Residential construction, specifically for single-family homes and existing home repair and remodeling, drives flatbed demand for lumber. According to Dustin Jalbert of Fastmarkets, the latter accounts for up to 40% of this demand. While the federal government shutdown has delayed the release of the U.S. Census Bureau’s September residential construction data—a key indicator for flatbed trucking—we can still evaluate the home repair and remodeling market using third-quarter earnings reports from Home Depot.

Get the clearest, most accurate view of the truckload marketplace with data from DAT iQ.

Tune into DAT iQ Live, live on YouTube or LinkedIn, 10am ET every Tuesday.

Home Depot’s comparable store sales in the US declined by 3.5%, marking the fourth consecutive quarter of negative growth. This trend reflects homeowners’ continued preference for smaller projects, as larger, financing-dependent remodeling categories remained weak. Similarly, Lowe’s reported ongoing softness in major home remodeling purchases during the second quarter, indicating many homeowners are still postponing significant renovations. While appliance and seasonal event sales, such as Halloween decor, were positive, they were not enough to counteract the year-over-year decrease in demand driven by remodeling.

In summary, both Home Depot and Lowe’s experienced sluggish home remodeling sales in Q3 2025 as customers remained focused on modest-sized, budget-conscious home improvements.

Flatbed Market Conditions

Last week, the flatbed load-to-truck ratio saw a slight increase to 23.91. This was a result of a 6% decrease in load posts combined with a 9% reduction in available equipment posts.

Capacity remains constrained in the Pacific Northwest, where load post volume surged by 11% last week and a significant 55% month-over-month. Specifically, in Medford, load post volumes rose by 13% last week, primarily for shipments heading to the San Francisco Bay Area and Los Angeles. This high demand for flatbeds drove outbound spot rates up by $0.37 per mile, representing a 15% increase last week. Carriers received an average of nearly $1,500 per load, including fuel, for loads to Stockton, which is approximately $50 more per load than at this time last year.

National flatbed spot rates

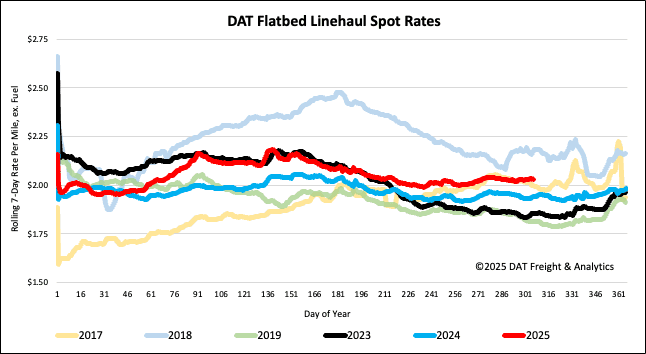

After remaining flat for the prior two weeks, flatbed rates dropped $0.02 per mile to a national average of $2.05 per mile last week, $0.09 or 5% higher than last year. Last week, the spot rate continued to exceed the 2017 rate by $0.03/mile, after closely mirroring it throughout the year.