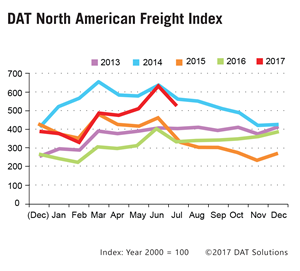

PORTLAND, Ore. — Spot market truckload freight volume declined seasonally last month but reflected unusual strength for July, according to the DAT North American Freight Index.

Load availability in July was 53 percent higher compared to July 2016, although it declined 19 percent compared to June, when truckload freight availability was at a two-year high. While freight activity typically falls during July, many lanes set all-time records for loads moved during the month’s final week.

Load availability in July was 53 percent higher compared to July 2016, although it declined 19 percent compared to June, when truckload freight availability was at a two-year high. While freight activity typically falls during July, many lanes set all-time records for loads moved during the month’s final week.

“It’s uncommon to see a high volume of truckload freight at this point in the summer,” said Mark Montague, DAT industry pricing analyst. He said van freight volume was particularly strong on lanes that connect markets in the Southeast and Midwest to large population centers in the Northeast. Those lanes are associated with retail freight, indicating consumer confidence.

Compared to June, van freight activity fell 22 percent while refrigerated (“reefer”) and flatbed freight volume were each 16 percent lower. The national average van rate lost a penny to $1.79 per mile and the reefer rate dipped 4 cents to $2.08 per mile, but rates in both segments were near two-year highs.

The flatbed rate was up 3 cents to $2.20 per mile, the highest monthly average since March 2015.

Established in 1978, DAT operates the largest on-demand freight exchange, a network of load boards serving intermediaries and carriers across North America. For more than a decade DAT has published its Freight Index, which is representative of the dynamic spot market.

Reference rates are the averages, by equipment type, based on $33 billion of actual transactions between freight brokers and carriers, as recorded in DAT RateView. Reference rates per mile include fuel surcharges, but not accessorials or other fees. Beginning in January 2015, the DAT Freight Index was rebased so that 100 on the Index represents the average monthly volume in the year 2000. Additional trends and analysis are available at DAT Trendlines.