Located an hour north of Los Angeles at the southern end of the Central Valley, Kern County is the carrot capital of the United States. It produces about 80% of all carrots grown in the U.S., making it the dominant region for carrot production nationwide. Kern County’s favorable climate, extensive acreage, and large-scale operations by major producers have solidified its leading status in the industry.

Get the clearest, most accurate view of the truckload marketplace with data from DAT iQ.

Tune into DAT iQ Live, live on YouTube or LinkedIn, 10am ET every Tuesday.

This concentration of production is due to the region’s favorable climate, advanced agricultural practices, and the presence of major carrot growers and processors headquartered there. Given that California’s annual carrot production is about 1.15 million tons, Kern County’s annual carrot production is estimated to be between 690,000 and 700,000 tons or the equivalent of just over 30,000 truckloads.

- Carrots are the second most popular vegetable in the world, after potatoes

- Carrots are the fourth most consumed vegetable in the U.S.

- While most carrots are orange, they can also be white, yellow, red, and purple

- The average person will eat around 10,866 carrots in a lifetime

- Carrots can be left in the ground all winter and still be harvested

- They were the first vegetable to be commercially canned.

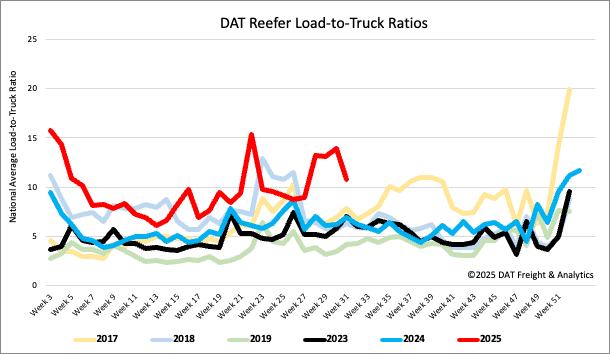

Load-to-Truck Ratio

Last week, the reefer load-to-truck ratio dropped by 23% to 10.73, mirroring the dry van spot market. This decline was due to a 21% decrease in reefer load posts, while available capacity rose with a 7% increase in carrier equipment posts.

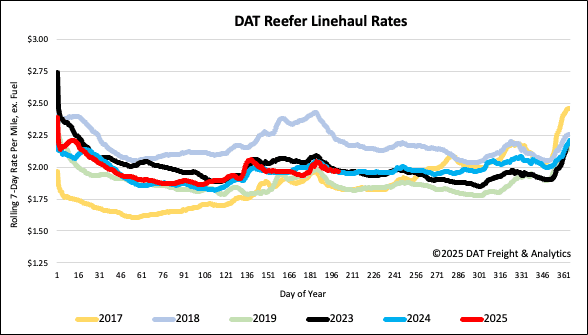

Spot rates

For the second consecutive week, national reefer rates have declined, dropping by $0.02 per mile to just under $1.98 per mile. This rate is currently on par with last year’s figures and slightly below 2023 levels.