Reefer rates rose in the first week of January, an unexpected trend for the start of the slow season. Nearly all the major reefer lanes got rate increases, with the biggest increases on lanes that started in South Florida or South Texas and headed north.

The reason is simple. Fresh produce makes up a big part of spot market reefer freight, and the winter is not a big produce-growing season in the U.S. So we import our fresh fruits and veggies from Mexico, via Texas and Arizona, and also from the Caribbean and South America, via Miami. Some produce travels by sea all the way up the coast to the port at Elizabeth, NJ, but mostly it lands in Florida and heads north by truck.

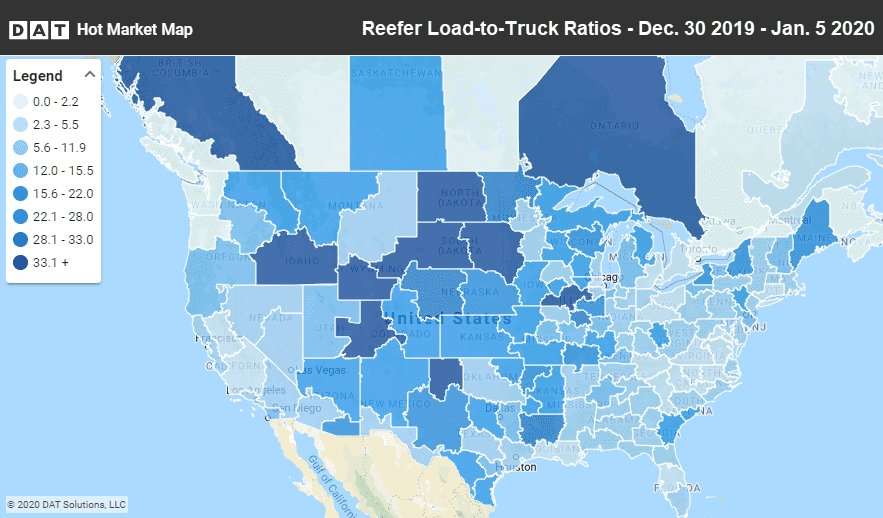

Hot Market Maps, an interactive feature in the DAT Power load board and DAT RateView, depict load-to-truck ratios in 135 U.S. freight markets, so you know where to start your next search.

It’s good news for reefer carriers. You have a lot of choices, and the rate trends are running in your favor. If you’re a broker, keep an eye on DAT RateView so you don’t go upside-down on your profit per load.

Rates rise on routes from South to North

- Lakeland, FL to Baltimore rates soared from $1.94 to $2.81 per mile. That’s an 87¢ increase. Southbound direction paid $2.23 last week, but there weren’t a lot of loads. You might have to deadhead or work in a TriHaul, which is a triangular route that replaces one leg of the round trip with two hauls that get you home.

- Miami to Boston rocketed up 48¢ to $2.38, and Boston to Miami paid $2.21, but there weren’t many loads in either direction. Still, you could get lucky.

- Dallas to Columbus jumped to $2.40 per mile from $1.90, and Columbus to Dallas dropped 7¢ to $2.03. That’s a nice roundtrip.

- Tucson to Los Angeles added 47¢ to $2.65 per mile, and the eastbound rate rose 13¢ to $3.13 from L.A. to Tucson. If you’re in Southern California, check it out. The rates are even better if you’re further inland, in the Ontario, CA, market area.

- McAllen, TX to Elizabeth rates added 42¢ to $2.93. It’s hard to get a load home from New Jersey, though, and they only paid $1.32 last week. See if you can put together a TriHaul via Cape Girardeau, MO.

Demand cools in Midwest markets and southbound lanes

The Midwest didn’t fare so well last week, and some southbound lane rates declined where northbound rates rose. That’s a common trend with lane pairs. The declines were not as dramatic as the increases, however.

- Grand Rapids, MI to Madison, WI lost 9¢ to $2.87 per mile. Try Grand Rapids to Cleveland instead, at $4.14 per mile and trending up.

- Twin Falls, ID, to Phoenix dropped 4¢ to $2.61. The return trip also paid $2.61 last week, but there weren’t a lot of loads heading that way.

- Philadelphia to Miami edged down 2¢ to $2.09 last week, but it may be heading back up already. I’m seeing a 7-day average of $2.14 today. Miami to Phildelphia got a 19¢ boost, to $2.07. Not a bad roundtrip for January but if you have a choice, try Baltimore instead.

- Denver to Houston also lost 2¢, to $2.19 per mile, and then dropped again, to $2.13. Houston to Denver is stable at $1.99. Not great rates, and there’s not a lot of freight in either direction. Keep looking.

Note that there’s snow and ice in the forecast this week, so you may need to deploy reefer trailers to keep temperature-sensitive cargo from freezing. That doesn’t always pay as well as loads of fresh produce, but it will keep the trailer full and the wheels rolling in the Midwest and Northeast this winter. Be sure you and your rig are prepared for the cold, and stay safe out there.