It’s been an up-and-down kind of market for reefer equipment. We’re not talking about a gentle rise and fall — more like a giant roller coaster.

First came Chinese New Year and the extended closures in Asia. Imports ground to a halt on this side of the Pacific, freeing up trucks on the West Coast and driving rates lower.

Next, the coronavirus threat crossed the ocean, growing rapidly from a vague public health issue into a full-blown crisis. Suddenly, everyone stocked up on groceries, emptying store shelves, as each shopper gathered several months’ worth of just about everything they might want or need. The mix of pickup and delivery locations also changed pretty radically, as restaurants, cafeterias and other food services closed down and so many more meals were served at home. Disruption on such a large scale tends to boost rates, and that was true for March.

See up-to-date rate trends for more than 65,000 point-to-point lanes in DAT RateView.

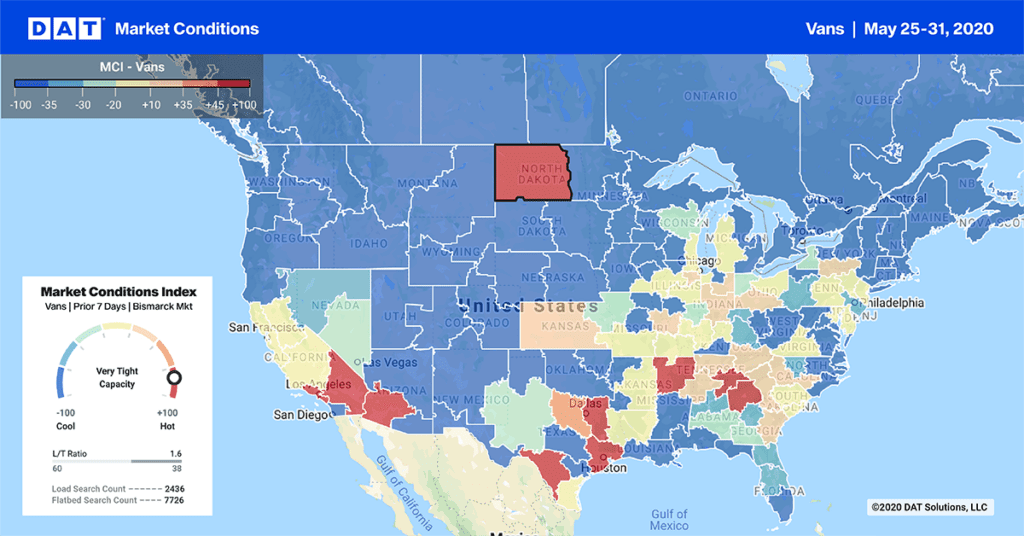

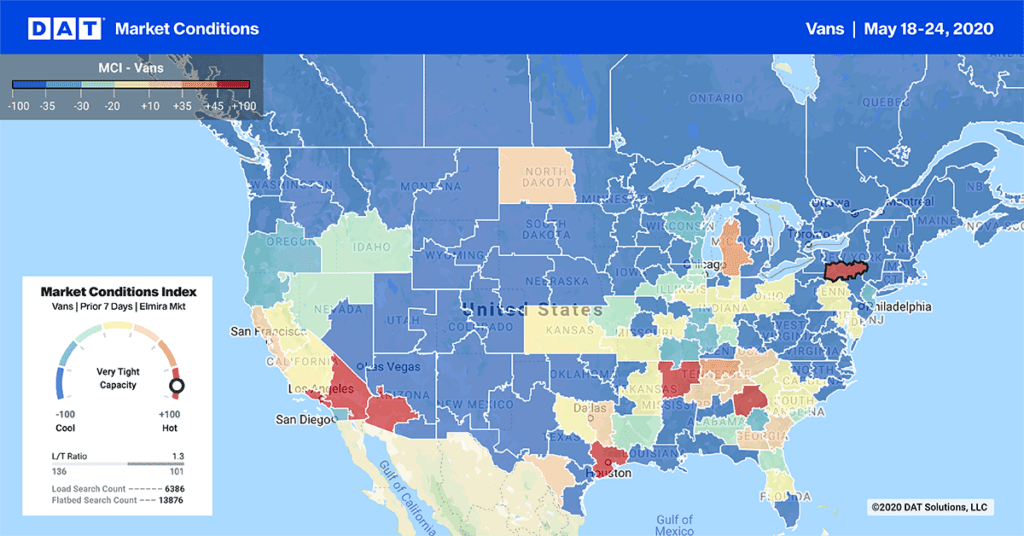

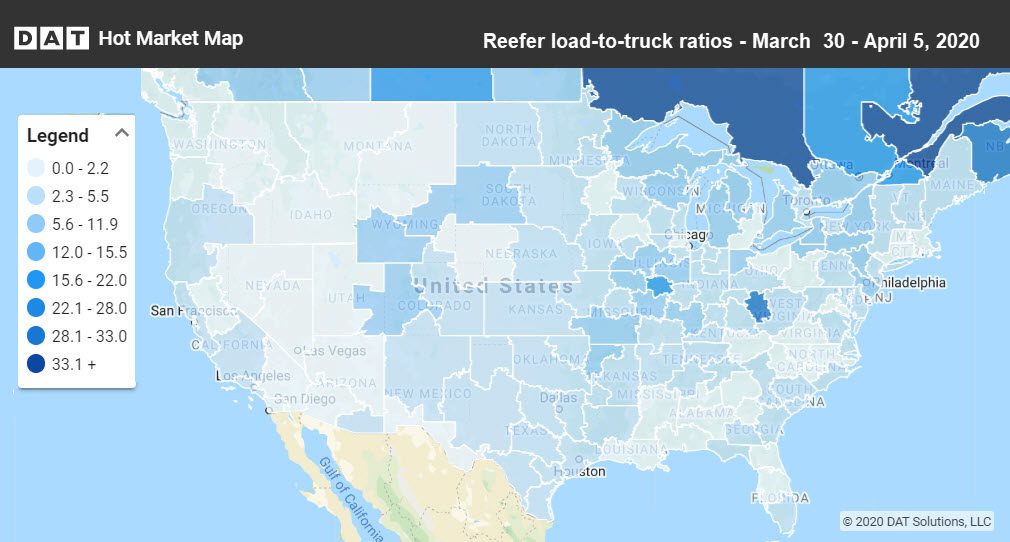

There weren’t a lot of hot markets for reefer freight last week. Learn more about local and regional trends in Hot Market Maps, found in DAT RateView and DAT Power.

Last week, reefer freight entered a new stage, as “social distancing” escalated to “shelter at home” and consumers stopped going to stores altogether. That took some of the urgency out of inventory replenishment, but spot market volumes barely budged from the elevated levels of the previous three weeks.

By comparison, dry van rates dropped like a rock last week, in almost every market and lane across the country. Luckily for reefer carriers, there are still some markets and lanes where spot rates are rising. That’s because more fresh produce is coming into season, just as other refrigerated foods are being re-supplied to grocery stores at a more normal cadence. Produce season bolsters rates to some degree, but rates also face downward pressures because of the sharp decline in food services.

Trucking companies that used to service fast-food chains and school cafeterias are more temp-controlled trucks available to move whatever needs moving, so capacity is expanding while the level of demand is not going to change all that much. Everyone is still eating, even though the dining table is at home instead of in a restaurant.

Reefer rates rose on lanes originating in the Midwest and California, plus a few lanes out of Florida.

- Chicago to Kansas City rocketed up 23¢ to $2.60 per loaded mile, and Kansas City to Chicago

- Green Bay, WI, to Minneapolis added 13¢ to $2.51

- Stockton, CA, to Portland, OR was up 16¢ to $3.09 (other Stockton lanes rose, too)

- Lakeland, FL, to Baltimore rose 9¢ to $2.12

- Los Angeles to Phoenix was up 11¢ to $2.97

- Twin Falls, ID, to Los Angeles rose 8¢ to $2.19

There’s still plenty of reefer freight to be found in the Mexican border markets of McAllen and Tucson, but rates trended down last week. Some Philadelphia outbound rates also lost traction.

- McAllen, TX, to Atlanta lost 22¢ to $2.45, which is still pretty good compared to three weeks ago. Lane rates also dropped from McAllen to Dallas, Chicago, and Northern New Jersey.

- Tucson to Los Angeles fell 19¢ to $2.44, but that rate is also higher than it was three weeks ago. Rates also dropped on lanes from Tucson to New York City and from Tucson to Chicago

- Philadelphia to Chicago dropped 7¢ to $1.56. Philly to Boston rates also fell, losing 12¢ to $3.80. That’s better than 3 weeks ago, and it sounds like a lot, but there are tolls and traffic on the route.