PORTLAND, Ore., —Truckload freight pricing rose and national average load-to-truck ratios for dry van and refrigerated freight hit record highs in February as severe weather across much of the United States distressed supply chains and disrupted transit times.

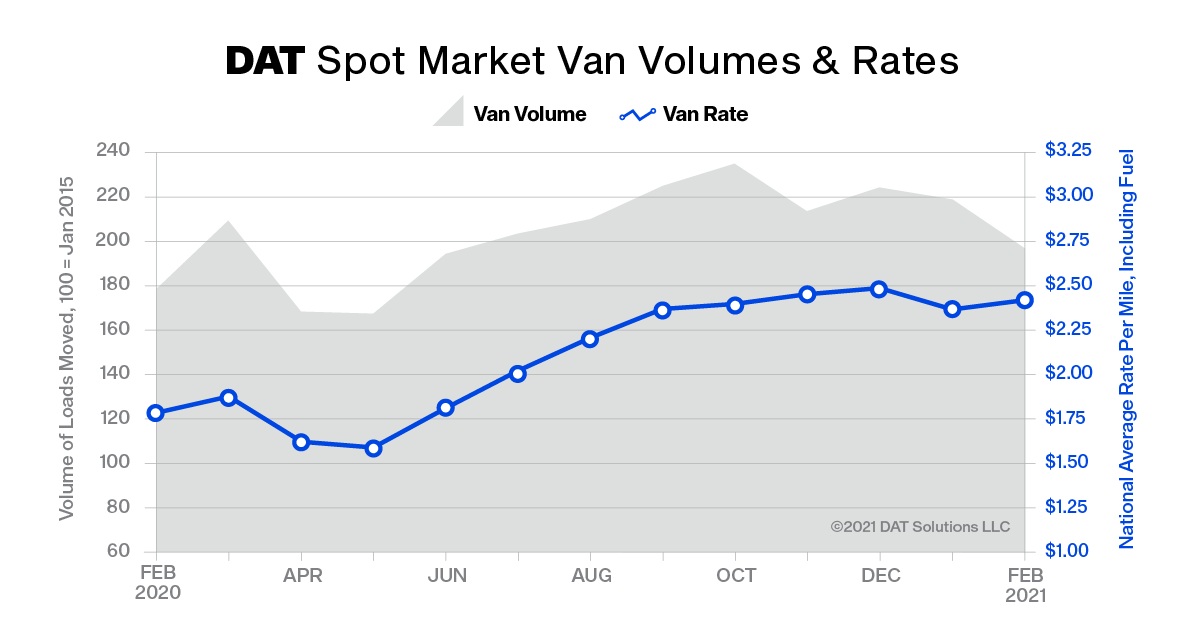

The DAT Truckload Volume Index, a measure of dry van, refrigerated (“reefer”) and flatbed loads moved by truckload carriers, declined 9.8% from January to February, reflecting a reduction in freight movement for the month.

However, demand for truckload capacity tightened as contracted carriers struggled to fulfill service commitments. During the week of Feb. 21, DAT achieved record network volumes when more than 10 million loads were posted on its network, an increase of 42% from the previous record high in June 2018 and a 174% improvement from February 2020.

Nationally, the van load-to-truck ratio averaged 7.5 in February compared to 4.3 the previous month, and the reefer ratio was 15.9, up from 8.2 in January. The flatbed ratio jumped from 47.9 in January to 62.2 last month.

The impact on truckload pricing was significant. Dry van spot rates averaged $2.41 per mile in February, up from $2.36 in January and 63 cents higher than in February 2020. Increases were even greater in the temperature-controlled sector, where reefers were in demand to keep traditional dry freight from freezing. Reefer spot rates averaged $2.70 a mile, up 9 cents month over month and 62 cents year over year.

“The scope of the weather system and impact on people and infrastructure at once constricted freight volumes and made it more expensive to move goods long distances over the road,” said Ken Adamo, Chief of Analytics at DAT. “After a decline in January and early February, pricing unexpectedly shot back up to post-holiday levels and strained fragile supply chains.”

In addition to record-level spot market volumes, intermodal network disruptions pushed more freight into the spot markets as shippers sought to meet delivery deadlines with customers.

At $2.58 per mile, the national average spot flatbed rate hit its highest point since August 2018 as the movement of building products and raw materials for manufacturing increased. The flatbed load-to-truck ratio was 62.2 compared 47.9 in January and 20.4 in February 2020.

Load-to-truck ratios reflect the number of available loads on the DAT network of load boards relative to the number of available trucks and indicate levels of supply and demand in the truckload marketplace.

March outlook

- The DAT market outlook in March is for spot rates and truckload freight volumes to fall from their record highs but remain elevated as they track a more normal pattern of activity. Strong import volumes continue to put pressure on supply chains as shippers try to replenish their inventories.

- Demand for refrigerated trailers will continue to build as shippers move domestic and imported produce. Supply chains are adjusting to more than $600 million in weather-related agricultural losses across Texas, including citrus crops; cold- and warm-season vegetables; livestock grazing materials such as oats, rye grass and triticale; and landscape plants, according to agricultural economists at Texas A&M University. The start of produce season in southern Florida will further tighten capacity.

- Flatbed carriers are benefiting from high demand for farm and construction machinery. The Port of Baltimore is the number one Roll-on/Roll-off (RoRo) port in the United States and handles the majority of the U.S. East Coast’s market share of imported RoRo cargo annually. Last month, total tonnage of RoRo equipment was up 301% year over year compared to February 2020.

- “Starting in March, you can give far less weight to year-over-year comparisons because you’re going to see some pretty wild numbers,” said Adamo. “Shifting consumer demand and imbalanced supply chains in 2020 make it more important than ever to rely on the industry’s best analysis and historical data, going back multiple years, as you forecast the rest of 2021 and into 2022.”

About the DAT Truckload Volume Index

The DAT Truckload Volume Index reflects the change in the number of loads with a pickup date during that month; the actual index number is normalized each month to accommodate any new data sources without distortion. Baseline of 100 equals the number of loads moved in January 2015, as recorded in DAT RateView, a database of rates paid on an average of 3 million loads per month. DAT national average spot rates are derived from RateView and include only over-the-road lanes with lengths of haul of 250 miles or more. Spot rates represent the payments made to carriers by freight brokers, third-party logistics providers and other transportation buyers.