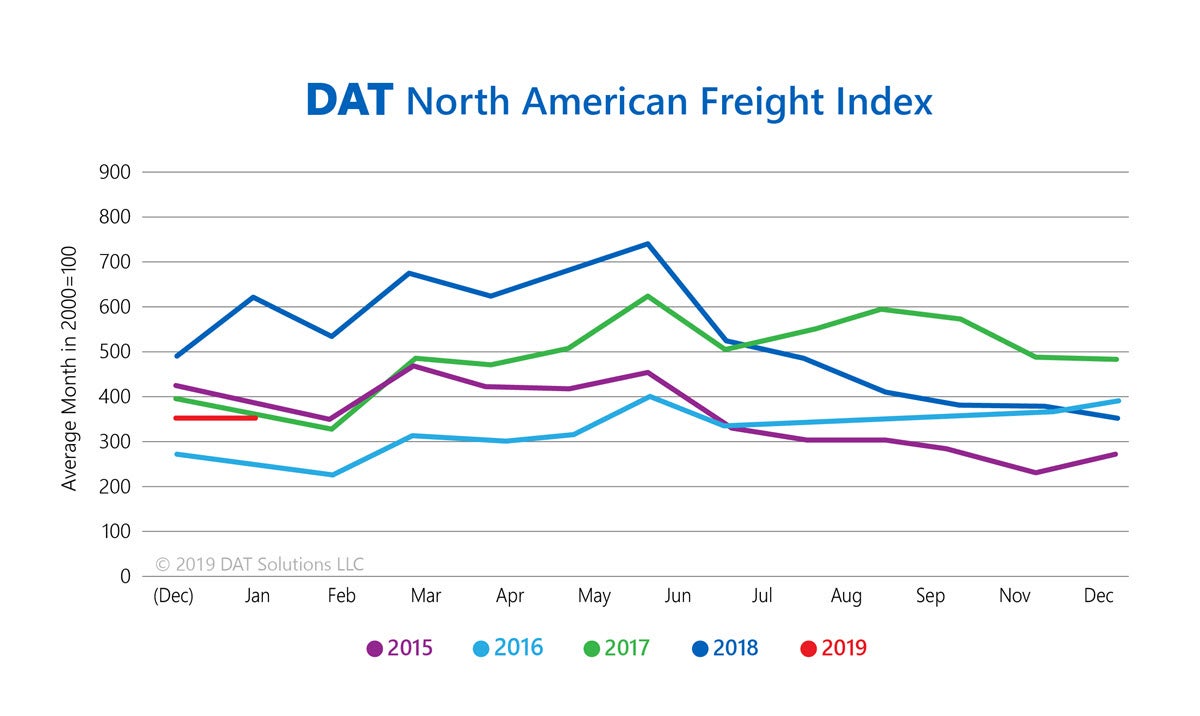

Truckload rates were down across the board in January, but it wasn’t for lack of demand. Spot market freight availability held steady last month compared to December, according to the DAT Freight Index.

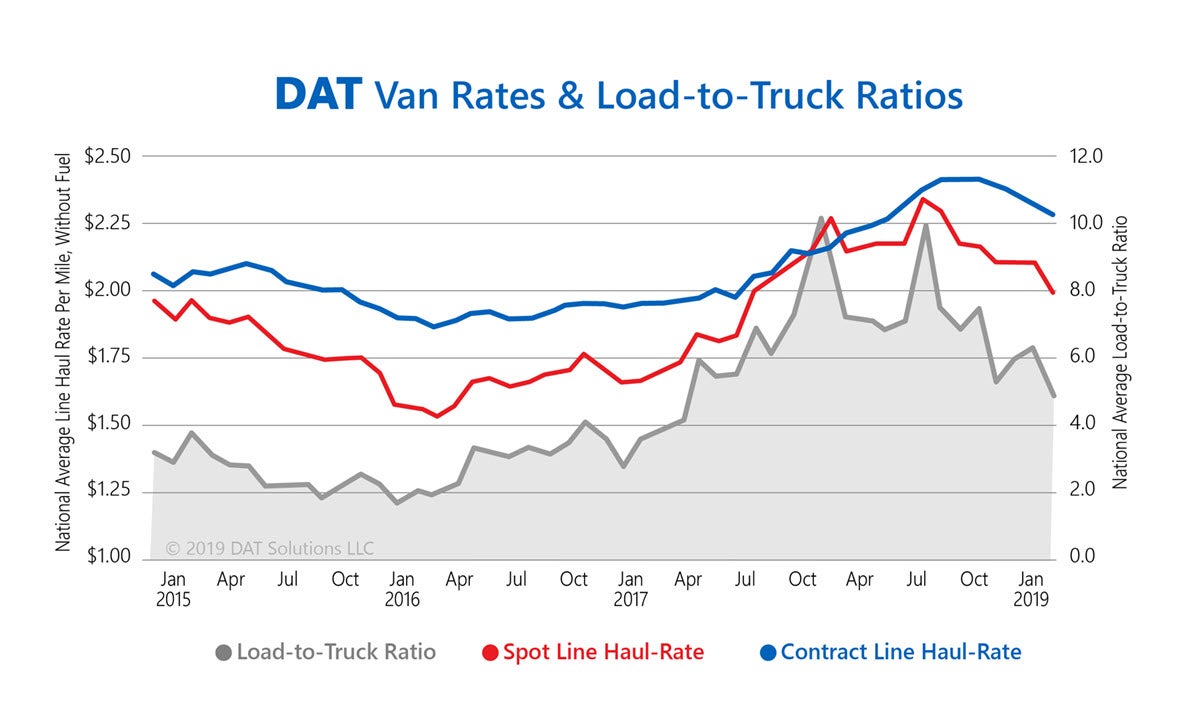

Trucks were plentiful, however, and the competition among carriers drove prices down for each major equipment type.

Van rates slipped 11 cents lower, month over month, while refrigerated (“reefer”) freight dropped 14 cents. Flatbeds lost only 6 cents, as activity picked up late in the month, primarily in Texas. Spot rates declined year over year for van and reefer freight, but flatbed rates were unchanged compared to January 2018.

“This trend is nothing new,” said DAT Market Analyst Peggy Dorf. “Spot rates fall every year in January and February, followed by a rebound in the second quarter and a peak in June. DAT has been tracking this for ten years.”

“The only exception to that pattern was 2018, when rates rose in January because the new electronic logging mandate led to capacity shortages,” Dorf added.

Contract rates also declined last month for all equipment types, but they remained at or above January 2018 levels.

Arctic weather in 15 states did cause some disruptions in the last few days of the month, as dangerous road conditions stalled freight movement. Many of those shipments will be rescheduled for February, and the pent-up demand should prevent rates from falling lower.

Spot market freight availability returned to normal seasonal levels in January, according to DAT Solutions, which operates the leading spot freight marketplace. The DAT Freight Index indicated that demand held steady month over month and declined 43 percent compared to the extraordinary market pressure of January 2018.

Dry van truckload rates dipped in January for spot market and contract service providers. A decline in load-to-truck ratios on DAT load boards signaled the impending rate trend, according to DAT Solutions, which maintains a rates database of $60 billion in annual market transactions.