The power of benchmarking: Unlock insights to boost performance

The following is a guest post from Josh Hanselman, a member of our enterprise sales team. Benchmarking is a critical

The following is a guest post from Josh Hanselman, a member of our enterprise sales team. Benchmarking is a critical

Here are measures that carriers can take to protect themselves against identity theft, double brokering, cargo theft and other scams.

The DAT iQ analytics team takes a weekly look at how the freight markets are responding to the COVID-19 crisis,

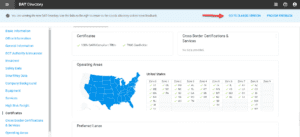

For years, DAT has provided its load board users with a directory where they can to learn more about the