Flatbed Report: Residential construction drops as builder confidence hits new low

Builder confidence dropped for the eighth month in August as the declining housing market weathered rising interest rates and ongoing supply chain disruptions.

Builder confidence dropped for the eighth month in August as the declining housing market weathered rising interest rates and ongoing supply chain disruptions.

The second quarter of 2022 was another excellent one for Daseke, the largest flatbed and specialized transportation and logistics company in North America.

Despite the news headlines, economic activity in the manufacturing sector grew in July, with the overall economy achieving a 26th consecutive month of growth.

Steel output in the U.S. in the week ending July 30th fell by 7.3% compared with the same time frame in 2021, according to the American Iron and Steel Institute.

The housing market continues to cool following the 8% m/m decrease in the number of new single-family homes constructed in June.

The housing industry is one of the first to react to the continual Federal Reserve interest rate hikes.

May’s new orders for manufactured goods increased by 1.6% m/m representing an increase in twelve of the last thirteen months.

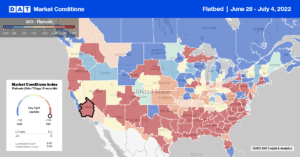

By Christina Ellington Flatbed demand out of Kentucky may see a decline in the next few months as an aluminum

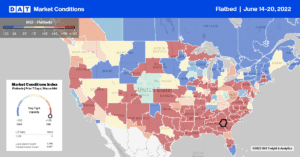

By Christina Ellington Steel output in the U.S. in the week ending June 11 fell by 3% compared with the

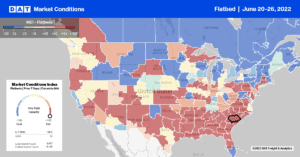

By Christina Ellington The U.S. Census Bureau residential construction statistics for May 2022 show that while homes under construction are

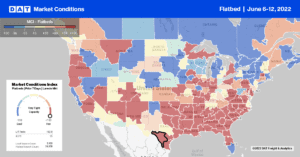

By Christina Ellington As fuel prices continue to rise with no apparent end in sight, oil companies can’t drill wells

By Christina Ellington The Institute for Supply Management (ISM®) Purchasing Managers Index (PMI®) continues to be a reliable indicator of