– Volume surpassed same-month levels year over year for the first time since December 2014

– Higher van and reefer freight volumes did not translate to higher spot rates

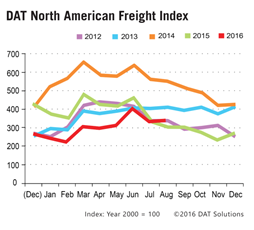

PORTLAND, Ore. — Truckload freight availability climbed last month as the number of loads on the spot market surpassed same-month levels from the previous year for the first time since December 2014, according to the DAT North American Freight Index.

Led by a 32 percent jump in van loads and a 31 percent gain in refrigerated (“reefer”) freight, spot freight volume on the DAT network of load boards was 11 percent higher in August compared to August 2015.

Led by a 32 percent jump in van loads and a 31 percent gain in refrigerated (“reefer”) freight, spot freight volume on the DAT network of load boards was 11 percent higher in August compared to August 2015.

Flatbed freight volume declined 16 percent year-over-year, however, due partly to prolonged cutbacks in key flatbed sectors including oil and gas, steel, coal, construction, and manufacturing.

Month-over-month, spot market freight volume increased 1.5 percent to the second-highest level this year. Van freight added 8.7 percent, and reefer volume surged 24 percent, but flatbeds lost 16 percent in August, compared to July.

Spot Rates Decline in August

Higher van and reefer freight volumes did not translate to higher spot rates.

Compared to August 2015, the average line haul rate fell 6.6 percent for vans, as reefer rates dipped 5.1 percent, and flatbed rates lost 7.2 percent. Diesel prices also contributed to the decline in rates. The average fuel surcharge, a component of the total rate paid to carriers, fell 17 percent year over year, driving down the total revenue per mile by 8.0 percent for vans, 6.9 percent for reefers, and 8.2 percent for flatbeds. The surcharge is pegged to the retail price of diesel fuel.

On a month-over-month basis, national average rates declined in August from an atypical July peak. The van rate edged down 0.7 percent (1 cent) to $1.41 per mile, reverting to the average rate for June. The reefer rate lost 1.7 percent (3 cents) as a national average, and the flatbed rate fell 1.2 percent (2 cents.) Van and reefer rates have rebounded in early September, to-date.

Established in 1978, DAT operates a network of load boards serving intermediaries and carriers across North America. For more than a decade DAT has published its Freight Index, which is representative of the dynamic spot market.

Reference rates are the averages, by equipment type, based on $28 billion of actual transactions between freight brokers and carriers, as recorded in DAT RateView. Rates are cited for line haul only, except where noted. Beginning in January 2015, the DAT Freight Index was rebased so that 100 on the Index represents the average monthly volume in the year 2000. Additional trends and analysis are available at DAT Trendlines.