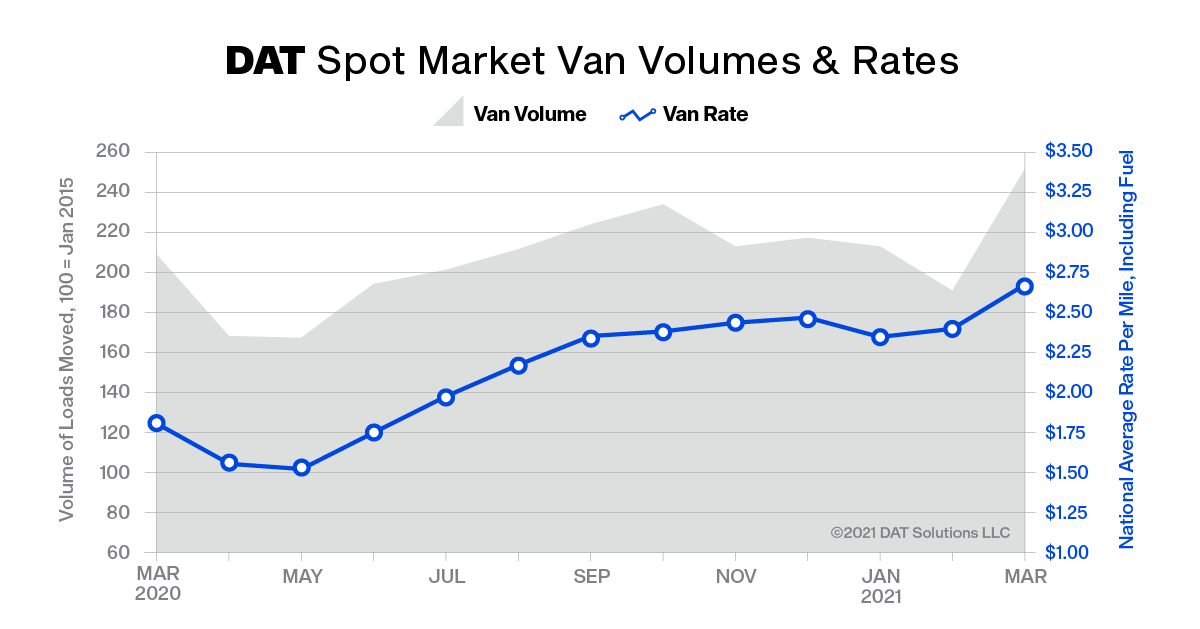

Spot truckload van and refrigerated freight rates hit all-time highs in March, said DAT Freight & Analytics, operators of the industry’s largest online freight marketplace and data analytics service. Demand for flatbed transportation, driven by strong construction and manufacturing activity, also soared into record territory.

The total number of loads posted on the DAT network increased 22.3% month over month while the number of available trucks was up 30.9%, indicating a return of traffic after being disrupted by February weather.

The DAT Truckload Volume Index, a measure of dry van, refrigerated (“reefer”) and flatbed loads moved by truckload carriers, was up 31% in March to the highest level since the Index was rebalanced in January 2015. The previous high was September 2020 as shippers positioned freight for holiday shopping.

“The strength of truckload freight relative to the amount of capacity available in the market, combined with the willingness of shippers to pay high rates, indicates an urgency from businesses to fill orders and meet delivery schedules after a difficult February,” said Ken Adamo, Chief of Analytics at DAT. “All three equipment types that make up our Truckload Volume Index showed extraordinary growth at a time when capacity is tight and truckload prices are up.”

Van, Reefer Rates Hit Highs

Spot van and reefer rates each set records in March.

The national average spot truckload van rate was $2.67 a mile, up 13 cents compared to February and almost 30 cents higher than the previous monthly average high in December 2020. The national average spot reefer rate was $2.95 per mile, up 25 cents compared to February and 20 cents higher than the monthly average contract rate.

Capacity remains tight in the temperature-controlled sector. The national average reefer load-to-truck ratio was 12.2, down from 15.9 in February, meaning there were 12.2 reefer loads on the DAT network for every available truck. The van load-to-truck ratio averaged 5.8, down from 7.5 in February, with high ratios in February being exacerbated by the severe winter weather that impacted much of the country.

Construction Drives Flatbed Demand

Spot flatbed truckload rates and load-to-truck ratios are at their highest points since the mid-2018. The national average flatbed load-to-truck ratio was 83.7 in March and spot flatbed volumes increased 34% compared to February on the strength of improving manufacturing output, a booming single-family housing market and seasonal construction activity.

The national flatbed load-to-truck ratio averaged 83.7 in March, its highest point since May 2018. The national average spot flatbed rate was $2.78 per mile, 20 cents higher than February.

DAT Freight Outlook

- The national average contract van rate was $2.60 a mile in March, 7 cents less than the average spot rate. The contract reefer rate was $2.75 a mile, 20 cents less than the spot reefer rate in March. When spot rates exceed contract rates, truckload carriers typically shift capacity to the spot market, creating uncertainty for shippers.

- Year-over-year comparisons of truckload rates and volumes are now less relevant given the effects of the pandemic.

- The impact of federal stimulus checks; an accumulation in household savings; component shortages in manufacturing; constraints and surcharges in intermodal networks; low inventories; and other supply chain disruptions at ports, canals and elsewhere could push the cresting of contract van and reefer rates into late Q2.

- A shortage of semiconductors and other components may delay production and delivery of heavy- and medium-duty trucks ordered in Q4 2020 until late 2021 or early 2022.

- The blockage of Egypt’s Suez Canal is expected to have a negligible impact on U.S. supply chains compared to backlogs processing containers at U.S. West Coast ports. Congestion at the ports of Los Angeles and Long Beach persisted as imports surged in March, as shown by the number of anchored vessels waiting to be offloaded, in addition to tight drayage and intermodal capacity coming off the ports.