The seasonally adjusted trucking ton-mile index (TTMI) for May indicates a cooling in demand for for-hire trucking services in the USA after strong growth in March and April. Here are the key points:

This index is co-authored by Professor Jason Miller and Yemisi Bolumole, at the Michigan State University, and estimates for-hire trucking demand by combining data from over forty freight-generating industries using a weighted geometric mean based on the Commodity Flow Surveys.

Get the clearest, most accurate view of the truckload marketplace with data from DAT iQ.

Tune into DAT iQ Live, live on YouTube or LinkedIn, 10am ET every Tuesday.

The index reports a 0.6% decrease in May from April but a 1.0% increase year over year. The decline is linked to weaker production in nonmetallic mineral products (NAICS 327) and construction wholesaling (NAICS 4233), reflecting the slowdown in single-family housing.

According to Prof Miller, “The May ton-mile index shows a slight cooling in demand compared to April. Given the ongoing weakness in manufacturing orders, I anticipate the index will struggle to improve in the second half of the year as new tariffs are implemented.”

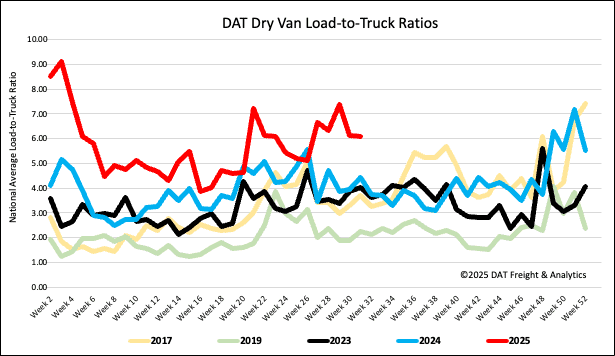

Load-to-Truck Ratio

Last week, both load post volumes and carrier equipment posts saw a 6% decrease. Despite this, load post volumes are still 8% higher than last year. As a result, the dry van load-to-truck ratio stayed relatively stable at 6.09.

Note: To provide a clearer view of seasonal trends, the pandemic-influenced years of 2020, 2021, and 2022 have been excluded.

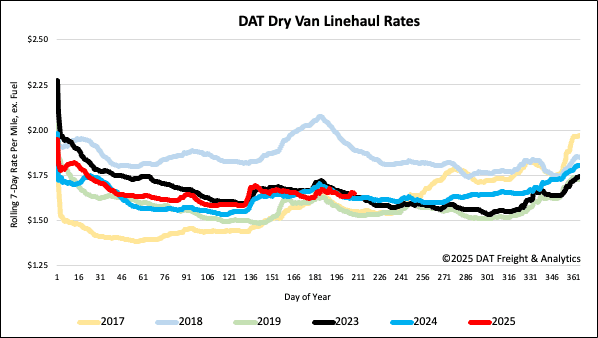

Linehaul spot rates

Dry van linehaul spot rates saw a $0.01 decrease last week, averaging just over $1.65 per mile, remaining $0.03 higher than the same time last year.

The average rate for DAT’s top 50 lanes by load volume decreased $0.01 per mile to $2.00 per mile and $0.35 higher than the national 7-day rolling average spot rate.

In the 13 key Midwest states, which represent 45% of national load volume and often indicate future national trends, spot rates fell by $0.03 per mile on a 1% lower volume of loads moved. Carriers in thesestates earned an average of $1.86 per mile, which is $0.21 above the national 7-day rolling average.

Note: To provide a clearer view of seasonal trends, the pandemic-influenced years of 2020, 2021, and 2022 have been excluded.