The housing market continues to cool following the 8% m/m decrease in the number of new single-family homes constructed in June. According to the Census Bureau, the number of new single-family homes built was 86,000 fewer than in May and 179,000 less than in June last year. Building permits for future construction were also down 8% m/m and 9% y/y. For context, the number of new single-family homes constructed in June was still 13% more than in June 2018, during the peak of the 2018 freight market. That’s the equivalent of 115,000 more homes built last month compared to 2018.

The star of the post-pandemic economic recovery is starting to fade also as consumer confidence in the housing market drops. According to the National Association of Home Builders’ monthly confidence index, the July reading of 55 is the second most significant decline in the index’s history. This time last year, the index stood at 80. A similar trend was also reported by Fannie Mae, with Home Purchase Sentiment Index® (HPSI) dropping 3.4 points in June to 64.8, its second-lowest reading in a decade. According to Doug Duncan, Fannie Mae Senior Vice President and Chief Economist, “In June, a survey-record 81% of consumers reported that the economy is on the wrong track, suggesting that people appear to be growing increasingly frustrated with inflation and the slowing economy”.

All rates cited below exclude fuel surcharges unless otherwise noted.

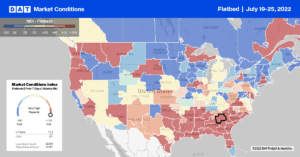

Following the prior week’s 52% w/w increase in load posts, flatbed capacity remained tight in Lakeland, FL, following last week’s $0.05/mile increase to $2.02/mile. Loads to Greenville, SC, dropped to their lowest level in 12 months at $1.43/mile, while loads to Atlanta followed the same trend decreasing from $0.16/mile in the last few weeks to $1.37/mile. Along the Gulf Coast, spot rates were much better for flatbed carriers. In Houston, spot rates were up $0.06/mile to $2.93/mile, and in neighboring New Orleans, outbound spot rates increased by $0.17/mile to an average outbound rate of $3.36/mile.

In Nashville, TN, load post volumes increased by 20% last week, resulting in capacity tightening and a $0.16/mile increase to $3.41/mile. Savannah, the fourth largest port market for imports, saw load post volumes increase by 23% last week while capacity increased, driving down spot rates by $0.13/mile to $3.05/mile. Even though load post volumes are down 71% in the last month in Columbus, OH, flatbed capacity remains tight following the previous week’s $0.29/mile increase to $3.21/mile. Short-haul loads to Louisville, KY, are up just over $100/load in the last few weeks to an average of $886/load.

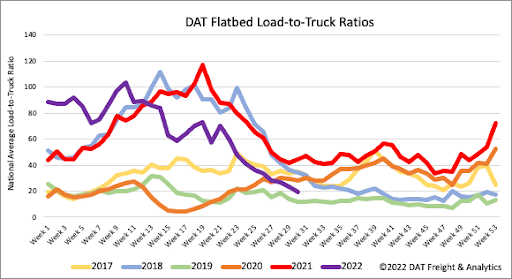

Flatbed load post (LP) volumes are within 3% of 2020 levels following last week’s 17% w/w decrease. Volumes are now 10% lower than this time in 2018, having declined 35% in the previous month. Equipment post volumes hit an all-time high surpassing the previous record set in late 2019. The net effect on the flatbed load-to-truck (LTR) ratio last week was another decrease to 19.01, with only 2019 recording a lower LTR for the third week of July.

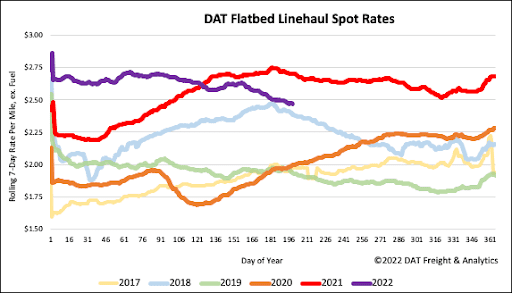

Flatbed linehaul rates have dropped $0.19/mile since the start of the year, with the majority of the decrease occurring in the last seven weeks, with rates dropping $0.17/mile over that timeframe. Following last week’s $0.01/mile decrease, the national average flatbed spot rate is just over $2.48/mile, which is $0.22/mile lower y/y but still $0.08/mile higher than in 2018.