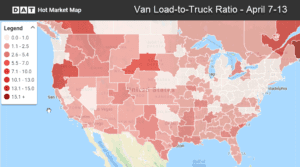

Easter week started strong before demand dipped

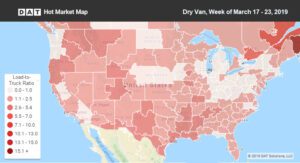

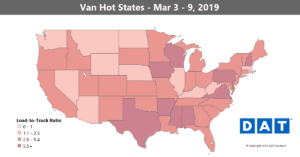

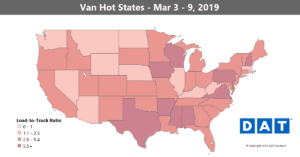

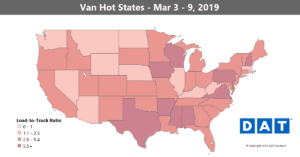

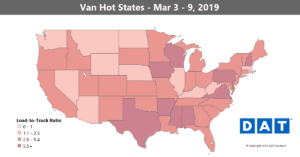

Last week started with solid demand, but activity tapered off as Good Friday and the Easter weekend approached. Load-to-truck ratios

Last week started with solid demand, but activity tapered off as Good Friday and the Easter weekend approached. Load-to-truck ratios

Despite an increase in freight volumes, national average rates slipped again last week for vans and reefers. Even the arrival

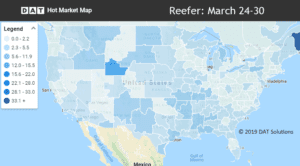

Van and reefer rates continue to move sideways. Refrigerated produce freight has been notably absent from the picture, so that

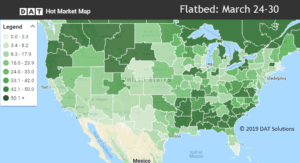

While van and reefer rates saw a decline in March compared to February, flatbed loads bucked the trend, making gains

It’s still early in the spring, but the refrigerated truckload sector is not picking up any momentum yet. I wouldn’t

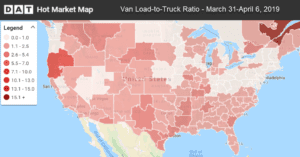

It looks like we’ll have to wait a little longer for a spring surge. The spot market appeared heading for

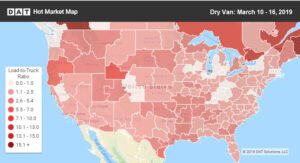

Just as rates were about to turn around, they took another hit last week. Extreme weather closed highways and forced

Just as rates were about to turn around, they took another hit last week. Extreme weather closed highways and forced

Van and reefer rates are stabilizing, after falling for eight straight weeks. The national average van rate held steady, and

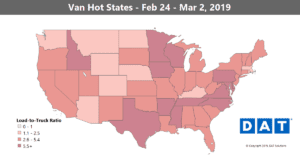

The spot market continues to offer a mixed bag. Van volumes got a late-winter boost on the West Coast, which

At first glance, it looks like the van spot market took a step back last week. Rates fell in most

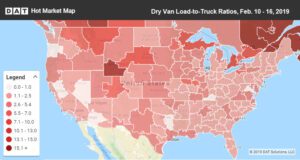

We’re still deep in the slow season, but spot market trends are actually running about a month ahead of schedule.