The major winter storm that crippled the Midwest immediately following Thanksgiving in late November created a sudden and intense spike in demand for refrigerated trailers, defying the typical softness of the post-holiday freight market. With over a foot of snow, high winds, and widespread travel chaos—including the closure of major airports like Des Moines and numerous highway accidents—dry van capacity was severely constrained. Compounding the disruption, shippers rushed to utilize reefers for “protect from freeze” loads, moving sensitive dry goods like beverages, chemicals, or electronics that would otherwise freeze in unheated dry vans. This immediate and essential shift pulled a large volume of temperature-controlled equipment off the spot market, leading to a sharp, temporary rise in reefer spot rates across the region. Midwest reefer spot rates jumped 23% in the week immediately after Thanksgiving as a result.

Get the clearest, most accurate view of the truckload marketplace with data from DAT iQ.

Tune into DAT iQ Live, live on YouTube or LinkedIn, 10am ET every Tuesday.

The surge in demand for “protect from freeze” capacity meant that trucks normally hauling perishable produce were diverted to move general freight, tightening the reefer market even further. This temporary capacity squeeze provided a brief, profitable reprieve for refrigerated carriers who were able to operate safely despite the hazardous conditions, helping to offset the sustained margin pressure they faced throughout 2025. As marginal capacity continues to exit the freight market, this first major winter storm of the season is a timely reminder of just how much impact cold weather is going to have on the temperature controlled freight market over the coming winter, especially for reefer carriers.

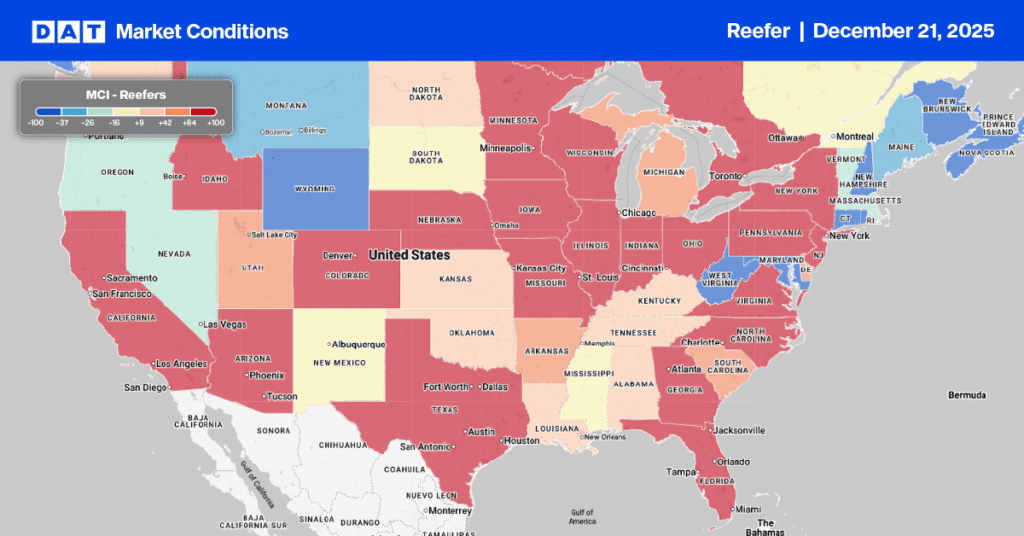

National load post volumes saw a 10% decrease last week, resulting in the reefer load-to-truck ratio increasing 21% to 17.81 last week. Load post volumes surged in Florida where scale houses have been converted to immigration enforcement centers (effective September 2025), increasing by 40% last week and 57% in the last month. Volumes were up 54% last week in Jacksonville, mostly for loads south to Miami, a deep backhaul market for carriers.

Reefer capacity in the McAllen market of southern Texas tightened last week, causing outbound spot rates to jump $0.08 per mile to $2.39. This rise follows a 23% surge in load posts in the region, which is a major gateway for Mexican produce (50% of the U.S. total). The USDA reported a shortage of trucks to move winter vegetables from the region to key markets, including East Coast cities, Chicago, and Los Angeles. Tighter capacity has been attributed to increased activity by U.S. Immigration and Customs Enforcement (ICE) in the region, particularly affecting carriers originating in California.

Targeted enforcement by U.S. Immigration and Customs Enforcement (ICE) focusing on English Language Proficiency (ELP) for truckload carriers operating near the southern border since September has driven a significant increase in spot rates. Specifically, backhaul lanes from McAllen to Los Angeles have seen a 44% rise in spot rates, consistently paying carriers approximately $1,000 more per truckload compared to the same period last year.

All rates cited below exclude fuel surcharges, and load volume refers to loads moved unless otherwise noted.

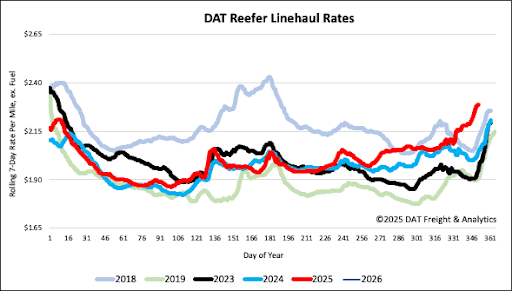

Spot rates in the temperature-controlled sector have continued their upward trend for the fourth straight week. The national 7-day rolling average spot rate increased by $0.08 per mile last week, settling at a national average of $2.29 per mile. This marks a 10% increase over the four-week period, which is $0.18 per mile higher than the three-month trailing average. Furthermore, the current rate is substantially higher than the same time last year—up $0.24 per mile, or 12%.