Is the spot market sputtering or stabilizing?

At first glance, it looks like the van spot market took a step back last week. Rates fell in most

At first glance, it looks like the van spot market took a step back last week. Rates fell in most

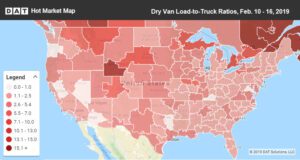

We’re still deep in the slow season, but spot market trends are actually running about a month ahead of schedule.

Has money been a little tighter for your business lately? If you’re a small carrier or owner-operator, you’re not alone.

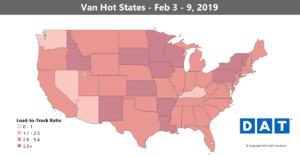

You can expect a couple of things to happen pretty much every January: Freight rates will fall, and some will

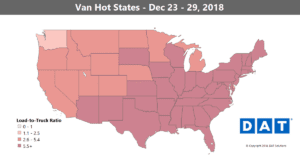

Last week the national average van rate dropped 4¢ to $1.97/mile. The last time the average van rate was below

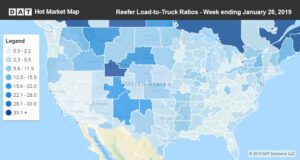

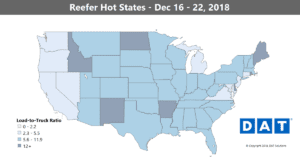

Expect a rush of reefer demand this week in areas hit by sub-zero temperatures, as shippers attempt to prevent sensitive

Tis the season for falling rates. As we move deeper into the slow season, rates are drifting in their typical

A lot of us in the trucking industry had to do something last week that we haven’t had to do

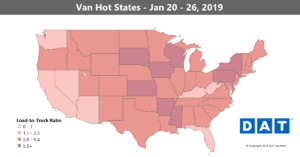

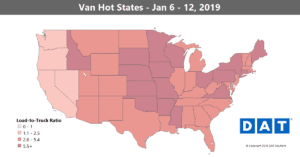

Truckload capacity remained tight during the first week of 2019, and national average rates increased 3¢ for vans, reefers and

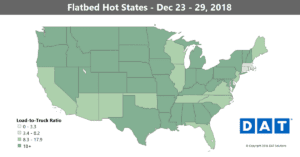

Flatbed carriers didn’t hear a lot of good news in the second half of 2018. After the spikes we saw

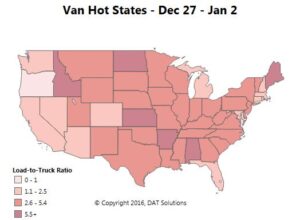

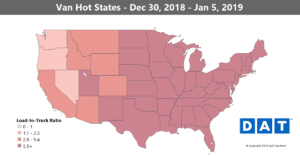

For the first time since 2012, the national average van rate was lower in December than it was in November.

Shippers had plenty of last-minute freight to deliver before Christmas, and that stopped the slow slide we had been seeing