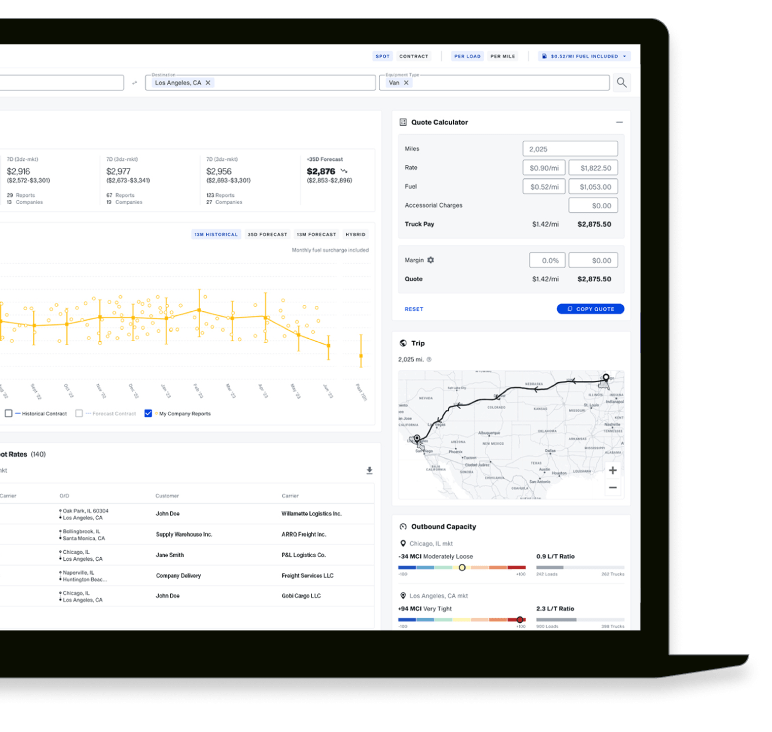

RateView Analytics from DAT iQ

Confidently navigate market volatility, take control of your network, and effectively move your business in the right direction.

The only 360° view of the entire freight marketplace

Actionable rate insights for smarter strategic planning, risk mitigation, and procurement. Control costs and profitability with data-driven bids, quotes, and negotiations.

Compare spot and contract rates

Relevant insights for brokers, shippers and carriers on any lane, based on the deepest, broadest data in the industry.

Get the most current market insights

Navigate market volatility with the timeliest data available.

See seasonal trends

Analyze rate trends on new lanes, with comprehensive 13-month pricing histories.

Bid and evaluate RFPs with confidence

Add-on forecasting model that’s over 95% accurate on more than 7 million daily predictions.

Understand market dynamics at every level

See both buy and sell rates, all in one place, to inform pricing, negotiation, and sourcing.

RateView Analytics from DAT iQ collects data from $1 trillion in transactions to produce market insights across all lanes.

RateView Analytics for Brokers

Quote prices for shippers instantly

Rates updated daily, with options to see 3-day, weekly, biweekly, monthly and yearly averages, plus 8-day forecasts.

Protect your margins

Calculate rates, surcharges, and margins faster and easier.

Bid on contracts with confidence

Win long-term business with accurate 52-week forecasts and specialized RFP response tools in the add-on Ratecast feature.

RateView Analytics for Shippers

Navigate volatile freight markets

Stay informed with the latest truckload rates to manage your transportation costs.

Get insights on new lanes

Strategically design your network with confidence using reliable 13-month pricing histories and forecasting.

Strengthen carrier relationships with transparent negotiations

Comprehensive visibility into market trends helps shipper right-size rates and mitigate routing guide failure.

Contextualize network performance

Use benchmarking to identify optimization opportunities with DAT iQ Benchmark.

RateView Analytics for Carriers

Bid on RFPs with confidence

Win long-term contracts with accurate 52-week forecasts and specialized RFP response tools in the add-on Ratecast feature.

Protect your bottom line

See current market rates and calculate surcharges and margins faster and easier.

Anticipate market shifts

Research lane seasonality plus accurate forecasting to anticipate market changes before they happen.

Trendlines Report

National average spot rates

Supply and demand metrics

Van, reefer and flatbed insights

Fuel prices

What our customers are saying

“We did rate analyses using a number of different vendors to compare data accuracy. We found that DAT’s rates were much more accurate compared to some of the other sources we reviewed, and our confidence level was much higher with forecasts using DAT data.”

Tom Curee, Senior VP of Strategy and Innovation, Kingsgate Logistics

FAQs

A few things you might be asking yourself

We collect invoices from thousands of transportation companies totaling $1 trillion. The process is automated, with invoices sent directly to our database. The data is verified and updated daily. Every market rate reported in RateView Analytics requires a minimum number of submissions so that the prices can not be manipulated, and the algorithms account for outliers.

The closest to real-time available in the industry, updated daily, giving you the most accurate information to navigate market volatility.

The accuracy of our data is our top priority, so we’ve established rigorous protocols to eliminate the possibility of manipulation. For every lane you search, RateView Analytics shows you how many companies and how many shipments that market rate is based on. The depth and breadth of that data means that no single contributors are able to influence the prices reported on any lane.

Need more tools?

Need capacity insights or custom data support?

Learn more about DAT iQ Analytics Solutions.

Network Analytics

Extensive lane and carrier insights for greater visibility and proactive management.

Analytics Services

Advanced data services, API integrations, and expert consultation.

Load Board

The right load for the right truck, anywhere

Network Analytics

Extensive lane and carrier insights for greater visibility and proactive management.

Analytics Services

Advanced data services, API integrations, and expert consultation.

Load Board

The right load for the right truck, anywhere