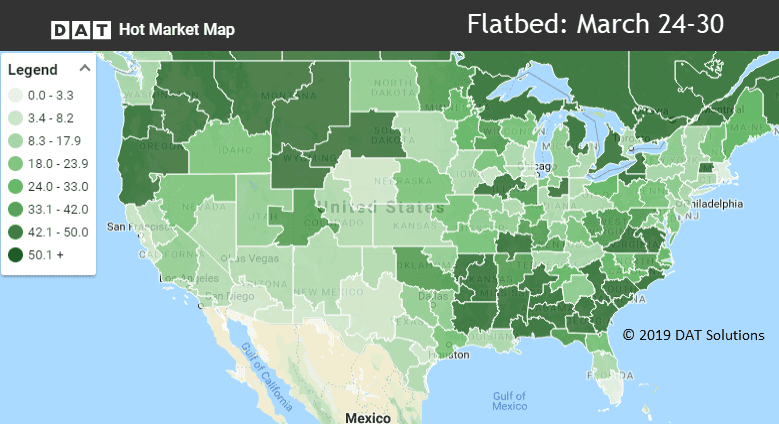

While van and reefer rates saw a decline in March compared to February, flatbed loads bucked the trend, making gains in both freight volumes and rates. Flatbed rates have risen for 5 consecutive weeks, and the national average rate ended March at $2.34/mi.

In the top 78 flatbed lanes, rates moved higher on 36 lanes, while 42 were lower. Even so, rates have increased 4% overall in the past two weeks.

The national load-to-truck ratio for flatbeds increased to 32 loads per truck last week.

Rising Rates

Plenty of flatbed markets in the South and East experienced rising prices, including Birmingham, Tampa, Atlanta, Savannah, Raleigh, Harrisburg, Dallas andPhoenix. Some of the lanes where rates increased last week included:

- Houston to Oklahoma City jumped 38¢ to $2.55/mi.

- Phoenix to El Paso, TX gained 32¢ to $2.08/mi.

- Atlanta to Houston increased 26¢ to $2.33/mi.

Falling Rates

On the other hand, flatbed prices trended down in a handful of key markets, including Jacksonville, Las Vegas, Cleveland, Pittsburgh, and Roanoke. Lanes with falling rates included:

- Pittsburgh to Houston fell 25¢ to $2.23/mi.

- Cleveland to Harrisburg, PA dropped 24¢ to $3.66/mi.

- Baltimore to Springfield, MA slid 21¢ to $4.04/mi.

Find loads, trucks and lane-by-lane rate information in DAT load boards, including rates from DAT RateView.