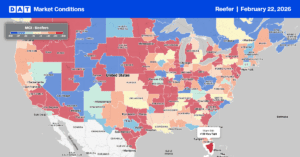

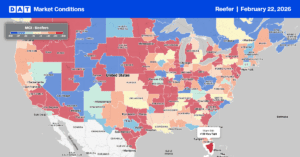

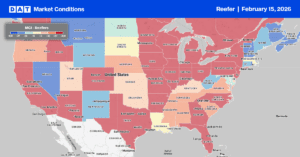

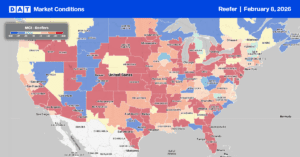

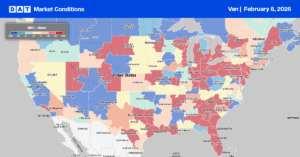

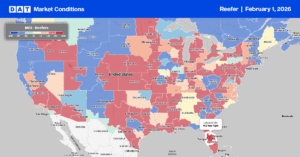

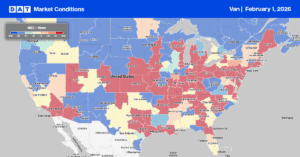

Reefer Produce Report: Florida’s reefer squeeze reverses; rates crater 20–32% as capacity returns

Last week’s story was Florida tightening fast. This week, it’s Florida giving it all back — and then some. Central

Last week’s story was Florida tightening fast. This week, it’s Florida giving it all back — and then some. Central

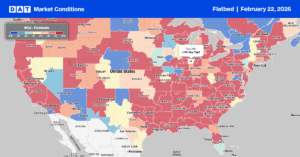

In early 2026, the American Iron and Steel Institute reported U.S. raw steel production running modestly ahead of the same

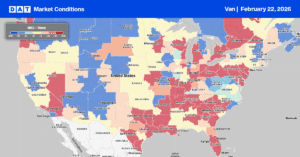

November’s trucking ton-mile index showed a promising rebound in freight volumes from a weak October reading. Volumes were up 1.0%

In the heart of the Permian Basin, the once-frenetic energy of Midland, Texas, is cooling as oil prices hover stubbornly

The February 10 USDA Specialty Crops Truck Rate Report paints a split market: Florida is tightening fast while South Texas

The U.S. Bank National Shipments Index saw a modest 1.5% increase in the fourth quarter, following a 2.9% contraction in

From a truckload carrier’s seat, January’s ISM Manufacturing PMI of 52.6% reads less like an abstract economic survey and more

The National Restaurant Association’s December Restaurant Performance Index dropped to 99.3, marking six consecutive months in contraction territory and the

The seasonally adjusted Trucking Ton-Mile Index (TTMI), a key benchmark for trucking demand, registered a noticeable downturn in October, falling

Carrier identity impersonation remains one of the most disruptive risks in freight transportation. Organized criminal groups increasingly pose as legitimate

For reefer carriers and brokers, the 2026 Florida Strawberry Festival (February 26 – March 8) isn’t just a celebration of

Trucking activity in the United States posted its second consecutive monthly gain in December, with the American Trucking Associations’ advanced