We are swiftly moving into the holiday part of the year. Yet the freight surges that many of us have been accustomed to seeing at this time have been noticeably absent. For multiple reasons, spot market freight volumes and rates have been trending down for most of 2015 — van rates since March, and flatbed and reefer rates since June. Now a plateau is forming, if not exactly an upward trend.

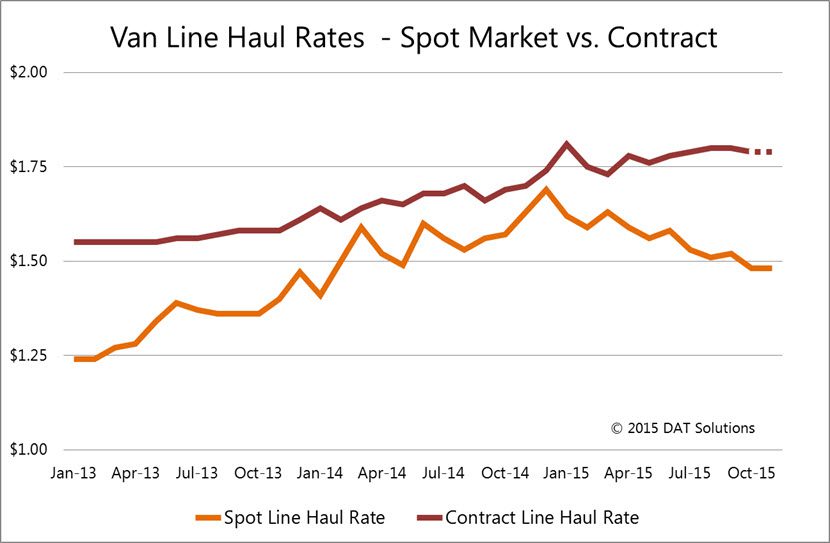

As an example, here is a comparison between spot market rates and contract rates, based on the line haul only, with the fuel surcharge omitted:

Spot market rates have fallen steadily since March, but are leveling off now. Contract rates (brown line) have risen almost as steadily, but also appear to be leveling off. The gap between the two lines is likely to narrow again in the coming months.

Dozens of Hot Markets. Others Not So Hot.

While the majority of markets are slowing down, there are plenty of exceptions. I did a survey of hot markets in the U.S., those with a load-to-truck ratio above 2.5 for vans, and I found 24 of the 135 markets with some degree of tightness. The cities with tight capacity include Memphis, Rock Island, IL, and Portland, OR.

On the other hand, there are another 46 metropolitan markets that are very soft, with load-truck ratios below one-to-one. These include major distribution hubs: Atlanta, Chicago, Dallas, Allentown, PA, and Elizabeth, NJ. This trend suggests the Grinch may show up for Christmas.

PMI Sectors Produce More Freight Than NMI Counterparts

Then again, while the Purchasing Managers’ Index (PMI) was down to 50.1 in October, the Non-Manufacturing Index (NMI) is up to 59.1 from 56.9. New orders and employment numbers, as well as construction, all contribute to the positive NMI trend. This explains why the overall economy continues to move forward, even though manufacturing is stuck in neutral. It also explains why freight seems anemic, despite GDP growth: the economic sectors measured by NMI do not produce as much freight as their PMI-component counterparts.

Spot Rates Hold Steady for Vans and Reefers in November

Van and reefer spot market rates are holding steady in November, so far. We may even see a surge in volume, as shippers need to hit critical target dates for holiday deliveries or work around business closures during Thanksgiving week. The more I see these trends, the more I’m inclined to think spot market rates have found the bottom.

Some Shippers Roll Back Contract Rate Increases

Contract rates are another story. Following the narrative of 2014 and tight capacity, many shippers adjusted their contract pricing to ensure capacity. Falling fuel rates resulted in lower fuel surcharges, allowing shippers to grant increases in line haul rates, while cutting overall transportation budgets. Now with extra capacity evident, some shippers are pushing back and demanding lower line haul rates.

This might provide that additional push into the spot market. Sometimes carriers have to decide between deadheading 50 miles for that last-minute load from a contract shipper or picking up a load from a broker that is across the street from a delivery. If the shipper pushes too hard on rates, that truck might find a better option on the load board.

Rates are derived from DAT RateView, a unique rate benchmarking tool based on 65,000 lanes in the U.S. and Canada, for vans, reefers and flatbeds. All rates are for actual freight movements with pickup dates during the corresponding months, as noted. For more information on DAT RateView, contact our award-winning customer support team at 800.551.8847 or fill out this online form.