Line-haul rates declined for the fifth consecutive month

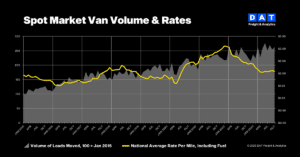

BEAVERTON, Ore., Nov. 14, 2023 — Dry van and refrigerated (“reefer”) truckload volumes increased modestly in October ahead of the high-demand holiday freight season, but truckload rates remained sluggish, reported DAT Freight & Analytics, which operates the DAT One online freight marketplace and DAT iQ data analytics service.

The DAT Truckload Volume Index (TVI), an indicator of loads moved in a month, increased for van and reefer freight:

- Van TVI: 263, up 3.5% compared to September

- Refrigerated TVI: 196, up 4.3%

- Flatbed TVI: 245, down 3.2%

“The van TVI was 2.3% higher compared to last October, the first year-over-year increase in a monthly TVI since September 2021,” said DAT Chief of Analytics Ken Adamo. “It’s a positive sign for freight carriers and brokers, but the expectation is for a seasonal bump as opposed to a sustained recovery of volumes and pricing.”

Load-to-truck ratios slipped

DAT’s national average load-to-truck ratios wavered in October, with the van and reefer ratios dropping to their lowest points since April:

- Van ratio: 2.1, down from 2.8 in September

- Reefer ratio: 2.9, down from 3.4

- Flatbed ratio: 6.3, down from 6.9

Load-to-truck ratios measure the number of loads posted to the DAT One marketplace relative to the number of trucks and are a simple indicator of demand for truckload services. Changes in the ratio typically anticipate changes in the pricing environment.

Line-haul rates extended their downward trend

Spot line-haul rates, which subtract an amount equal to an average fuel surcharge, for all three equipment types declined for the fifth straight month:

- Line-haul van rate: $1.55 per mile, down 1 cent

- Line-haul reefer rate: $1.87 a mile, down 5 cents

- Line-haul flatbed rate: $1.83, down 2 cents

DAT’s broker-to-carrier benchmark spot rates also decreased. The spot van rate averaged $2.09 per mile, down 2 cents compared to September, and the reefer rate dropped 6 cents to $2.46 per mile. The flatbed rate was $2.48 a mile, 3 cents lower month over month.

Spot pricing remained well below year-ago levels when the benchmark line-haul van rate was $1.77 a mile, the reefer rate was $2.08 and the flatbed rate was $2.07.

Benchmark rates for contracted freight declined as well. The DAT contract van rate decreased 2 cents to $2.57 per mile, the reefer rate fell 4 cents to $2.97 and the flatbed rate dropped 7 cents to $3.13.

The gap between spot and contract van rates has remained at 48 cents for three months. That’s 15 cents a mile less than in October 2022, when the average spot rate was $2.43 and the contract rate was $3.06.

About the DAT Truckload Volume Index

The DAT Truckload Volume Index reflects the change in the number of loads with a pickup date during that month; the actual index number is normalized each month to accommodate any new data sources without distortion. A baseline of 100 equals the number of loads moved in January 2015, as recorded in DAT RateView, a truckload pricing database and analysis tool with rates paid on an average of 3 million loads per month.

Spot truckload rates are negotiated for each load and paid to the carrier by a freight broker. National average spot rates are derived from payments to carriers by freight brokers, third-party logistics providers and other transportation buyers for hauls of 250 miles or more with a pickup date during the month reported. DAT’s rate analysis is based on $150 billion in annualized freight transactions.