BEAVERTON, Ore., December 19, 2025 — November truckload volumes fell to their lowest level of 2025, with double-digit declines across van, refrigerated, and flatbed segments despite holiday shipping activity, said DAT Freight & Analytics, which operates the DAT One freight marketplace and DAT iQ data analytics service.

The DAT Truckload Volume Index (TVI), a key freight market indicator measuring demand for truckload services, reflected widespread weakness:

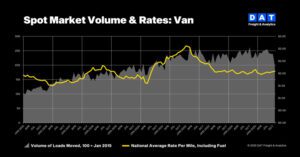

- Van TVI: 197, down 18% month over month and 12% year over year

- Refrigerated TVI: 172, down 11% month over month and 6% year over year

- Flatbed TVI: 243, down 22% month over month and 3% year over year

“With Thanksgiving and Black Friday falling nearly as late as possible on the calendar, there was less urgency to move freight until the final week of the month,” said Ken Adamo, DAT Chief of Analytics. “With the short holiday week, winter weather, and other disruptions, it was a busy end to an otherwise soft November, but not enough to offset the earlier weakness.”

Spot rate changes were mixed in November:

- Spot van: $2.09 per mile, up 2 cents from October

- Spot reefer: $2.54 per mile, up 6 cents

- Spot flatbed: $2.47 per mile, down 4 cents

Spot rates were also higher year over year. In November 2024, van rates averaged $2.03 per mile, reefer rates $2.45, and flatbed rates $2.37. Higher fuel prices were a factor.

Contract rates increased compared to October:

- Contract van: $2.46 per mile, up 4 cents month over month

- Contract reefer: $2.81 per mile, up 3 cents

- Contract flatbed: $3.07 per mile, up 1 cent

Average contract rates were higher than spot rates in November, maintaining the pricing dynamic that has persisted across the freight market since early 2022.

“The market remains fundamentally inverted,” Adamo said. “Oversupply persists, shippers are cautious amid economic uncertainty, and many carriers are still operating unprofitably. December should bring some seasonal lift, but we will need to see sustained strength after the holidays to gain confidence that the market is poised to flip.”

About the Truckload Volume Index

The DAT Truckload Volume Index reflects the change in the number of loads with a pickup date during that month. A baseline of 100 equals the number of loads moved in January 2015, as recorded in DAT RateView, a database tracking rates paid on an average of 3 million loads per month. DAT benchmark spot rates are derived from invoice data for hauls of 250 miles or more with a pickup date in the reported month, providing a consistent view of truckload volume trends and freight market activity.