Leafy green production in “The Winter Salad Bowl” in Yuma, AZ, is drawing to a close as growers transition back to the Salinas Valley in California. Yuma, also known as America’s winter lettuce capital, produces just under 90% of the lettuce, citrus, and many other vegetables for the United States every winter.

According to Mark McBride of Coastline Family Farms, lettuce markets in Yuma, AZ, have seen escalating prices thanks to swinging weather patterns. “Because of the weather conditions we’ve had–it’s alternating hotter than normal with cooler than normal impacting head size and price,” he said. The latest data from the USDA indicated shipments of lettuce in California’s Imperial Valley and Yuma was down 16% y/y in March, although total volumes for the winter season are up 5% y/y.

The leafy green season in the Imperial Valley has about three weeks to run before growers shift operations from Yuma back to the Salinas Valley just south of San Francisco. Growers like Church Brothers Farms will move their entire salad plant between the two locations involving over 200 people and 60 flatbed trucks twice each year. For reefer carriers, this means a shift in production volumes of leafy greens back to the Central and Salinas Valley until Winter rolls around again.

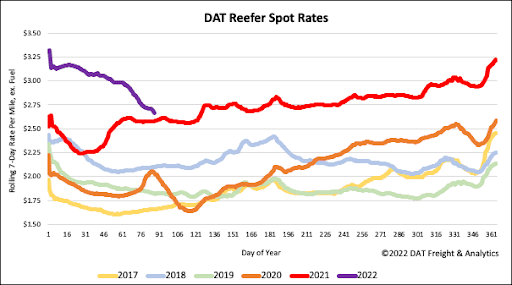

As produce volumes decrease, so do spot rates out of Yuma, AZ, to all major markets. Average reefer rates in the Phoenix market have dropped by $0.42/mile m/m to an average outbound rate of $2.47/mile excl. FSC this week. Load post volumes are also down 30% in the last four weeks. Loads west to Los Angeles have dropped to $3.58/mile excl. FSC, after averaging $0.16/mile higher in February – that’s still $0.76/mile higher than the previous year. Long haul loads to Elizabeth, NJ, have plummeted to $2.15/mile excl. FSC this week, which is $0.63/mile lower than the same week in 2021.

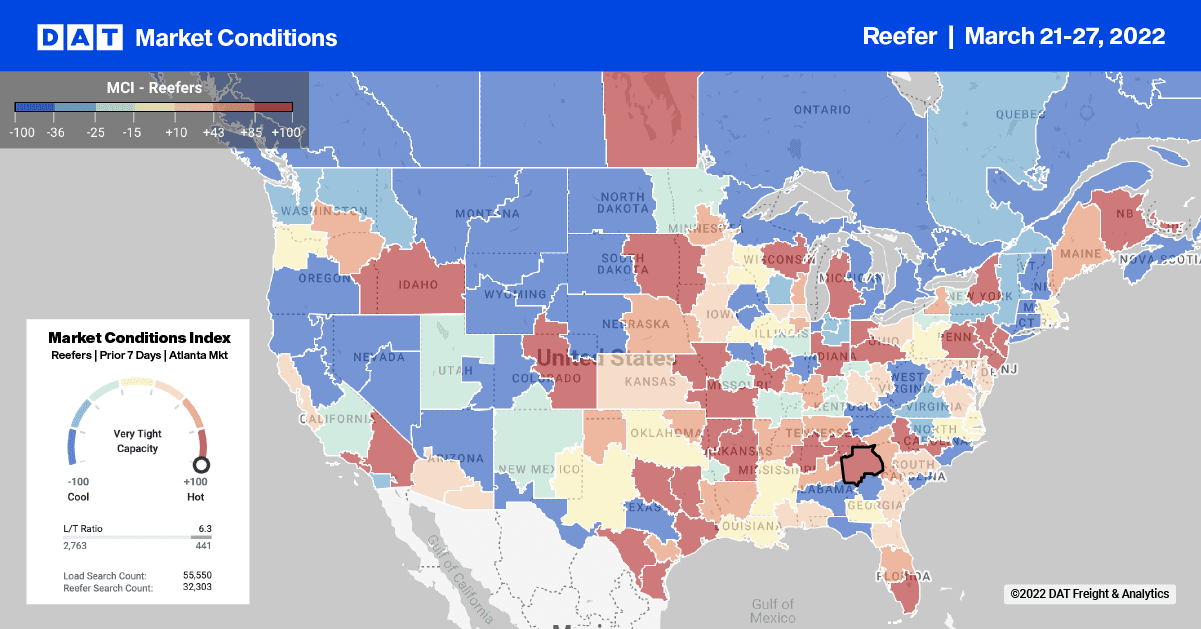

Along the Gulf Coast in New Orleans, reefer capacity tightened rapidly last week following an increase of $0.90/mile to an average outbound rate of $3.10/mile excl. FSC. Loads east to the Lakeland, FL, market were down to $3.40/mile excl. FSC after being almost $0.60/mile higher in the second half of last year. In the West, capacity remains tight in Las Vegas as rates continue to drop on inbound loads, including the high-volume Los Angeles lane. After peaking at $6.35/mile excl. FSC last November, reefer rates have dropped by $1.75/mile to an average outbound rate of $4.60/mile excl. FSC this week.

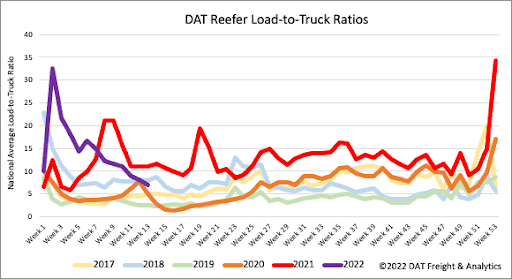

According to the USDA, domestic produce volumes were down 35% y/y last week; imported volumes are also down by 8% y/y, which explains the drop in reefer volumes in the previous few weeks. Last week, load post volumes dropped 14%, resulting in the reefer load-to-truck ratio decreasing by 14% w/w from 8.09 to 6.93.

Reefer spot rates dropped another $0.06/mile last week and are now down almost $0.30/mile in the previous month. The reefer national average spot rate ended last week at $2.69/mile excl. FSC is $0.09/mile higher than the previous period last year.