Truckload supply dictates price in imbalanced freight markets

Historically, increased spot market activity signaled higher overall truckload demand and tighter capacity. This year we’re seeing something of a

Historically, increased spot market activity signaled higher overall truckload demand and tighter capacity. This year we’re seeing something of a

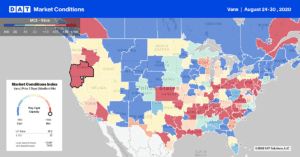

While spot rates continue to spike, many motor carriers are making business decisions based on what they learned from 2018.

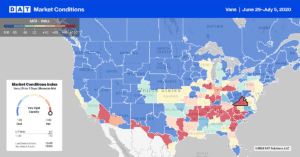

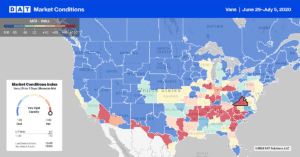

As we reach the five-month mark of the pandemic, the freight market has yet to reach any semblance of equilibrium

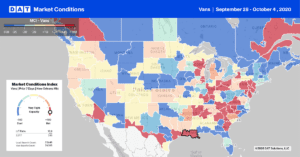

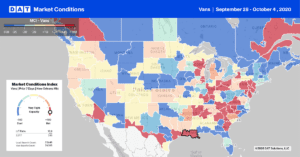

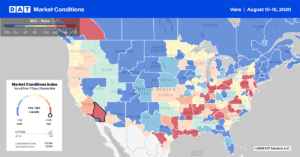

With freight markets already upended by COVID-19, supply chains are in a precarious position heading into hurricane season. Further complicating

While there’s evidence emerging that truckload volumes may be stabilizing, the direction of spot rates remains uncertain, with upward pressure

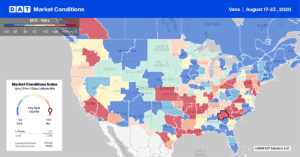

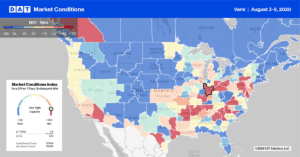

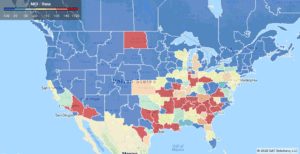

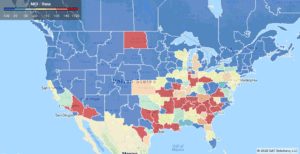

The coronavirus continues to drive the direction of the freight economy, and although the COVID Tracking Project reports that new

The coronavirus continues to drive the direction of the freight economy, and although the COVID Tracking Project reports that new

Several key factors cloud the current freight outlook: The possible end of the extended unemployment insurance program next week, COVID-19

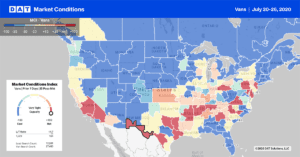

The third week of July is normally the busiest for summer vacationers, and seasonal retailers rely on them. But with

June provided some much-needed recovery for truckload markets, but as COVID-19 outbreaks grow exponentially in major freight markets, including California,

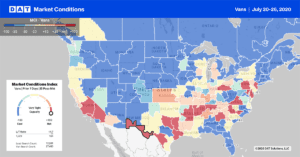

Last week saw a huge surge in demand and prices on the spot market, as shippers closed the books on

Last week, COVID-19 hotspots erupted both across the country and world, in places that had been declared COVID-free, such as