In 1980, finding a backhaul was a slow, costly process rooted in physical presence and scattered information. The first signs of digitization started in 1978 at the Jubitz Truck Stop in Portland, OR, with the launch of Dial-A-Truck (now DAT Freight & Analytics). Before this, drivers relied on bulletin boards where brokers manually posted load details or waited for “pump jockeys” (fuel attendants) to run inside the truck stop to check load availability while fueling. When a driver finally found a load, they faced a clunky process: waiting for an available rotary phone, hours of negotiating a rate, and then waiting again for physical paperwork—a delay that could turn their unproductive, deadhead miles into days or even a week.

Get the clearest, most accurate view of the truckload marketplace with data from DAT iQ.

Tune into DAT iQ Live, live on YouTube or LinkedIn, 10am ET every Tuesday.

Dial-A-Truck initially disrupted this by installing an electronic monitor at Jubitz. Brokers called in details, and staff manually typed them onto the screen, displaying available freight in a format that was instantly visible—a basic, real-time load board. This system cut down on frantic searching, but it still relied on phone calls, broker availability, and manual information exchange. Fast forward to 2025: today’s trucker uses an iPhone and an AI-powered app connected to a network of nearly 2 million loads every week. The entire process, from search to confirmed booking, takes seconds. The speed of AI-driven matching removes the costly friction of the past, reducing deadhead miles and boosting revenue—a major leap from the slow digital change that started over a cup of coffee at a Portland truck stop.

In the 1980s, finding a load could take anywhere from hours to a full day; now, it happens in seconds. The tools evolved, but the road remains the same. Trucking didn’t get easier—it simply got smarter.

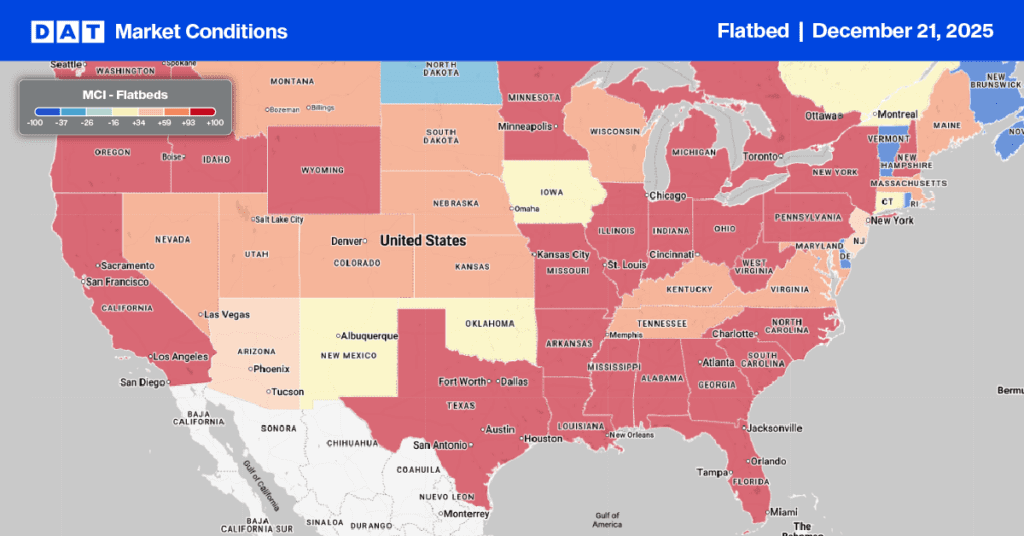

Flatbed load post volumes have surged, showing a 25% increase from the previous week and are now 66% higher than the same time last year. This significant spike is linked to the persistent cold weather and the multi-week winter storms affecting the Midwest. Consequently, the Midwest Region saw spot rates jump by $0.11 per mile last week, which is $0.06 per mile higher than the national 7-day rolling average increase. Last week, the flatbed load-to-truck ratio stood at 33.35.

All rates cited below exclude fuel surcharges, and load volume refers to loads moved unless otherwise noted.

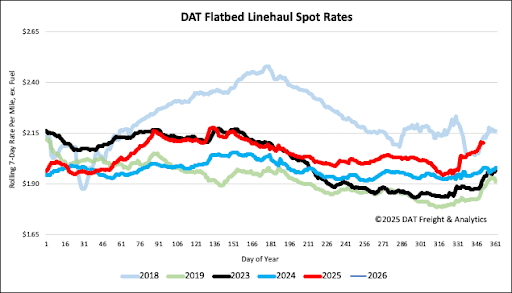

Last week, the national average flatbed spot rate increased by $0.05, reaching $2.12 per mile. Currently, the national average rate is $0.13 per mile, or about 6%, higher than the rate recorded during the same period last year and matches the rate from 2018.