Freight Volume Heats Up in Northern Regions, as Q1 Closes

Our usual theme for Spring is to look South for an increase in freight activity. This year has been different

Our usual theme for Spring is to look South for an increase in freight activity. This year has been different

The crazy weather continues to disrupt freight patterns. The American Trucking Associations blamed ice and snow for a decline in

The weather had a huge impact on last week’s freight movements, including some unexpected developments. Certain secondary markets were

Investment analysts see indicators of a recovery in the manufacturing sector, particularly in the Midwest, but current trends in

Freight is moving like gangbusters on the spot market, and rates are trending up again. This is unusual for the

Rates are unusually strong on the spot market in mid-August, especially for reefers and vans. Reefers Get a Lift –

Van and flatbed rates rebounded this week, following “Backhaul Tuesday.” Van rates jumped 4¢ per mile as a national average

Got reefers? It’s time to move ’em on down to produce markets in the Southern states. Spring is finally here.

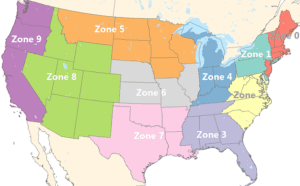

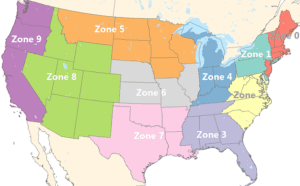

Where’s the Action? Right now, you’re either shaking your head and saying there’s no action at all, or you are