U.S. single-family homebuilding hit an 11-month low in June, with housing starts decreasing by 4.6% to a seasonally adjusted annual rate of 883,000 units. This marks the lowest rate since July 2024, with declines observed across all four regions, notably in the West and South.

Get the clearest, most accurate view of the truckload marketplace with data from DAT iQ.

Tune into DAT iQ Live, live on YouTube or LinkedIn, 10am ET every Tuesday.

The Commerce Department’s report links this downturn to high mortgage rates and economic uncertainty, factors that are suppressing home purchases and point to an ongoing contraction in residential investment for the second quarter.

The pessimistic outlook among homebuilders is further underscored by a more than two-year low in permits for future single-family home construction last month. The reduced demand has led to a surge in housing supply, deterring new construction. Current new housing inventory levels are now on par with those from late 2007.

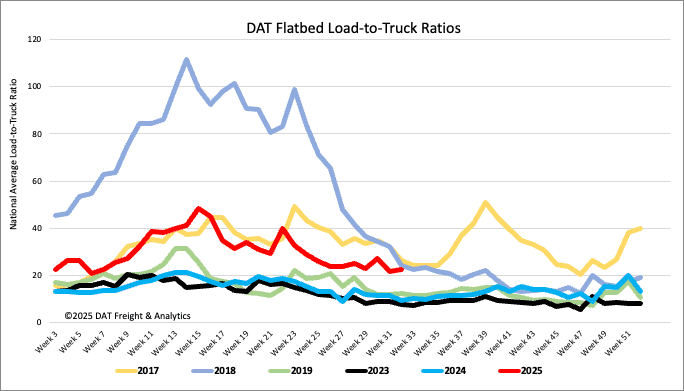

Load-to-Truck Ratio

Last week, the flatbed load-to-truck ratio rose by 4% to 22.49. This was due to flatbed load post volume remaining mostly flat but still 18% higher than last year, while carrier equipment posts decreased by 4%.

Note: To provide a clearer view of seasonal trends, the pandemic-influenced years of 2020, 2021, and 2022 have been excluded.

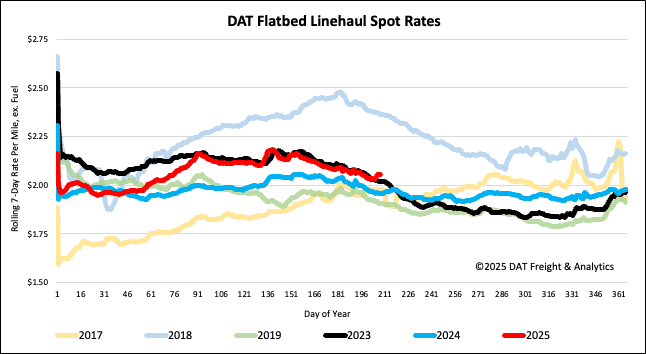

Spot rates

The national average flatbed spot rate, excluding fuel, saw a slight decrease last week, dropping by just over a penny per mile to $2.06. Despite this decline, the current rate is still $0.10 per mile higher than the same week in 2024 and $0.04 per mile higher than in 2023.

Note: To provide a clearer view of seasonal trends, the pandemic-influenced years of 2020, 2021, and 2022 have been excluded.