Turn your freight data into a competitive advantage

Shippers are collecting more freight data than ever—but many aren’t doing enough with it. Data can help shippers uncover inefficiencies, reduce costs, improve service, and much more. However, shippers need to first truly understand how to turn data into actionable insights.

Benchmarking performance against the rest of the industry, analyzing lane-level data, and creating a strong freight data strategy can help shippers make smarter procurement choices, improve their performance, cut costs, and ultimately manage their network better, particularly when navigating a volatile market.

Make the most out of your freight data

These days, most freight shippers collect a lot of transportation data in an attempt to track key shipper metrics like on-time delivery rates, pickup performance, order accuracy, and damage rates, as well as track tender acceptance rates, spot versus contract ratios and rates, and more. But it takes more than just collecting data to make it valuable – it takes structure, discipline, and alignment to deliver results.

But raw data on its own won’t deliver results. To get the most out of it, you need to convert that data into insights, which means analyzing trends and benchmarking your performance against the rest of the industry to make smarter decisions.

However, knowing how and when to use freight data isn’t always straightforward. This article will explore using freight data to increase efficiency, identify low-performing lanes and carriers, reduce costs, and ultimately make better decisions to improve your strategy.

Why shippers need a stronger freight data strategy

Freight markets have become increasingly complicated, meaning shippers need to make smarter and faster decisions to keep up with the competition. Those that don’t adapt risk losing out on capacity, paying higher rates, and ultimately falling behind.

Without a solid data strategy, it’s easy to miss savings, deliver poor service, and worse. Often, shippers overlook insights right in front of them, causing them to lose out on opportunities to improve routing, cut dwell time, negotiate better rates, and improve their carrier base.

To stay competitive in today’s market, shippers need to step up their game in order to shift from reactive planning to proactive management. Not only do you need to use real-time and historical data to understand what has already happened and resolve current issues, but you also need to use data-driven forecasting to make forward-looking decisions. With visibility into the freight market, you can think more strategically about your entire supply chain, leading to better carrier alignment, smarter routing decisions, better service levels, and more resilience amidst market volatility.

Turning raw data into meaningful insights

Raw freight data typically falls into a few key categories: shipment activity, cost data, and carrier performance. But raw numbers alone don’t drive results—it’s how you analyze and apply them that creates impact.

Here are some of the most valuable data types shippers should be paying attention to:

- Historical rates: Reveal pricing trends and help identify where you may be overpaying.

- Spot vs. contract rates: Support smarter decisions on when to go to the spot market or rely on contracted carriers.

- Load-to-truck ratios: Indicate market tightness—high ratios suggest higher rates and limited capacity; low ratios can reveal cost-saving opportunities.

- Capacity trends: Help you plan for seasonal shifts and potential disruptions to ensure adequate coverage.

- Tender rejection rates: Signal misaligned pricing, service gaps, or tightening market conditions.

- Dwell time: Exposes operational inefficiencies that can result in detention fees and damage carrier relationships.

- Delivery performance (OTIF, etc.): Helps identify underperforming carriers and guide strategic adjustments.

Despite having access to this data, many shippers aren’t using it to its full potential. Siloed systems, unclear ownership, outdated tools, and inconsistent data quality can all get in the way—making it hard to see the full picture or act with confidence.

With centralized, accessible, and trusted data, every team—from procurement to operations—can make smarter, faster decisions that reduce costs, improve carrier partnerships, and drive better performance across your network.

Benchmarking: How do your costs and performance stack up?

Freight shipper benchmarking is vital to contextualizing your performance and identifying areas for improvement. By comparing your transportation rates and evaluating your logistics performance metrics against the market, you can identify underperforming lanes, uncover inefficient carriers, identify opportunities to renegotiate, and improve your overall logistics strategy. For example, if a carrier’s on-time delivery rate is below the industry average or a lane is consistently more expensive than average, you can take action to optimize your network and boost service reliability.

Benchmarking your performance against the market can also help you track trends over time, better understand your business’s operations, and highlight areas for improvement. By comparing your performance to the market and monitoring changes over time, you gain a clearer picture of your operational strengths and weaknesses and make smarter, data-based decisions that are both timely and forward-thinking.

External benchmarking tools can also help validate your current strategy or justify future strategy decisions. They provide an objective way of assessing whether your current strategy is working or needs adjustments.

Informing procurement and carrier decisions

Having a freight data strategy can also help when it comes to making procurement and carrier decisions. With freight analytics for shippers, you can:

- Understand where and when to launch bids or renegotiate. Launching bids and renegotiating contracts are excellent opportunities for cutting costs, but you need to time everything strategically. By analyzing market trends, rate shifts, and carrier performance, you can find the best time to take action. For example, you might relaunch bids or renegotiate when capacity is looser.

- Support mini-bid decisions or lane rebalancing. Another option for using freight data is for mini-bid decisions and lane rebalancing, particularly when facing unexpected disruptions or shifting demand. Once you have visibility into your lane-level performance and can benchmark your current rates with the broader market, you can make quick mini-bids between bid cycles to fill capacity gaps or take advantage of more favorable rates.

- Match the right carriers to the right lanes. Historical performance data can show which carriers perform best on specific lanes based on metrics like on-time delivery, tender acceptance, and dwell times. By regularly reviewing historical carrier performance data as part of your shipper freight data strategy, you can more strategically assign lanes, optimize routes, and renegotiate better rates.

- Avoid rate shocks. The market can be incredibly volatile, and rates are frequently evolving. With freight analytics for shippers, you can anticipate changes before they happen and adjust your strategy accordingly. As a result, you’ll be ahead of the curve compared to your competitors, can avoid costly surprises, secure capacity at the right time and for the right price, and better protect your profit margins—even when the market tightens.

Optimizing your network with freight analytics

Shipper freight analytics can also help you optimize your entire network. For example, if you analyze cost per mile, dwell times, on-time performance and tender rejection rates, you can easily identify redundant routes. Then, you can reroute freight and choose higher-performing or lower-cost lanes or consolidate your shipments.

Using analytics can also help you spot regional capacity constraints before they impact service. Predictive analytics will enable you to prepare for seasonal shifts by proactively adjusting your strategy to secure capacity before the market tightens and avoid disruptions. With the help of a strong shipper freight data strategy, you can anticipate market changes instead of merely reacting to them, enabling you to plan better and budget operations.

Another reason learning how to use freight data is worthwhile is that it can help you improve your service consistency while lowering the cost per shipment. Freight data can identify patterns driving up costs and impacting service, ranging from high dwell times to poor carrier performance, and help you take targeted action to resolve issues. For example, some carriers may consistently perform better than others, meaning you can reallocate more volume to your higher-performing carriers if you want more efficiency. Or, you could reroute through more reliable lanes and consolidate loads to create a more consistent network and cut costs per shipment.

Building a data-driven shipping culture

A strong shipper freight data strategy is essential, but it’s just the beginning. To drive real impact, freight analytics needs to be embedded in your daily operations.

Standing up an effective data and analytics framework requires support from across the organization—not just logistics or procurement. You’ll need to align executive leadership, finance, IT, and other key stakeholders around shared goals and expectations. Kicking off these conversations and building internal consensus will save you from bigger challenges down the road in today’s evolving landscape.

Once you’re aligned and in motion, don’t wait for quarterly reviews or annual planning cycles. Instead, collect, monitor, and act on your freight data on a regular cadence. Consistency is key. When every team—from procurement to operations to finance—is working from a shared source of truth, decisions get faster, smarter, and more aligned.

Centralized dashboards are helpful, but your teams also need the skills to interpret and act on what they see. Invest in training so they can identify trends, optimize procurement, rebalance or renegotiate lanes, and make more informed decisions.

Finally, collaborate closely with carriers and internal stakeholders. Align around shared data and common goals to build stronger partnerships, increase accountability, and help you respond quickly when the market shifts.

The insights you need may already be in your hands

You don’t necessarily need more data—you just need to use the freight data you have more effectively. So, take a closer look at what you’re already collecting, how you’re analyzing it, and how you’re using it. The answers to your biggest challenges are often already in front of you.

With a thoughtful shipper freight data strategy and the right tools, you can ensure no data is wasted and turn that existing information into smarter decisions, stronger partnerships, and a more resilient, cost-effective supply chain.

FAQs

A few things you might be asking yourself

Freight analytics involves collecting, analyzing, and interpreting transportation data to make smarter decisions, streamline operations, and improve logistics performance. With a strong data strategy and access to rate and network analytics, shippers can operate more confidently with valuable insights into key metrics, including freight costs, delivery times, carrier performance, and market trends.

These insights help shippers uncover inefficiencies, negotiate better rates, plan more strategically, and take proactive action against potential disruptions and other problems. In a fast-moving freight market, turning raw data into actionable intelligence isn’t just helpful—it’s essential for staying competitive.

Shippers can use comprehensive freight rate data and analytics to reduce costs by analyzing historical rates, carrier performance, lane-level data, and market benchmarks. With all of this data, shippers can optimize routing guides, negotiate better contracts with carriers, avoid overpaying on lanes, and make more informed decisions overall. Freight data can also help shippers uncover and address costly issues, ranging from late deliveries to long dwell times, which can help reduce overall costs. Additionally, predictive analytics can help shippers anticipate market shifts and avoid rate spikes.

To optimize their network, shippers should track lane-level performance data. For example, keeping an eye on transit times and cost per shipment can help shippers identify underperforming routes, uncover inefficiencies, and make effective freight rebalancing decisions to help streamline operations and improve service consistency. It’s also a good idea to pay attention to tender acceptance and rejection rates, as these can shed light on capacity challenges, while keeping track of dwell times at facilities and on-time delivery rates can highlight potential bottlenecks.

Benchmarking freight performance offers plenty of benefits. Not only does benchmarking performance allow shippers to compare their rates and service metrics against the broader market and gain a better understanding of where they stand, but it also helps highlight any underperforming lanes or carriers, enabling shippers to take targeted action to cut costs and improve service levels. On top of that, benchmarking can give shippers the data they need to renegotiate contracts, launch bids, determine if their current strategies are working, and remain agile in a volatile freight market.

With over $1 trillion in freight transaction data, DAT boasts the deepest, broadest, and most diverse database in the industry, powering robust data and analytics tools for critical business insights that shippers need to stay ahead of the competition in an unpredictable market.

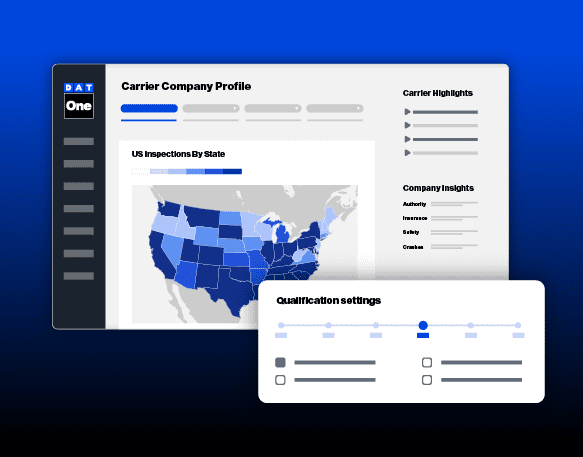

Along with a broad overview of the entire market, DAT iQ enables shippers to dive deeper into lane-, carrier-, and load-level analysis to identify inefficiencies and cost-saving opportunities along specific lanes. DAT iQ also has freight rate forecasts that are over 95% accurate, allowing shippers to better predict and prepare for market shifts. With a reliable data provider, shippers can confidently make proactive procurement decisions and keep a pulse on performance to drive optimizations.

Give your shipping business a competitive advantage with DAT iQ

With DAT iQ, you can gain access to real-time, lane-level insights, allowing you to transform freight data into a competitive advantage. From benchmarking to real-time market insights to forecasting, DAT iQ can help you apply analytics where it matters most—improving procurement, optimizing networks, and reducing costs. Reach out today to learn more!

Relevant Products

RateView Analytics

Actionable past, present, and future rate insights you can rely on for smarter strategic.

Network Analytics

Extensive lane and carrier insights for greater visibility and proactive management.

Ratecast

Bid on long-term business and negotiate with confidence using the Ratecast tool in RateView Analytics.