Apples recently topped the USDA’s commodity list, making up roughly 12% of national truckload volume. The main apple-producing states are Washington, New York, Michigan, North Carolina, and California. California’s apple production is nearing its yearly high, and growers expect a larger harvest this year despite considerable market hurdles. California’s Gala apples, in particular, gain a competitive advantage by reaching the market weeks ahead of Washington’s crop, which still has a significant carryover from the previous year.

Get the clearest, most accurate view of the truckload marketplace with data from DAT iQ.

Tune into DAT iQ Live, live on YouTube or LinkedIn, 10am ET every Tuesday.

Because California starts picking apples several weeks before Washington state—the nation’s leading producer—providing the first fresh apples of the year is a key selling point. For 2025, California’s apple commission projects approximately 60 million pounds of apples will be packed for the fresh market. This marks an increase from the 49.1 million pounds reported in 2024 by the U.S. Department of Agriculture (USDA). Last year, the state’s total apple production reached 157 million pounds, with 31% allocated to the fresh market and 68% utilized for processing, according to USDA figures. The remaining portion was not sold.

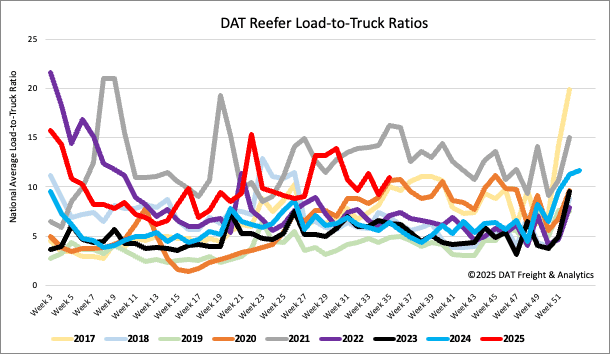

Load-to-Truck Ratio

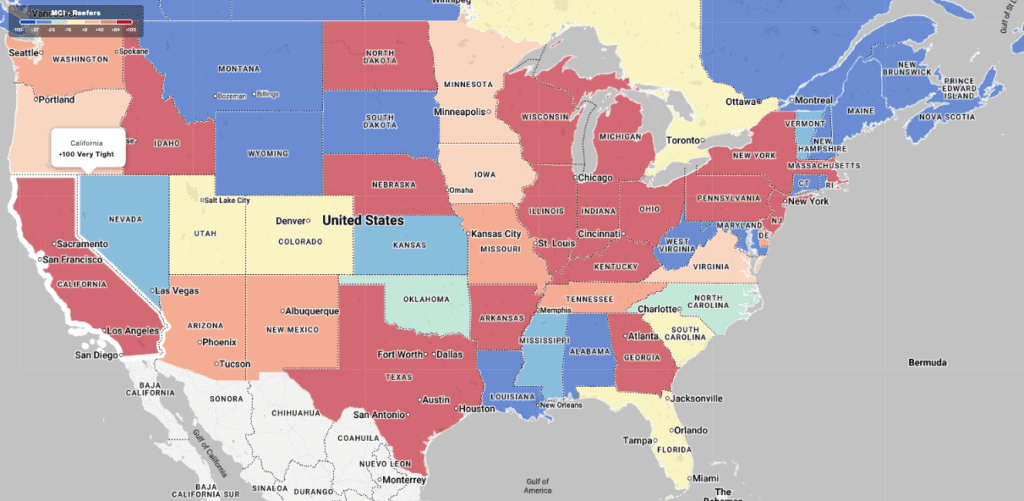

Last week saw a 12% increase in reefer load post volumes, partly due to a 3% week-over-week rise in California produce volumes, which account for around 20% of national truckload produce volume. This surge is largely attributable to berry season, with strawberry volumes specifically increasing by 8% weekly, predominantly from the Salinas/Watsonville region in Northern California, significantly benefiting the reefer market. Simultaneously, carrier equipment posts declined by 5% week-over-week, resulting in a 19% increase in the reefer load-to-truck ratio, reaching 10.91.

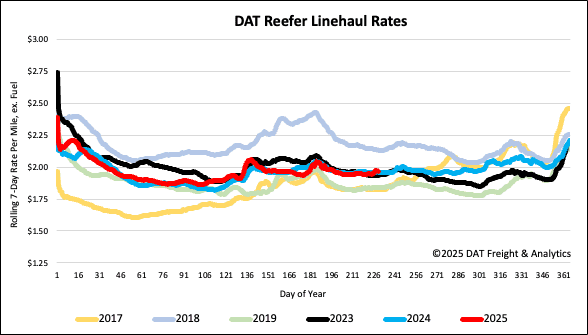

Spot rates

National reefer rates recovered last week’s one-cent decline, settling just over $1.97 per mile. This new rate is nearly $0.01 higher than the previous year and $0.03 higher than in 2023.