How to Start a Trucking Business

Starting a trucking business can be a rewarding venture in the transportation industry, offering immense potential for growth and profitability. The trucking sector is a vital component of the economy, responsible for transporting goods and materials across the country and beyond.

However, embarking on this journey requires more than just a passion for driving; it demands thorough preparation. Establishing a successful and sustainable trucking business involves understanding industry regulations, securing adequate financing, developing a robust business plan, and more.

Navigating the road to your own trucking business

Starting a trucking business can be a rewarding venture in the transportation industry, offering immense potential for growth and profitability. The trucking sector is a vital component of the economy, responsible for transporting goods and materials across the country and beyond.

However, embarking on this journey requires more than just a passion for driving; it demands meticulous planning and thorough preparation. Establishing a successful and sustainable trucking business involves understanding industry regulations, securing adequate financing, developing a robust business plan, and leveraging the right tools and resources.

In this article, we’ll dive into the key aspects you’ll need to start your own trucking business.

Getting started on your journey

Starting a trucking business begins with obtaining a Commercial Driver’s License (CDL), essential for legally operating commercial vehicles. The process involves passing a written knowledge test and a skills test covering vehicle inspection, basic controls, and on-road driving. To help prepare, you can attend a private truck driving school or join a company-sponsored training program. Private schools offer comprehensive training with hands-on experience, while company-sponsored programs may cover training costs in exchange for a work commitment.

Many aspiring owner-operators start as company drivers to gain valuable industry experience and learn operational aspects like route planning, customer interactions, and load management. Plus, working as a company driver also helps build a network of industry contacts and provides insights into financial aspects like fuel management, maintenance costs, and revenue generation.

Developing a business plan

Creating a detailed business plan is a critical step in launching your trucking business, as it serves as a roadmap for your venture and helps secure financing. Your business plan should clearly outline your expected revenue streams, operational expenses, and long-term financial goals. This includes estimating costs for acquiring trucks, fuel, maintenance, insurance, and permits, as well as projecting your income based on freight rates, load volumes, and market demand.

Consider consulting with a business advisor who specializes in the trucking industry. An advisor can help you tailor your plan to your specific needs and circumstances, taking into account factors such as your living expenses and unique market conditions.

Business structure and legal considerations

Choosing the right business structure is a crucial decision as it affects your legal liability, tax obligations, and overall management. Common structures include Sole Proprietorship, Limited Liability Company (LLC), and Corporation. An LLC is popular among truckers due to its flexibility and protection of personal assets from business liabilities. It allows for pass-through taxation, meaning business income is only taxed once on your personal tax return. Corporations, on the other hand, offer limited liability protection and potential tax benefits but involve more complex regulations and double taxation on dividends.

Overall, consulting with an accountant or a business advisor is essential to determine the best structure for your specific situation. They can help you understand the implications of each option, considering factors such as the number of owners, your financial goals, and the regulatory environment.

Financing your startup

A trucking business requires significant initial investment for trucks, trailers, licensing, and registration fees. Besides these costs, experts suggest having enough savings to cover at least six months of operational expenses, including fuel, maintenance, insurance, and lease payments. This financial buffer helps manage early-stage cash flow fluctuations and operational challenges, ensuring business stability.

To optimize your resources, explore various financing options such as traditional bank loans, SBA loans, and equipment financing. Each has different interest rates, repayment terms, and eligibility criteria. Leasing trucks and trailers can also reduce upfront costs and offer cash flow flexibility, with lower monthly payments and easier equipment upgrades.

Planning business operations

Careful planning of every aspect of your business operations is crucial for success, including managing truck parking, regular maintenance, and efficient fleet logistics to keep your trucks on the road and minimize downtime. Establish streamlined processes for key administrative tasks such as invoicing, accounting, payroll, and tax management.

Developing effective strategies for finding and securing profitable freight loads is equally important. Utilize load boards, broker relationships, and direct shipper contracts to keep your trucks full and revenue steady. Analyzing market trends and adjusting routes and schedules can enhance profitability, and networking within the industry and leveraging technology can provide a competitive edge, helping you maximize efficiency and profitability.

Regulatory compliance

Before launching your trucking business, ensure compliance with federal and state regulations by obtaining necessary permits and licenses, such as a USDOT Number and Operating Authority. Adhere to state-specific requirements, including vehicle inspections and emissions standards, to avoid fines and operational delays.

Additionally, manage tax obligations like the Heavy Vehicle Use Tax (HVUT), International Registration Plan (IRP), and International Fuel Tax Agreement (IFTA) to ensure proper reporting and payment. Maintaining meticulous records and timely filings is crucial to avoid penalties. A helpful tip is to utilize compliance management software to streamline these processes and keep your business compliant.

Insurance and risk management

Primary Liability insurance is mandatory for trucking businesses, covering bodily injury and property damage to others in an accident. Cargo insurance safeguards the goods you transport, while physical damage insurance protects your trucks and trailers from collisions, theft, and other damages. Additionally, non-trucking liability insurance covers incidents when driving without a trailer, and per-load insurance can cover high-value or sensitive shipments as needed.

Equipment acquisition

Deciding whether to purchase or lease trucks and trailers significantly impacts your business’s financial health and operational efficiency. Purchasing involves a high upfront cost but offers full ownership and control, making it beneficial if you plan to keep the trucks long-term and build equity. However, it also means you’re responsible for all maintenance and repair costs, which can add up.

Leasing provides flexibility with lower initial costs. Options like Operating Leases, TRAC Leases, and Lease Purchase Plans cater to different needs. Operating Leases have lower monthly payments and allow frequent equipment upgrades, while TRAC Leases offer potential tax benefits and the option to buy at the lease’s end. Lease Purchase Plans combine leasing with a path to ownership. Consider factors such as freight type, route lengths, and financial strategy when evaluating these options.

Utilizing DAT for business growth

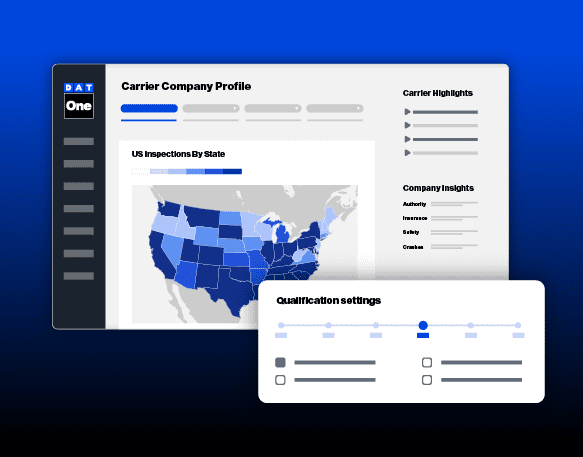

DAT offers a comprehensive suite of tools and services designed to streamline operations and foster the growth of your trucking business:

- DAT Authority: Obtain your MC Number and operating authority through DAT to legally haul freight across state lines. Benefit from expert support and guidance to navigate regulatory requirements seamlessly.

- DAT One Load Board: Access one of the industry’s largest load networks to find and secure profitable freight loads efficiently. Utilize advanced search and filtering options on the DAT load board to match your equipment and preferences with available loads.

- Freight Factoring: Strengthen your financial stability with DAT Outgo freight factoring services. Get paid within hours of delivery to ensure steady cash flow and keep your business moving. With transparent pricing, full invoice management, and seamless integration through the DAT One platform, DAT Outgo simplifies the payment process so you can focus on growth.

Explore our full range of services to discover how DAT can support your trucking business every step of the way.

Paving the road to success for your trucking business

Starting a trucking business can be an exciting endeavor. Begin by getting your Commercial Driver’s License (CDL) and gaining some industry experience. Preparing a solid business plan and choosing the right business structure will lay a strong foundation for your venture.

It’s crucial to ensure you’re compliant with regulations and have the right insurance to protect your business. Develop strategies for effective fleet management, secure financing to cover initial costs, and focus on creating efficient operational processes.

With the right tools and support, you can tackle challenges more effectively and set your trucking business on the path to success. This comprehensive approach will help you build a resilient and profitable business in the competitive trucking industry.

FAQs

A few things you might be asking yourself

Starting a trucking company typically requires a significant investment, often ranging from $10,000 to $30,000. This includes costs for obtaining your Commercial Driver’s License (CDL), purchasing or leasing trucks and trailers, insurance, permits, and initial operating expenses such as fuel and maintenance. Additionally, it’s wise to have enough savings to cover at least six months of operating expenses to ensure financial stability as you establish your business. Consulting with financial advisors can help you plan and allocate your funds effectively.

Starting a trucking business with limited funds requires strategic planning and resourcefulness. Consider leasing trucks and trailers instead of buying them to reduce initial costs. Explore financing options and grants specifically for small businesses. Start with a single truck and gradually expand as your business grows. Additionally, look for used equipment in good condition to save on upfront costs. Building relationships with shippers and brokers can help secure consistent work, ensuring steady income to reinvest in your business.

The best trucking business to start depends on your interests, experience, and market demand. Common options include long-haul trucking, which involves transporting goods over long distances and can be highly profitable. Alternatively, consider specializing in niche markets like refrigerated trucking, which requires transporting perishable goods, or flatbed trucking for oversized loads. Local delivery or regional hauling can also be lucrative and may allow for more predictable schedules. Research the market demand in your area and choose a segment that aligns with your strengths and goals.

Starting a trucking company can take anywhere from a few months to over a year, depending on various factors. Initially, you’ll need to obtain your CDL, which can take several weeks to a few months. Securing financing, purchasing or leasing equipment, and obtaining necessary permits and licenses like a USDOT Number and Operating Authority can take additional weeks. Setting up your business operations, including insurance, hiring drivers if needed, and securing contracts, also requires time. Planning and staying organized can help streamline the process and get your trucking company up and running more efficiently.

Starting a trucking company involves several key steps. First, obtain your CDL and gain some industry experience. Next, create a solid business plan, choose the right business structure, and secure financing. Purchase or lease your trucks and trailers, obtain the necessary permits and licenses and get adequate insurance coverage.

To get loads, build relationships with freight brokers and shippers. Consider joining industry associations and attending trade shows to expand your connections and find new opportunities. Programs like DAT Authority can help you build your trucking business from the ground up, including assistance with finding loads.

Build a successful trucking business with DAT

Secure your trucking business’s operating authority with DAT Authority. With over 45 years of experience, DAT simplifies the process by handling all the paperwork and filings, including federal and state permits like IFTA and IRP. Our expert guidance ensures you get your DOT registration and MC Number quickly, helping you avoid delays and legal headaches.

Partnering with DAT Authority means you can focus on running your business while we take care of the legal requirements, ensuring a smooth and efficient start.

DAT Copilot™ Authority Bundle

- Federal MC Authority ($300)

- BOC-3 MC Authority ($30)

- 50% off DAT One for 6 months (from $150)

- Factoring for fast payouts, low rates, and no long-term commitments