The shipper’s guide to building a smarter freight carrier strategy

Freight market volatility has made it riskier than ever to rely on a small, static group of carriers. Seasonal surges, changes in service levels, and even bankruptcies have exposed the limits of traditional freight carrier strategies. Building a more resilient approach means diversifying your carrier network, making use of real-time data, and staying more flexible.

Why your freight carrier strategy needs an upgrade

The freight market has become more volatile, and this unpredictability also affects carrier behaviour and abilities. Relying on the same group of carriers is no longer a safe strategy, with more frequent capacity issues, seasonal fluctuations, and unexpected carrier bankruptcies. The traditional approach of sticking with a small, loyal group of carriers simply isn’t enough anymore.

Instead, you must adopt a more resilient, adaptable freight carrier strategy. A smarter approach is one that is data-driven and flexible enough to respond to market disruptions. Using modern technology and tools, you can diversify your carrier base, optimize your routing guides, and make proactive decisions to reduce risks to your business.

It’s important to remember that there’s no one-size-fits-all approach, and that the right strategy depends on your business factors. Nonetheless, there are a few key things to keep in mind. This article will review the risks of a static carrier network, optimization, and how to evaluate and diversify your current setup. Then we’ll go through how to use data to tap into broader markets, turn insights into actionable steps, and how carrier diversification supports your business.

The risks of a static carrier network

Relying on the same set of carriers for your entire freight network can seem like a safe approach. Consistent shipper/carrier relationships bring reliability and trust built over time. However, keeping a static carrier network can pose several risks in today’s dynamic market.

First, overreliance on a few carriers for all your shipments can create a vulnerable position. If one of these carriers faces a disruption (bankruptcy, capacity shortages, or service issues), it can leave you scrambling to find alternative solutions at the last minute.

In addition, by not regularly evaluating new carriers that have entered the market, you could miss out on cost-effective carriers or carriers that offer better service levels. As new carriers emerge or existing ones expand their capabilities, you may miss opportunities to take advantage of better service while lowering costs.

Finally, when you stick to a small, static group of carriers, it’s easy to miss when capacity is taking a hit or when a carrier’s performance starts to decline. Issues like service delays or rising rates may sneak up on you, unless you’re carrying out a regular review process and comparing your current carriers with new entrants.

Real world examples

Some real-world problems with static carrier networks include:

- Late deliveries: Over-reliance on a small number of carriers can lead to delays if they’re experiencing capacity or operational issues. A lack of carrier diversification makes it harder to pivot and pick up slack when things go wrong.

- Rejected tenders: When a carrier can’t meet the terms or cannot accept your freight under the right conditions, you might have to deal with tender rejections. These rejections disrupt your supply chain and create inefficiencies, particularly when no backup carriers are lined up.

- Overpaying on underperforming lanes: Always using the same carriers without looking further afield can lead to overpaying. Without benchmarking performance against alternative or new carriers, you can easily miss out on better rates or more efficient freight allocations.

How to evaluate and diversify your carrier base

Now that you know the risks of having a static carrier network, let’s take a look at how to evaluate your carrier base and improve your carrier network optimization. Here are four key steps to help you find gaps in your network:

- Set clear performance metrics: Key metrics to track include how often carriers deliver on time, how often carriers reject tenders or fail to accept shipments, and how well your carriers keep you up to date about delays, capacity changes, or other shifts. When you have clear metrics to assess your carriers, you can more easily spot capacity issues, service failures, or misalignment with your needs.

- Use historical service data and market comparisons to assess each carrier: With a high-quality load board and network analysis tool, you can compare this historical information with broader market trends to determine whether the carrier is performing in line with industry standards. Alternatively, you may find other carriers who are offering better service or could provide cost savings for your business.

- Identify capacity gaps by region, lane, or mode: Using data analytics tools, try to discover capacity gaps in your network. This could be region-specific, lane-specific, or even mode-specific capacity gaps. If a carrier isn’t able to service certain lanes or regions or can do it only occasionally, you likely need to expand your carrier network in those areas.

- Build relationships with alternative carriers before you need them: Finally, one important step is to establish relationships with alternative carriers well before you need them. Build up a pool of trusted carriers that you can turn to when necessary, so that you’re not left high and dry during periods of high demand or when one of your main carriers runs into an issue.

Using data to improve routing guides and reduce tender rejection

Optimizing your routing guide and reducing tender rejection rates are other vital parts of carrier network optimization. By using a data-driven approach, you can ensure that your routing guides are aligned with your needs and flexible enough to adapt to changes in the market.

Four key steps to take include:

- Analyze where your routing guide fails: Review your routing guide to identify any weak points. Look for high fall-off rates (when shipments are dropped from the routing guide)—this can be a sign that a carrier cannot consistently meet your needs. In addition, look for slow tender acceptances. If a carrier takes a long time to accept tenders, it could indicate mismatches in capacity or poor communication on the carrier’s side.

- Adjust carrier allocations using performance data and market conditions: Once you’ve identified where your routing guide is weak, shift your carrier allocations to match. Use performance data from historical shipments to decide which carriers should be prioritized or removed from specific lanes. In addition, change which carriers handle certain routes to deal with fluctuating demand or seasonal capacity shortages.

- Use network analytics tools to identify regions or lanes with unreliable capacity: Use high-quality network analytics tools to get a clearer picture of your entire carrier network. Good-quality tools can help find areas or lanes where capacity is unstable so that you can proactively address them. For example, if you notice specific lanes have a lot of high rejection rates or delays, change your routing strategy to avoid or find additional carriers to service those areas.

- Reallocate freight based on carrier strengths and coverage patterns: If a carrier consistently performs well in certain regions but struggles with others, shifting those routes to a more reliable provider (or providers) can reduce inefficiencies and improve your service. Look at each carrier’s strengths and play to those, and cover any weaknesses you discover.

Tapping into broader market capacity

You need to monitor trends and look for new opportunities to take advantage of broader market capacity. This can help you find new carriers and expand your network in ways that keep your strategy more dynamic and sustainable over the long term.

One key part of this is using market data, which can help you identify alternative capacity in underserved lanes. Certain regions or routes often experience capacity shortages, but with the right data and market information, you can find new carriers that can help to plug these gaps.

In addition, you can discover high-performing carriers from other parts of the market by keeping track of broader market capacity. These high-performing carriers are good candidates for expanding your network when needed, and you can start building relationships with them as soon as you discover them. Finally, following market trends and capacity helps you to avoid overexposure to high-risk or highly concentrated carriers.

Carrier scorecards: turn insight into action

Carrier scorecards are part of turning analytics and performance data into insights you can act on. Scorecards should reflect the key metrics important to your business, including on-time delivery rates, tender rejection rates, communication quality, and how cost-effective a carrier is. Creating these scorecards gives you a clear, data-driven perspective on each carrier’s performance. These metrics allow you to spot high-performing carriers and help you see where improvement is needed.

Once you have a scorecard set up, you need to share your conclusions and performance reviews with your carriers regularly. This helps your carrier network know what your expectations are and whether they are meeting them. Transparency and open discussion can even help carriers improve or shift in ways to better meet your business needs. This creates a culture of collaboration and improvement that can vastly improve your network and help you look elsewhere when improvement doesn’t happen.

Scorecards can also prioritize carriers when making procurement and routing decisions. When choosing a freight carrier for a specific load or route, you can use scorecards to guide your choices. Instead of a fantasy idea of your carrier relationships, data should dictate your freight allocation strategy. This ensures you always choose carriers based on performance, not just familiarity.

How carrier diversification supports cost, service, and resilience goals

These shifts to your freight carrier strategy can significantly improve your service, cost, and resilience metrics. Carrier diversification helps your business in a number of ways.

Reduces dependence on a single provider during disruption.

Diversifying your carrier base helps to reduce the risks that come with relying too heavily on one or two carriers. If service failures, bankruptcies, or seasonal capacity problems arise, a diversified network makes sure you have backup options.

Improves service by matching freight to the best-fit carrier.

By taking stock of your carriers based on their strengths and capabilities, as well as data-driven scorecards, you can assign loads to the most appropriate providers for each lane, region, or service type. This leads to better on-time performance, fewer delays, and more reliable service overall.

Provides leverage in rate negotiations.

When you have a variety of options and don’t know how to choose a freight carrier, you can look around for the best pricing and terms. Having alternative capacity and options available also gives you an upside in negotiations, which can help you get better rates and conditions, particularly in rapidly changing market conditions.

Supports more flexible procurement models like mini-bids or lane rebalancing.

A diverse carrier base gives you more flexibility to implement dynamic procurement strategies including mini-bids or lane rebalancing. By constantly assessing and adjusting your freight carrier strategy, you can respond more effectively to market changes and optimize your procurement processes to keep your business competitive.

The right freight carrier strategy is a competitive advantage

Static carrier networks are no longer sufficient to meet the demands of the fluctuating freight market. Disruptions, capacity changes, and shifts in service levels are all part of the new reality for shippers. To stay competitive, it’s crucial that you continuously monitor, diversify, and optimize your freight carrier strategy.

With a data-driven approach, your freight carrier strategy becomes more resilient, efficient, and cost-effective. You can confidently make carrier decisions using good data and keep your business moving forward.

FAQs

A few things you might be asking yourself

A freight carrier strategy is your approach to managing and optimizing relationships with carriers. It involves selecting the right carriers, diversifying your network, and aligning your carrier base with your logistics goals. A well-structured carrier strategy is key to navigating market fluctuations, ensuring service reliability, and maintaining cost-efficiency for your business.

You can evaluate carrier performance by tracking key metrics such as on-time delivery percentage, tender rejection rates, communication responsiveness, and carrier capacity. Using historical service data alongside real-time market comparisons helps you to see carrier strengths and weaknesses. You can use tools like carrier scorecards to see performance trends more easily and take action on them.

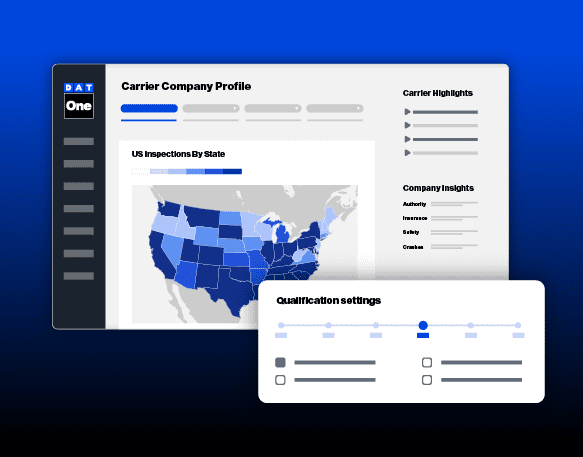

Good carrier network optimization means using tools such as network analytics platforms. These tools help you to see carrier performance, identify capacity gaps, and find ways in which you can improve. Platforms like DAT iQ offer real-time and historical data on rates, capacity, and service levels, so you can make the best decisions on carrier selection, routing guides, and procurement strategies.

Carrier diversification offers several advantages, including reducing risk, adding alternative options for cases of shortfall, improving service levels, increasing your leverage in negotiations, and allows you to adopt more flexible procurement models. Taking this approach both significantly protects you from disruptions while giving you a competitive advantage.

DAT iQ provides powerful network analytics that help you to optimize your freight carrier strategy. With insights into carrier performance, capacity gaps, and market trends, DAT iQ gives you an overview of your current carrier base, so you can find opportunities for improvement. The platform’s data-driven approach enables smarter decision-making, so you can build a more resilient, cost-effective, and flexible carrier strategy.

Diversify your carrier network and improve business strategy with DAT iQ

Evaluate carrier performance, identify capacity gaps, and uncover new freight partners with DAT iQ. If you want to build a smarter, more resilient carrier strategy with real-time and historical insights tailored to your business needs, DAT offers the tools shippers need to get ahead.

Learn more about DAT iQ today!

Relevant Products

RateView Analytics

Actionable past, present, and future rate insights you can rely on for smarter strategic

Network Analytics

Extensive lane and carrier insights for greater visibility and proactive management.