According to the National Association of Home Builders (NAHB)/Wells Fargo, Housing Market Index (HMI), “Rising inflation and higher mortgage rates are slowing traffic of prospective home buyers and putting a damper on builder sentiment.” The HMI is based on a monthly survey of home builders. In a troubling sign for the housing market, builder confidence in the market for newly-built single-family homes posted its sixth straight monthly decline in June, according to the NAHB report. The June HMI dropped two points to 67, 17% lower than June last year and the lowest reading since June 2020.

According to NAHB Chief Economist Robert Dietz, “The housing market faces both demand-side and supply-side challenges. Residential construction material costs are up 19% year-over-year with cost increases for various building inputs, except for lumber, which has experienced recent declines due to a housing slowdown. On the demand-side of the market, the increase for mortgage rates for the first half of 2022 has priced out a significant number of prospective home buyers, as reflected by the decline for the traffic measure of the HMI.”

In the manufacturing sector, there was better news following the release of the U.S. Census Bureau M3 report. May’s new orders for manufactured goods increased by 1.6% m/m representing an increase in twelve of the last thirteen months. Shipments increased by 1.8% m/m representing an increase in twenty-four of the last twenty-five months. As a leading indicator of flatbed demand, new orders for manufactured durable goods increased 0.7% m/m in May.

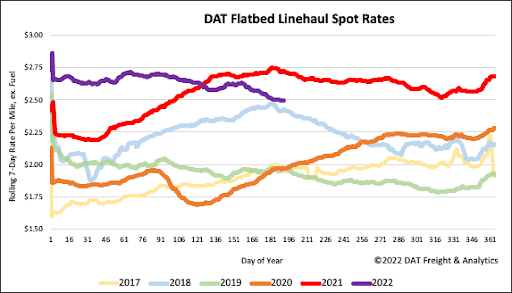

All rates cited below exclude fuel surcharges unless otherwise noted.

After dropping for the previous three weeks, load post volumes surged, increasing by 86% last week in Laredo. As a result, capacity tightened rapidly, pushing up spot rates by $0.28/mile to an average outbound of $2.86/mile. On the Laredo to Ft. Worth lane, rates increased by $0.26/mile to $2.89/mile – the second-highest reading in 12 months and $0.02/mile higher y/y. On the number-one flatbed volume lane from Houston to Ft. Worth, rates reached a 12-month high of $4.29/mile even though the load volume dropped by 2% w/w.

In the Midwest Region, capacity tightened in Kansas City, MO, following a 63% w/w increase in load post volumes following four weeks of decreasing volumes. Spot rates have followed a similar monthly trend until last week’s $0.07/mile to an average of $2.27/mile. On the 600-mile haul west to Denver, flatbed rates were flat at $2.48/mile while capacity loosened on the short-haul lane to Omaha. Spot rates dropped by $178/load last week to an average of $505/load or around $400/load lower than the previous year.

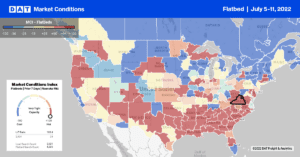

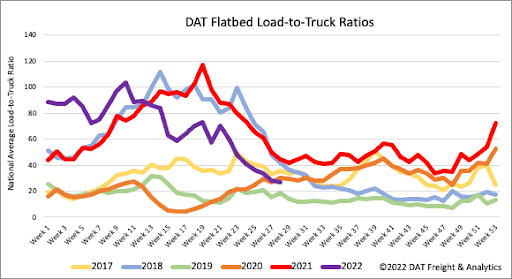

Flatbed load post (LP) volumes are sitting around 22% lower than this time in 2018 when the bull market started to turn. Last week’s LP volumes were almost identical to 2020 levels but continue to track seasonally the closest to 2018 levels with equipment posts (EP) tracking the closest to 2019 levels when the market was also over-supplied. As a result of lower LP and EP levels last week, the flatbed load-to-truck (LTR) ratio decreased to 26.67.

Flatbed linehaul rates were flat last week ending the week at around $2.51/mile. Demand is clearly cooling off for flatbed carriers following the $0.11/mile decrease in spot rates in the last month with 2018 rate directionality the most likely outcome this year. Flatbed spot rates are now $0.23/mile lower than last year but still 3% or $0.07/mile higher than in 2018. Compared to prior non-pandemic years, flatbed linehaul rates are $0.49/mile higher.