RFP season arrives amid uncertainty

Uncertainty abounds as we begin to look forward to the New Year. Election clarity and virus/vaccine issues aside, a key

Uncertainty abounds as we begin to look forward to the New Year. Election clarity and virus/vaccine issues aside, a key

Guest opinion by Mark Montague, industry pricing expert. Recent news has been all about the downturn in freight volumes, and

Freight rates are weak right now, as everyone in the industry is painfully aware. But while poring over the data in

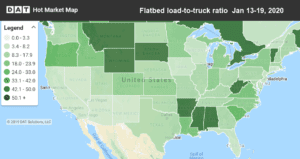

Since 2014, van and reefer rates have peaked late in the 4th quarter, thanks to the impact of e-commerce freight. Flatbed loads, however,

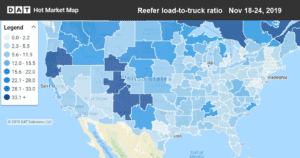

The holiday rush is underway. Refrigerated freight volumes hit a new weekly record, surpassing even 2017’s record-setting volumes. Reefer rates jumped more

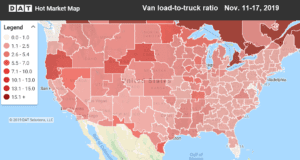

Freight volumes have been building for weeks, but sufficient capacity has kept rates in check so far this fall. The

Over the past few weeks, freight volumes have been building, but there was enough capacity to keep rates from rising.

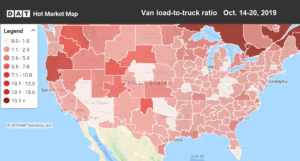

Truckload van shipments on the top 100 van lanes nearly hit a record high last week. In past years, a

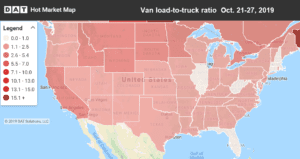

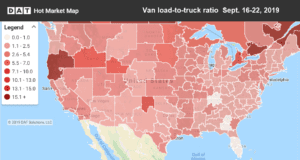

Van volumes got a bit of a boost late last week. Three of the most important van markets — Chicago, Dallas, and

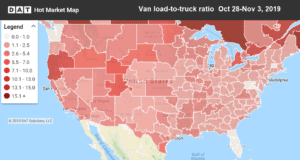

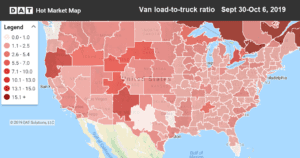

Following a surge to end the month and the third quarter, the first week of October saw fewer loads and

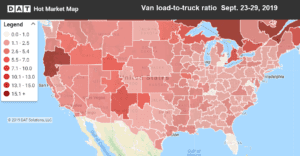

We usually see a boost in freight volumes in the last week of the quarter, and last week was no

Tropical Storm Imelda hit the Gulf Coast last week, bringing up to 40 inches of rain to the Houston area. Houston