Flatbed carriers serving the Texas oil patch are seeing a slackening in demand as drilling in the Permian Basin slows to multiyear lows. According to Baker Hughes, as of mid-October 2025, the Permian Basin rig count stands at 251 active rigs—down sharply from 304 rigs a year ago and representing the lowest level since late 2021. Nationwide, the total U.S. rig count ticked up by one to 548, but remains 6% below last year’s level. Texas saw a drop of one rig, bringing its total to 237, the lowest in four years. Since the new administration took office, rig counts have decreased by 41, or 7%, despite the Trump Administration’s “Drill Baby, Drill” election promise.

Get the clearest, most accurate view of the truckload marketplace with data from DAT iQ.

Tune into DAT iQ Live, live on YouTube or LinkedIn, 10am ET every Tuesday.

With producers trimming capital budgets and focusing on debt reduction rather than new drilling, fewer wells are being spudded, directly reducing move volumes for casing, drill pipe, and other heavy materials that move by flatbed into Midland and Odessa. For trucking operators whose primary freight flows tie to energy-field activity, the contraction is translating into softer utilization and less outbound traction from steel distributors around Houston and Baytown. DAT data shows flatbed loads destined to West Texas are down 40% in the last year, while spot rates on the Houston to Lubbock flatbed lane, the largest in the state, are 3% lower than 2024 levels.

Flatbed Market Conditions

Last week, the flatbed load-to-truck ratio dropped to 23.81. This was primarily due to a 3% decrease in flatbed load posts, with only a slight reduction in equipment posts. Freight brokers noted significant capacity limitations in the Miami market, where flatbed load posts jumped by 42% last week as scale houses were repurposed into immigration enforcement centers.

Capacity is tightening in the Pacific Northwest, with load post volume increasing by 18% last week and 22% month-over-month. As a result, regional spot rates rose by $0.12 per mile last week, reaching an average outbound rate of $2.41 per mile. Portland, the largest flatbed market in the region, saw a 24% increase in load post volume last week, primarily for loads destined for San Francisco and Stockton.

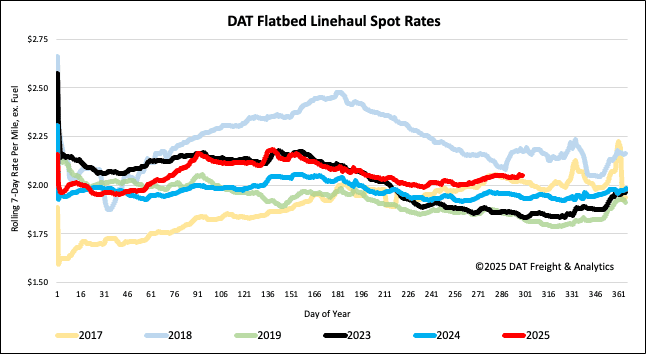

National flatbed spot rates

Flatbed rates were flat for the second week, remaining at $2.07 per mile, $0.11 higher or 6% higher than last year and $0.21 higher than in 2023. Last week, the spot rate surpassed the 2017 rate by $0.03/mile, after closely mirroring it throughout the year.