PORTLAND, Ore. —Truckload freight activity declined last month but April was still the second busiest month on record for shippers, freight brokers and motor carriers, said DAT Freight & Analytics, which operates the industry’s largest online freight marketplace and DAT iQ data analytics service.

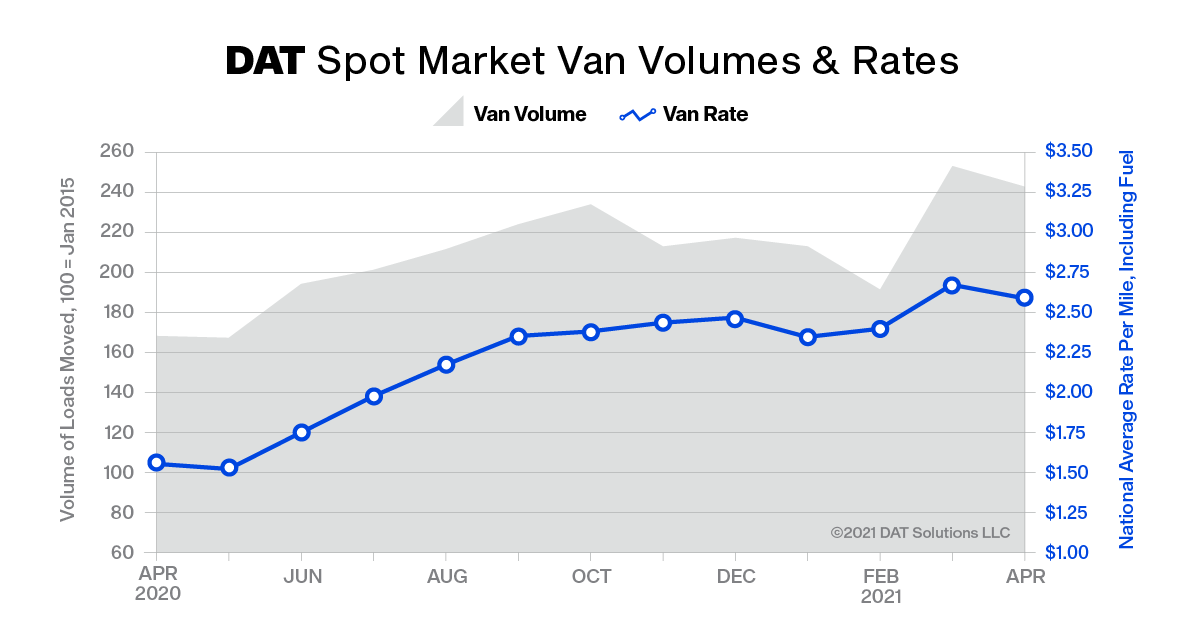

The DAT Truckload Volume Index (TVI) registered 225 in April – down 5% from the all-time high set in March. The index is an aggregated measure of dry van, refrigerated (“reefer”) and flatbed loads moved by truckload carriers. A baseline of 100 reflects freight volume in January 2015.

“It’s not unusual to see a decline from March to April, but truckload freight activity remained at historic levels compared to previous years,” said Ken Adamo, Chief of Analytics at DAT. “The April TVI was 39% higher than it was in April 2020 and April 2018, and 26% higher than in April 2019, indicating unusually strong demand for truckload capacity last month. Trucking companies are in the driver’s seat with respect to pricing power.”

The national average spot rate for van loads on the DAT One load board network was 8 cents lower than the March average at $2.59 per mile, but the second-highest monthly average van rate on record. The national average spot reefer rate was $2.93 per mile – 2 cents lower than in March – while the spot flatbed rate averaged $2.96 per mile, 18 cents higher month over month.

Contract rates for truckload services – scheduled and planned transportation where the rate is negotiated well in advance and part of a larger commitment to move goods – were historically high in April. The average contract van rate was $2.66 per mile and increased for the twelfth consecutive month. In addition, the average contract rate for reefer freight was $2.78 a mile, 15 cents below the average spot reefer rate.

The national average contract rate for flatbed equipment, which is used to haul construction materials, heavy equipment and a variety of other industrial goods, was $2.96 per mile – $1.03 higher than in April 2020. On the spot market, the flatbed load-to-truck ratio averaged 95.7, meaning there were more than 95 loads posted for every available truck last month.

“There’s a feeling among businesses that they are at their ceiling for the price of logistics,” Adamo said. “Spot and contract rates are high as we enter a period when truckload capacity is only going to tighten, as produce and retail goods move ahead of the July 4 holiday and back-to-school shopping season.”

May outlook

- Supply chain imbalances due to commodity shortages for manufacturing and the reopening of long-shuttered offices and service businesses have led to increased use of the spot market. In most years, 12 to 15% of truckload freight moves on the spot market; that figure is closer to 25% today.

- During the first week of May, the volume of load posts on DAT One was 36% higher compared to the same period in 2018, when spot truckload freight activity followed a more typical pattern.

- Expect demand for refrigerated trailers to increase as domestic produce harvests expand north beyond the U.S. southern border.

- The national average price of on-highway diesel was $3.13 a gallon in April. Spot rates include a calculated surcharge that fluctuates with the price of fuel, which is expected to rise following the cyberattack on the Colonial Pipeline.

About the DAT Truckload Volume Index

The DAT Truckload Volume Index reflects the change in the number of loads with a pickup date during that month; the actual index number is normalized each month to accommodate any new data sources without distortion. Baseline of 100 equals the number of loads moved in January 2015, as recorded in DAT RateView, a database of rates paid on an average of 3 million loads per month. DAT national average spot rates are derived from RateView and include only over-the-road lanes with lengths of haul of 250 miles or more. Spot rates represent the payments made to carriers by freight brokers, third-party logistics providers and other transportation buyers.