One week after one of the world’s largest container vessels lost control and ran aground, blocking the Suez Canal, over 300 vessels were stuck waiting to transit the world’s most important trade route. According to the Suez Canal Authority, around 50 ships per day pass through the canal, which connects Asia, Europe and the United States, making it a key waterway in international trade.

Just four weeks ago the U.S. saw a similar event occur when Interstate 40, one of busiest trucking highways, shut down due to the Polar Vortex weather event, taking around 7% of capacity out of the market. It took three weeks for truck markets to stabilize after that acute capacity crunch.

Get the clearest, most accurate view of the truckload marketplace with data from DAT iQ.

Tune into DAT iQ Live, live on YouTube or LinkedIn, 10am ET every Tuesday.

The World Shipping Council estimates the Suez Canal reduces the transit time from the Arabian Gulf to London by 10 days compared to the longer journey around the Cape of Good Hope. A large number of vessels already elected to take the longer route back to Asia before the Ever Given was freed. More port disruption and congestion is on the horizon.

Ripple effects for U.S. ports

Ports on the East Coast of the U.S. are already experiencing higher import volumes and congestion, which means this vessel grounding will add more delay to everything from food, furniture, clothes, shoes, exercise equipment, electronics, car parts and carpets being imported to the U.S. Even though the Ever Given was bound for Rotterdam from China, there are numerous vessels delayed that are bound for East Coast ports. Additionally, the blockage also delays the return of empty containers to Asia for reloading.

At a time when the U.S. ports are struggling to overcome surging volumes, the grounding of the Ever Given could result in a ripple effect throughout the intermodal and truckload sectors through the summer.

“The dominoes have been toppled,” Lars Jensen, chief executive of SeaIntelligence Consulting in Copenhagen, wrote on social media over the weekend. “The delays and re-routing which have already happened will cause ripple effects on both vessels and empty equipment, which will be felt for several months.”

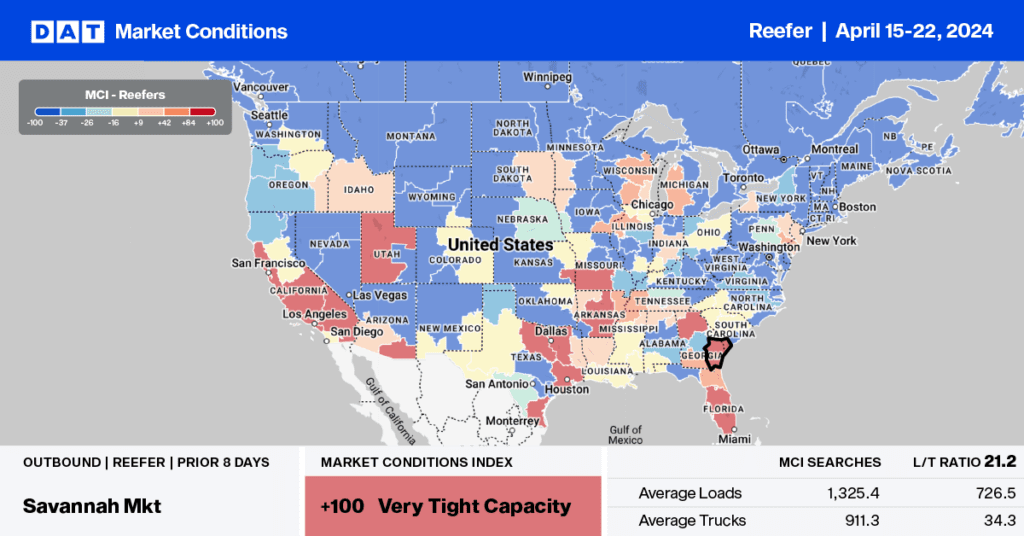

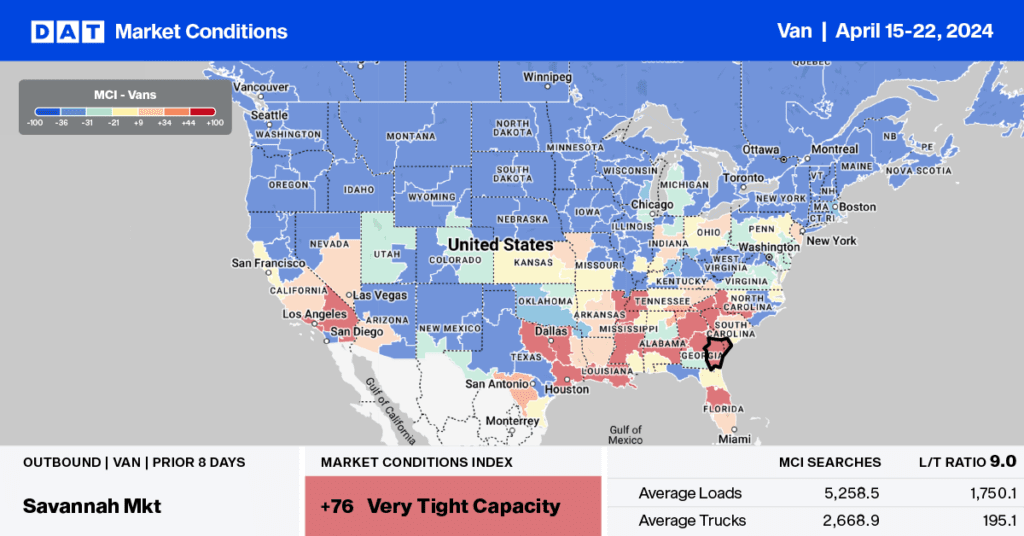

All eyes will be on the U.S. East Coast ports, including Savannah, GA, where around one third of their container traffic travels via the Suez Canal.