Van rates drop as more Americans shelter at home

Demand for dry van equipment continued to slide last week, along with rates. We saw it coming, as load-to-truck ratios

Demand for dry van equipment continued to slide last week, along with rates. We saw it coming, as load-to-truck ratios

While the van markets might be showing signs of heating up, flatbed loads have been hot all winter long, and

February is usually the slowest month of the year for spot freight, and declines in reefer rates have been sharper

Load posts were up a bit again last week, which is the second straight week of improving spot market volumes.

February is the slow season for freight, and it may feel like your business is at a crawl right now.

Van load availability dropped another 9% on the spot market last week, while truck posts on DAT Load Boards held

Demand for reefers in the Pacific Northwest has also boosted van demand in that area, since reefers are competing less

RATES FUEL SURCHARGE AND ARBITRAGE CARGO TYPES MARKET- AND REGION-SPECIFIC VOLUME Total rate for van hit $2.08 per mile in

Fuel costs don’t typically make the news when prices are falling. This winter, as fuel prices continue to drop, the

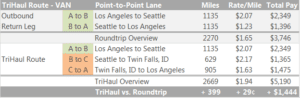

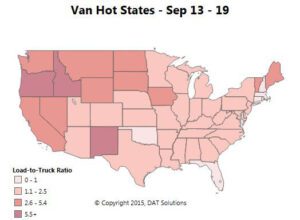

I was cautiously optimistic about September freight volume, but volume and rates peaked early in the month. Since then, trucking

Volume was way up last week. Was it a month-end spike, or real growth? I asked Mark Montague and he

Volume was way up last week. Was it a month-end spike, or real growth? I asked Mark Montague and he