Each Fall, the Willamette Valley in Oregon, a hub for North America’s Christmas tree production and helicopter harvesting, transforms into a logistical hotspot. Growers depend on truckload carriers to transport hundreds of thousands of trees, often within a hectic 30-day timeframe surrounding Thanksgiving. This surge leads to a temporary, significant increase in demand for dry van and reefer trucks entering the Pacific Northwest market, seeking specialized, high-paying loads.

Get the clearest, most accurate view of the truckload marketplace with data from DAT iQ.

Tune into DAT iQ Live, live on YouTube or LinkedIn, 10am ET every Tuesday.

Despite helicopters delivering bundles of freshly cut Christmas trees every 30 seconds to loading pads, the shipping season is extended by destination and transit time. It commences with the longest journeys, including international markets such as Dubai, Hong Kong, or Singapore, and long-haul destinations east of the Mississippi (like Texas), which necessitate reefers. Around the same period, Wreaths Across America receives supplies for wreath-laying ceremonies nationwide on December 13th, and shipping containers are loaded for retailers in Hawaii.

The main push for domestic trees begins in early to mid-November, rapidly intensifying 7 to 10 days before Thanksgiving. This surge targets large western markets, frequently using rail piggyback trailers (containers on flat cars) to ship bulk loads to major distribution centers like Los Angeles or San Diego when over-the-road truckload capacity tightens. According to Noble Mountain Tree Farm, after dry vans are loaded, trucks transport the Douglas firs to a third-party where a ton of ice is blown over them for the day-and-a-half trip to Southern California.

The peak truckload harvest in the Pacific Northwest operates seven days a week during the critical period just before Thanksgiving, with peak shipping days seeing over 60 loads dispatched daily. This is when growers fiercely compete for dry van trucks to supply regional and West Coast markets, driving spot rates up by as much as 20% in the three weeks leading up to Thanksgiving.

Reefer market conditions

Even though national load post volumes were flat last week, there was considerable tightness in capacity as measured by a surge in load posts in the West stretching all the way from Nogales, AZ to Medford, OR. Reefer load post volumes spiked by 34% last week and are up 41% in the last month in this region, and in the largest produce market in California, load posts were up 40% last week in Fresno and 70% in the last month.

Recent enforcement actions by the California Department of Transportation and Immigration and Customs Enforcement (ICE) are strongly suspected to be impacting available capacity in the region. This is a trend we’ve been monitoring and reporting on in recent weeks.

However, the current off-season for West Coast produce growers means that this reduced capacity is unlikely to cause a rise in reefer spot rates in the immediate future. Last week, California produce volumes dropped by 15%, contributing to a 10% decrease year-to-date. Consequently, outbound reefer rates remained mostly flat, averaging approximately $2.30 per mile.

Following the end of the Federal Government shutdown, the USDA has resumed normal operations, reporting a 5% week-over-week increase in produce volumes for temperature-controlled freight last week. Specifically, Washington State saw a 3% rise in apple volumes, and Idaho’s dry onions were up 5% from the previous week. According to the USDA, refrigerated carriers transporting fruits and vegetables earned an average of $3.36 per mile last week, a rate that was almost identical to the same period last year.

The Miami market experienced a significant surge in reefer load post volumes last week, increasing 19% week-over-week and 40% over the last month. This boost is primarily driven by demand for long-haul routes to Dallas and New York. This period also marks the beginning of Florida’s citrus season, including early shipments of oranges, tangerines, and grapefruit. Additionally, fall harvests are starting for leafy greens, like romaine, and the initial strawberry crops from the Plant City area.

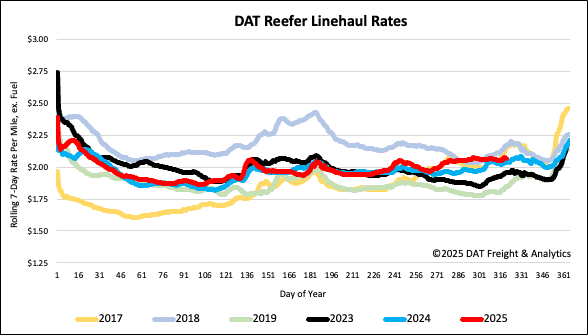

Reefer national spot rates

The national 7-day rolling average for last week settled at $2.08 per mile, a single-penny drop, matching the decline seen last year. This rate is $0.03 per mile, or 1%, higher than the rate at this time last year, and it is also $0.03 per mile above the three-month trailing average.