How to Post Your Truck with a Rate

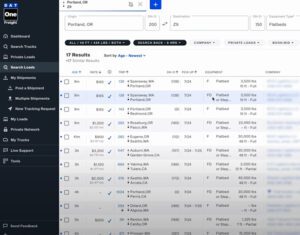

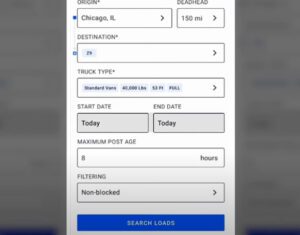

Want to have fewer, more productive calls with brokers? Post your truck with a starting rate on DAT One.

Want to have fewer, more productive calls with brokers? Post your truck with a starting rate on DAT One.

Get an in-depth overview on how to use the web/desktop version of DAT One.

Get an in-depth overview on how to use the mobile app of DAT One.

Find hot markets for your business with DAT’s Market Conditions.

Don’t leave money on the table. Here’s why you need a DAT One subscription.

Learn about these tips to optimize your operating costs for your trucking business.

Learn how to take your business to the level with data from DAT.

Learn about the top tools in DAT One to leverage to negotiate higher rates.

Commercial truck insurance is essential, but rates can vary significantly by state. Everything from population density to hazardous material transport can influence premium costs. Carriers with good credit and secure truck storage often receive lower rates. In this article, we’ll explore state-by-state insurance rates, key regulations, and practical cost-saving tips to help you make more informed decisions.

Choosing reliable partners for cargo transportation is essential for shippers, as freight companies ensure the safe and efficient transport of goods. These companies are pivotal in modern logistics, offering services from small parcel deliveries to large-scale freight movements. They connect manufacturers, retailers, and consumers, while providing value-added services like real-time tracking and customs clearance. Selecting the right freight shipping services can greatly impact your business’s efficiency and bottom line.

Optimizing less-than-truckload (LTL) freight shipments involves strategic consolidation, accurate freight class classification, and effective carrier selection. Implementing these practices helps enhance efficiency and reduce costs. Utilize technology solutions for better visibility and control, ensuring your shipments are reliable. Leveraging tools like DAT iQ Benchmark LTL provides insights into rate fluctuations and network performance, enabling informed decisions to improve your transportation strategy.

Supply chains are intricate networks connecting manufacturers, suppliers, and customers. A well-designed supply chain improves efficiency, cuts costs, and boosts customer satisfaction. We’ll explore strategies for optimizing your supply chain network, including transportation methods, inventory placement, and demand forecasting, to help you stay competitive in today’s market and adapt to evolving demands.