Invoice Factoring Rates

Fast, reliable payments to keep you on the road

Explore a wide range of offers, including non-recourse factoring options.

Managing cash flow can be one of the biggest challenges in trucking. When waiting for an invoice to be paid out, the last thing you want to deal with are hold-ups that could put your business in financial risk.

Factoring services help carriers get paid quickly and reliably. With competitive rates, fast funding, and flexible terms, factoring helps you stay focused on growing your business without worrying about cash flow.

- Get paid quickly and keep your fleet running

- Flexible integration with your operations

- Expert customer service, when you need it

Get paid quickly and keep your fleet running

No more waiting weeks for payments—with the right invoice factoring partner, you get your money fast.

Cash flow is the backbone of your trucking business, and delayed payments can throw everything off track. Waiting weeks or even longer to get paid can be frustrating and create unnecessary stress.

That’s why Outgo, a DAT product, provides a hassle-free experience with a simple and transparent process. Submit invoices easily and stay focused on running your business.

With non-recourse factoring options, once your invoice is approved, you get paid fast — without the stress of collections. Plus, with competitive rates, no hidden fees, and flexible terms, you can factor on your own terms and keep your business moving forward.

Flexible integration with your operations

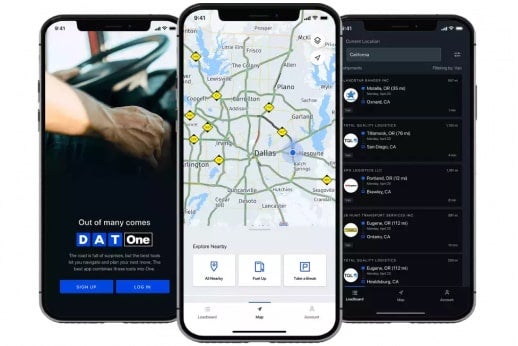

The perfect tools to simplify load booking and speed up payments.

Managing multiple tools and platforms can be overwhelming, and invoicing shouldn’t add to the hassle. The right solution helps make the process easier.

With the right integrations into the DAT load board, it’s easy to identify approved brokers and factor invoices efficiently. Payments can be managed in one place, eliminating unnecessary steps and complications.

This streamlined process provides more time to focus on finding high-paying loads and helps ensure fast, reliable payments.

Expert customer service, when you need it

Personalized service and dedicated support can make a real difference in managing your business.

When it comes to invoice factoring, responsive and high-quality customer service helps ensure a smoother experience. With so many freight factoring companies to choose from, it’s important to look for options that provide reliable assistance and clear communication.

Working with a factoring provider that offers access to an experienced support team can help simplify the process and provide peace of mind when questions or issues arise.

Invoice factoring is a financial service that allows trucking businesses to sell their outstanding invoices to a factoring company for immediate cash. Instead of waiting 30-90 days for customers to pay, most of the invoice value is provided upfront. The factoring company then collects full payment from the customer, and the remaining balance is paid to the business minus a factoring fee. This can help provide consistent cash flow and reduce the stress of waiting for payments.

Recourse and non-recourse factoring differ mainly in who takes on the risk if a customer doesn’t pay.

- Recourse factoring typically comes with lower fees, but you are responsible for repaying the factoring company if the customer fails to pay the invoice.

- Non-recourse factoring provides more protection, as the factoring company assumes the risk of non-payment in the event of customer bankruptcy or going out of business. However, this added security often comes with a slightly higher cost.

Recourse factoring is ideal for larger carriers with enough volume and customer diversity to take a loss if one does not pay while non-recourse factoring offers peace of mind and the highest value add for new and small carriers by protecting you from potential losses.

Payment speed depends on the factoring provider, but many offer fast funding options to help carriers access their money quickly after submitting an invoice. With streamlined digital processing, verification, and funding, you can often receive most of your invoice value shortly after completing a load—far faster than traditional payment cycles.

Reliable factoring partners like Outgo, a DAT product, prioritize quick payments to help carriers maintain steady cash flow, cover expenses, and keep their business moving without unnecessary delays.

A factoring service like Outgo, a DAT Product, can help carriers improve cash flow to cover fuel, maintenance, and other operating costs. They may also handle collection efforts, reducing the administrative burden on the business. By offering financial flexibility and support with back-office functions, factoring allows carriers to focus more on hauling loads rather than managing payments.

Invoice factoring rates vary based on factors like your business size, customer creditworthiness, contract terms, and funding speed. Most factoring providers charge a percentage of the invoice total, and rates differ depending on your agreement.

Some factoring companies also charge additional fees for services like invoice processing or same-day funding, so it’s important to choose a provider with transparent pricing and no hidden costs.

Take control of your finances today. Keep your business moving forward with factoring support from Outgo, a DAT product.

Get paid faster with competitive factoring rates

Why wait 30+ days to get paid? Factoring can provide faster access to payments and help support healthy cash flow without long waits. With competitive rates and flexible terms, it’s a solution designed to meet the needs of trucking businesses. Get started today.

Outgo, a DAT product

- Invoices approved within 4 hours

- Low, transparent rates (no hidden fees)

- No annual contracts, no reserves