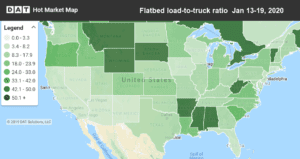

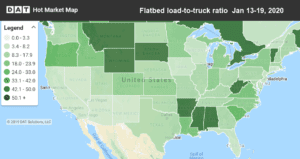

Flatbed rates see off-season surge

Since 2014, van and reefer rates have peaked late in the 4th quarter, thanks to the impact of e-commerce freight. Flatbed loads, however,

Since 2014, van and reefer rates have peaked late in the 4th quarter, thanks to the impact of e-commerce freight. Flatbed loads, however,

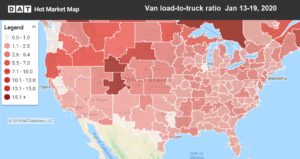

Here comes the winter slump. Van rates slipped below December levels last week, after an unexpected surge in the first

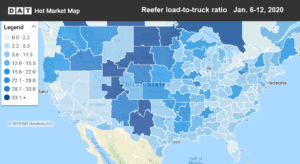

The holidays are over, and there’s not a lot of fresh produce being harvested in the U.S. So why are rates

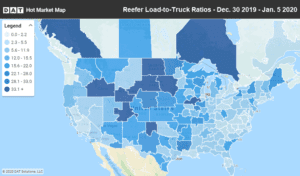

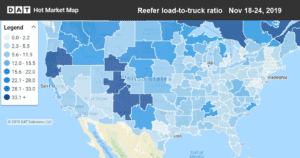

Reefer rates rose in the first week of January, an unexpected trend for the start of the slow season. Nearly

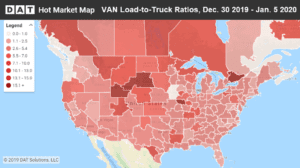

Van and reefer rates continued to rise in the first week of January, a sign that there’s still some momentum

Spot market rates rose sharply last week, as urgency mounted to deliver holiday gifts before Christmas. Then spot market activity

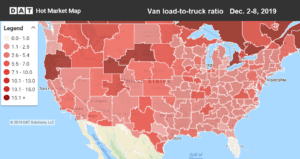

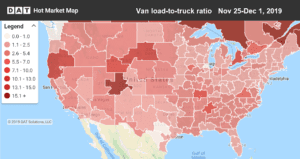

All the nice van carriers are being rewarded by Santa this month, as they haul gifts and other seasonal merchandise

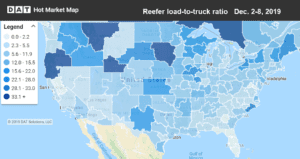

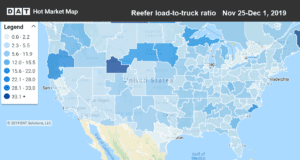

If you were expecting Thanksgiving to be the end of the season for reefers, think again. Rates are still rising.

The holiday rush is underway. Last week, van rates hit their highest level since January, as the national average jumped

Thanksgiving coincided with the end of the month, adding extra urgency to truckload reefer shipments. That boosted rates and pushed the

Thanksgiving week was short but intense. Thanksgiving occurred later in November this year, so the holiday weekend coincided with end-of-month pressures. Not surprisingly,

The holiday rush is underway. Refrigerated freight volumes hit a new weekly record, surpassing even 2017’s record-setting volumes. Reefer rates jumped more