Spot market truckload rates hit a four-year low in April. For dry van freight, the national average was just $1.64 per mile. You have to go back to September 2016 to find a national average lower than that for vans. The story was similar for reefers and flatbeds: The national averages for those segments were the lowest since early 2017.

May is often when we start to see the spot market gaining steam. Spurred by harvest season and the urgency to get produce to market, truckload rates start their climb to their June peak. This isn’t going to be a typical May, though. While we’re seeing many of the usual seasonal patterns emerge, we’re starting from a mighty deep hole.

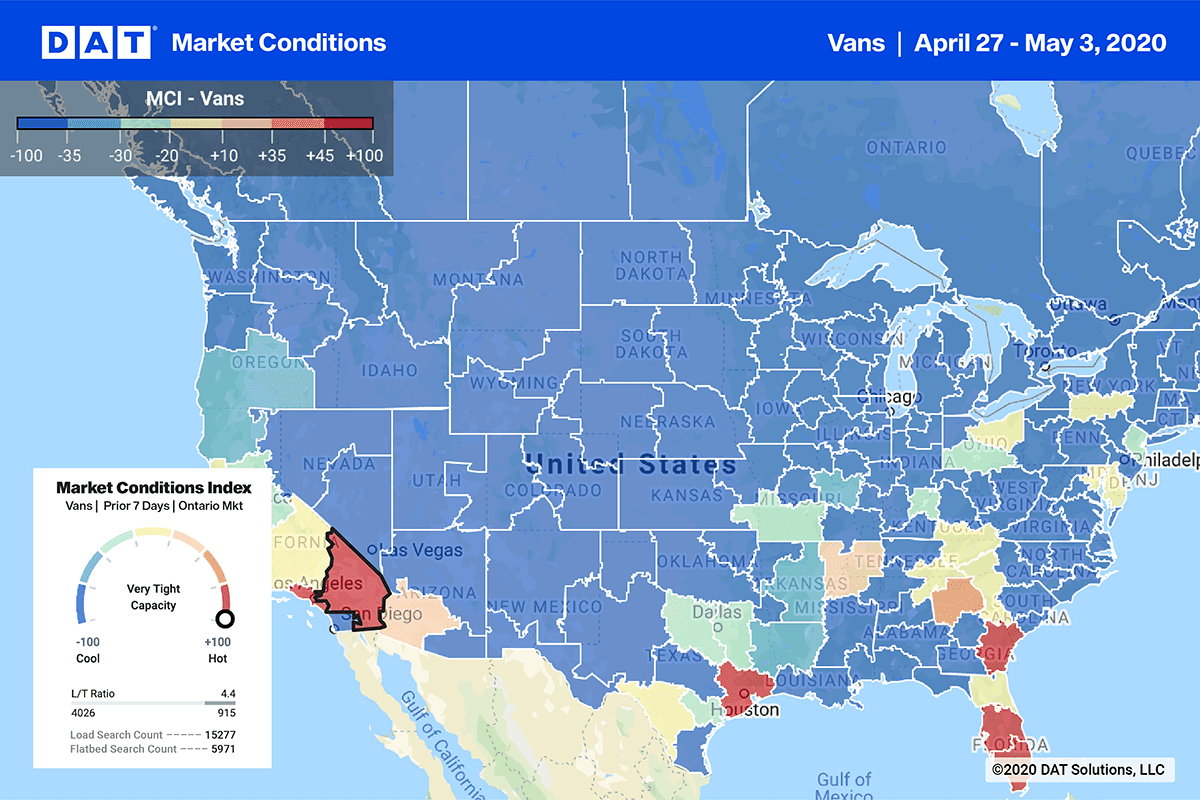

The Market Conditions map is available in DAT Power load board subscriptions and DAT RateView.

Of course, COVID-19 is the culprit. Aside from a brief period in March when the demand for trucks spiked to restock grocery store shelves, demand for freight has plummeted, with most business shuttered or operating at low capacity.

But as you can see in the Market Conditions map above, activity is finally picking up in states that have begun to reopen (Missouri, Tennessee, Texas, Georgia). Demand is also heating up in produce regions (Florida, California, Texas and Georgia again). Carriers are also hoping that the resumption of import traffic will bring some relief, and we’re seeing some early evidence of that in Los Angeles, Houston, Savannah, GA, and Elizabeth, NJ.

But even as we watch these new developments, one fact remains the same in the meantime: Prices are still falling, and it’s become unsustainable for carriers.

Van trends

While rates fell on a majority of the top van lanes last week, there are signs that the declines are leveling off. We also saw increases on some key lanes, including just about every major lane out of Los Angeles and Stockton, CA.

- L.A. to Denver rose 16 cents to an average of $1.94 per mile. That’s one of the more significant increases we’ve seen in recent weeks, but that price is still way below the norm for that lane.

- Stockton to Salt Lake City rose 15 cents to $1.95 and was still climbing early this week.

- Atlanta to Charlotte climbed 11 cents to $2.00. Still not the norm for that lane, but not as far below the mark.

Again, most lanes still saw lower prices, but the pace of those declines slowed in many areas. Some of the bigger drops were in response to improved outbound conditions in places like Stockton and Atlanta.

- Denver to Stockton fell 15 cents to just $1.16 per mile

- Chicago to Atlanta fell 13 cents to $1.44

Reefer trends

Produce harvests are providing stability in some reefer markets, with prices holding steady out of California while the familiar patterns take place in and out of places like Florida. In fact, higher volumes out of Florida were responsible for most of the large increases and decreases, with outbound lanes up and inbound lanes down.

- Atlanta to Miami fell last week, but that was offset by a 22-cent increase on the lane from Miami to Atlanta, fueled by higher volume.

- Lakeland, FL, to Atlanta also climbed 22 cents at $1.76, but declines on the southbound lane from Atlanta wiped out the gains for the roundtrip.