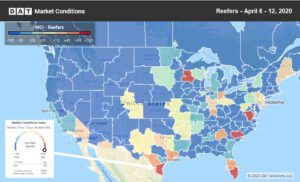

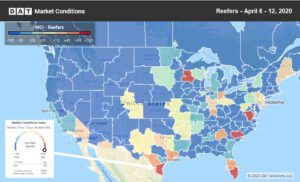

Reefer freight outlook cools due to food service closures

Reefer carriers are feeling the pain of coronavirus-related closures, as volume and rates declined sharply for reefer equipment in the

Reefer carriers are feeling the pain of coronavirus-related closures, as volume and rates declined sharply for reefer equipment in the

“April is the cruelest month,” said renowned poet T.S. Eliot, and those words resonate in this season of coronavirus-fueled woes.

The COVID-19 coronavirus pandemic has upended everything in our personal and professional lives. Most of us know at least one

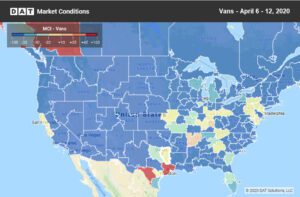

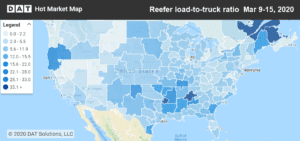

The word “disruption” seems too mild to describe the impact of COVID-19 on truck freight. Supply chains are strained to

As more and more cities and states institute measures in response to the COVID-19 threat, consumers have rushed to grocery stores

COVID-19 is causing the mother of all supply chain disruptions. Two weeks ago, we worried that the gap in imports

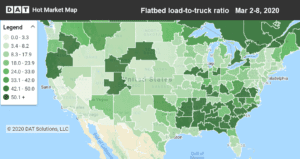

Rates haven’t been all that high for flatbeds, but the national average has held in a pretty stable in a

Got hand sanitizer? Canned soup? What about toilet paper? No? Well, you may have to get in line. Costco is

The daffodils are already popping up in my yard, but a frost still poses a potential threat to their longterm

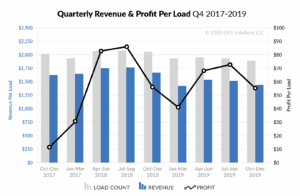

For small and mid-sized brokerages, quarterly load volumes were lower than they had been in more than two years, based

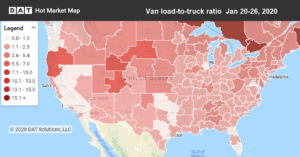

It’s officially the slow season for truckload freight. January is coming to an end, and it already feels like the

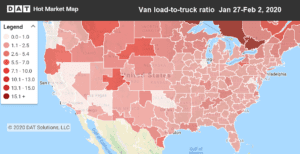

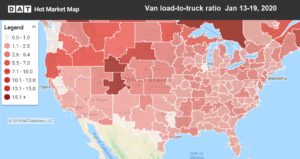

Here comes the winter slump. Van rates slipped below December levels last week, after an unexpected surge in the first