“April is the cruelest month,” said renowned poet T.S. Eliot, and those words resonate in this season of coronavirus-fueled woes. March was a good month for spot market providers, but April is looking bleak.

This crisis is temporary, but we don’t know how long it will last. For now, van spot freight volumes lost 20% in the past two weeks, and national average rates lost 8¢ per mile, to $1.78, reflecting declines all over the country. To add insult to injury, the South Central and Southeast regions were pummeled by tornadoes this weekend, and a big storm hit the Mid-Atlantic and Northeast states with heavy rain and 70-mile per hour winds.

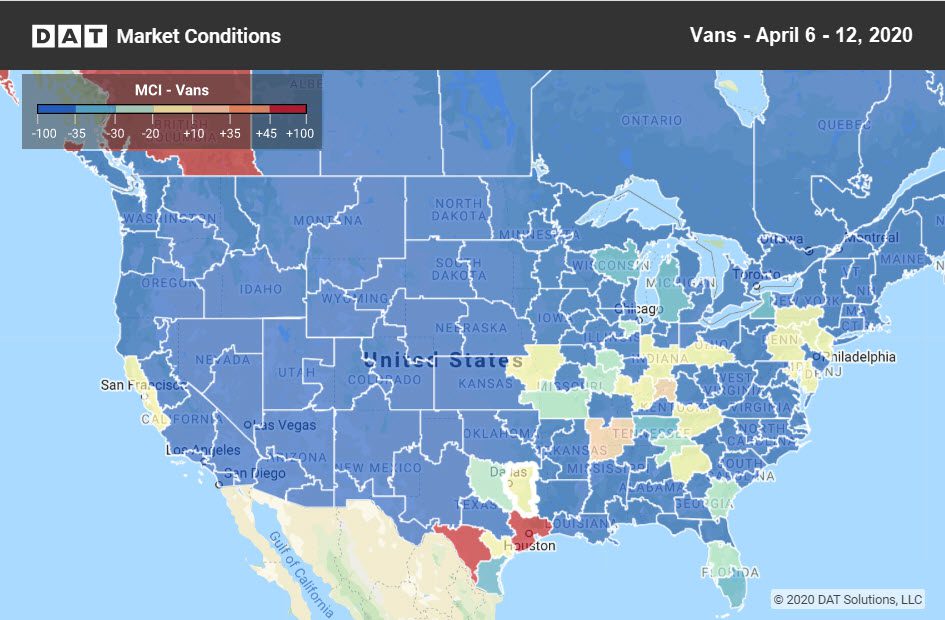

According to the new Market Conditions map in DAT Power and RateView, there are exactly two hot spots in the U.S. for carriers: Houston and Laredo. If you’re in South Texas, you should be able to find a load, and possibly a decent rate. A handful of markets are lukewarm, neutral, or cool, but most are an icy cold, deep blue.

Red is hot and blue is cold in DAT’s new Market Conditions Index. This informative metric replaces the load-to-truck ratio in a heat map that includes load and truck searches as well as posts, for a more comprehensive view of load availability and capacity levels. This map is available in DAT RateView and DAT Power, along with gauges and charts that provide additional views of each market area, plus load-to-truck ratio data.

Only 2 of the Top 100 high-volume lanes had higher rates last week than the week before, but the rate on the return trip fell in both cases.

- Denver to Phoenix rose 5¢ to $1.29 per loaded mile, but Phoenix to Denver dropped 19¢ to $1.78

- Denver to Dallas added 4¢ to $1.08, but Dallas to Denver lost 10¢ to $1.99

Another 3 lanes held steady, week over week. But on the remaning 95 of the top 100 lanes, rates slid lower. Some dropped sharply. Where to begin?

- Seattle to Spokane lost 30¢ to $2.39, and Spokane to Seattle fell to $2.49 from $2.65 at the end of March

- Memphis to Columbus plummeted 28¢ to $1.87, and Columbus to Memphis fell 17¢ to $1.62

- Atlanta to Charlotte tumbled 31¢ to $2.28, and Charlotte to Atlanta slid 22¢ to $2.20

- Cleveland to Chicago fell 22¢ to $1.67, and Chicago to Cleveland dropped 20¢ to $2.35 per loaded mile

- Dallas to Los Angeles hit $1.38, down 18¢, and L.A. to Dallas fell 11¢ to $1.39

- Buffalo to Allentown, PA, lost 34¢ to $2.86 and Allentown to Buffalo hit $2.27, a 21¢ drop

We’d like to say that there’s no place to go but up from here, but that might not be true. When businesses start to re-open, we’ll see improvement in all aspects of the economy, including freight. For now, as you alternate between washing your hands and crossing your fingers, be sure to keep an eye on DAT RateView and the Market Conditions Index. You’ll be the first to know when the market is ready to rebound.