We’re still deep in the slow season, but spot market trends are actually running about a month ahead of schedule. There’s been seasonal weakness, but we’re already seeing volumes firming up, which is something we don’t usually expect until mid-March.

In other words, rates are gearing up for a rebound.

While DAT predicted in early December that the spot market in Q1 would be weaker than in previous winters, trends are already stabilizing and poised to exceed expectations in the second quarter. This whipsaw effect will catch some by surprise since some analysts are predicting market weakness, but their forecasts either miss the mark or they’re working off outdated information.

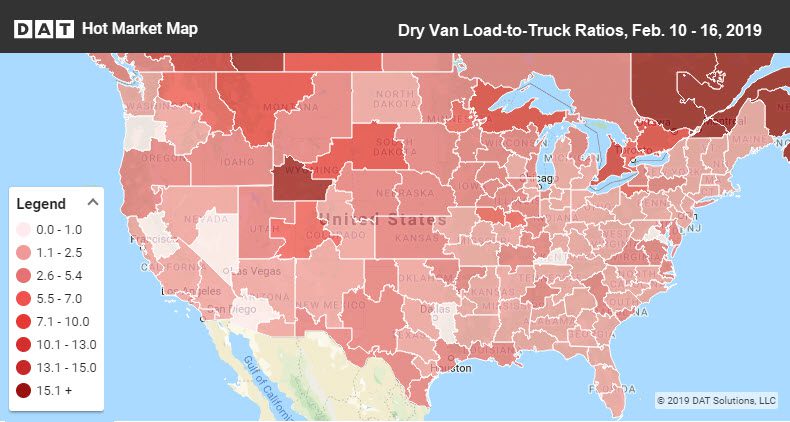

The load-to-truck ratio rose 3.5% to 4.8 loads per truck. Demand appears to be poised for a rebound, and rates may have hit bottom for the season.

The recent increase in oil prices also gives us confidence that a spot market thaw is imminent. West Texas Intermediate crude has risen to $56 per barrel, spurring new activity in Texas oil fields. The rising trend will likely continue to generate additional freight volumes there and throughout the country as soon as spring arrives.

Last week, the top 100 high-volume van lanes turned positive, by an ever-so-slight margin. Rates rose a minuscule 0.2% or three-tenths of a cent per mile, but that ends a streak of weekly losses going back to early January. Of those 100 lanes, 47 lanes had higher rates, while prices fell on 40 lanes. The other 13 lanes were unchanged compared to the previous week. That “lucky 13” was a record high number of neutral results for this bellwether report, which suggests that the spot market has already found the bottom.

RISING RATES

The biggest increases last week were in markets that usually have weak pricing:

- Seattle to Spokane jumped up 31¢ to $3.54/mile, due to snowstorms that closed some of the major highways, on and off during the week

- Denver to Albuquerque recovered 12¢ to $2.00/mile, after a sharp drop in the previous week

- Denver to Houston also added 12¢ at $1.37/mile, which is still not a great rate

FALLING RATES

Pricing was stable on most other lanes, with a couple of noteworthy declines:

- Chicago to Buffalo rates fell 16¢ to $2.54/mile, which could just be a tough comparison to the previous week when both cities recovered from major snowstorms

- Los Angeles to Denver lost 12¢ at $2.22/mile — this could also be weather-related

Find loads, trucks and lane-by-lane rate information in DAT load boards, including rates from DAT RateView.