allows companies to focus on Northeast issues.

Most major intermodal corridors will not be impacted – ramps in New Jersey are the big exception. Railroads are also better prepared for inclement weather this year. After last year’s transportation fiasco, BNSF, UNP, NSC and CSX all added locomotives and other equipment, hired more operational employees, and improved procedures and infrastructure for handling weather-related challenges.

Fuel is more affordable now than at this time last year, too, with diesel prices dropping to less than $3 per gallon on average across the country. That’s good news for carriers, as fuel is a large operating cost for any fleet. When trucks are sidelined by storms, revenue is reduced, and any cost savings helps the bottom line.

The HOS rollback also restored some of the fleet productivity that was lost during last year’s Polar Vortex, and many carriers have expanded their fleets since then, resulting in record sales of Class 8 trucks.

Road conditions also improved, as state and local governments across the country repaired highways, purchased snow-removal equipment and established better procedures to cope with extreme weather.

Get the most accurate and up-to-the-minute rate information on 65,000 lanes with DAT RateView. To learn more or request a demo, please contact our award-winning customer service team at 800.511.8844 or complete this online form.