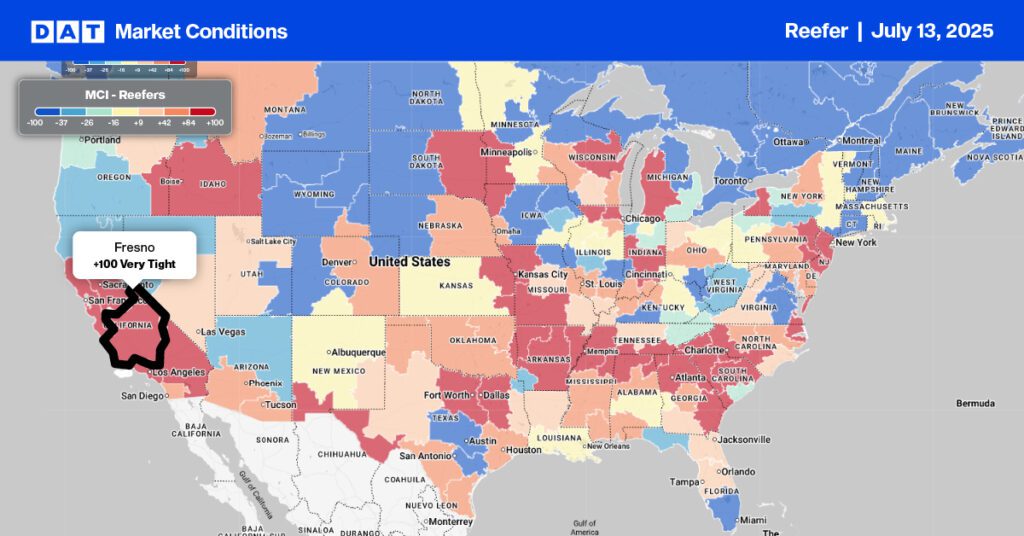

Fresno, California, is widely recognized as the “Raisin Capital of the World” due to its significant role in raisin production and its ideal climate for growing grapes, which are then dried into raisins. Fresno and its surrounding area in the San Joaquin Valley produce more than half of the world’s raisins, making it a global leader in the industry. Major raisin brands, such as Sun-Maid, are also based in Fresno, further cementing its reputation.

Get the clearest, most accurate view of the truckload marketplace with data from DAT iQ.

Tune into DAT iQ Live, live on YouTube or LinkedIn, 10am ET every Tuesday.

Fresno became the world’s leading raisin producer due to its ideal climate, fertile soil, innovative farming, and industry consolidation. Key factors include: optimal sun and soil in the San Joaquin Valley; late 19th-century growth driven by Armenian immigrants; early 20th-century geographic concentration that made the U.S. a global leader by 1904; collective action via the California Associated Raisin Company (Sun-Maid) in 1912 for marketing and quality; and technological advancements like new grape varieties and improved processing, boosting efficiency and quality.

Today, over 1,500 growers in the Fresno area produce 100% of U.S. raisins on about 100,000 acres, exporting to nearly 50 countries. The region produces between 300,000 and 320,000 tons of raisins annually, about 60% of the world’s raisin supply and the equivalent of almost 14,000 truckloads.

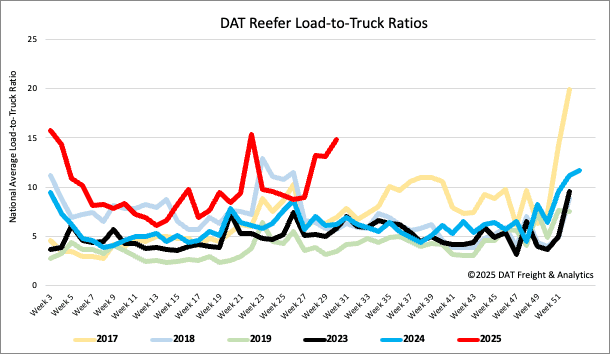

Load-to-Truck Ratio

Similar to the dry van spot market, the reefer load-to-truck ratio rose by 13% to 14.81 last week. This increase was driven by a 13% rise in reefer load posts, following the previous short shipping week, while carrier equipment postings remained largely flat.

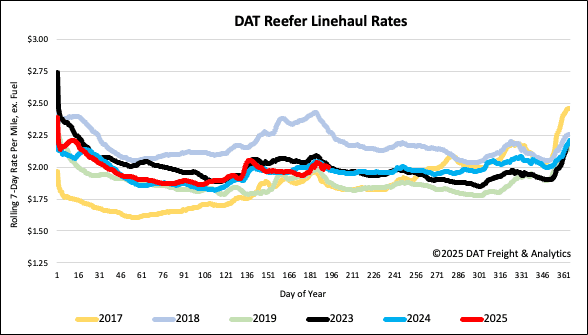

Spot rates

Last week, national reefer rates decreased by almost $0.05 per mile, settling just under $2.00 per mile. This predictable loosening of available reefer capacity marks the beginning of the “dog days of summer,” bringing with it lower spot market freight volumes. Despite the recent drop, this year’s average rate is $0.02 per mile higher than last year and nearly identical to 2023 figures.