Spot market poised for stronger Q4

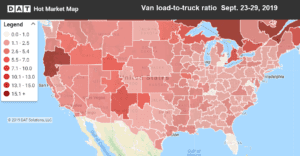

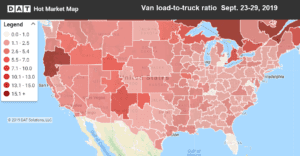

We usually see a boost in freight volumes in the last week of the quarter, and last week was no

We usually see a boost in freight volumes in the last week of the quarter, and last week was no

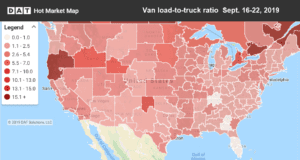

Tropical Storm Imelda hit the Gulf Coast last week, bringing up to 40 inches of rain to the Houston area. Houston

After moving slowly across the Atlantic and devastating several islands in the Bahamas, Hurricane Dorian reached the East Coast of the

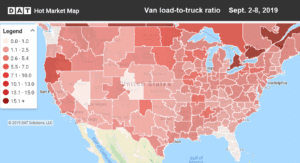

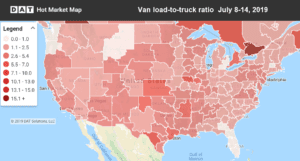

It’s typical for rates to fall after the Fourth of July, and this year was no different. Now that the holiday

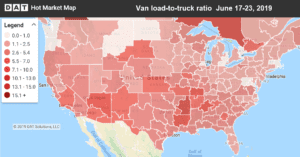

June freight volumes have been rising the past two weeks, ever since International Roadcheck took some capacity off the road during

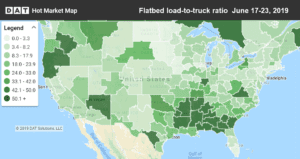

While van prices have remained fairly stable in the past couple weeks, we’ve seen some huge swings in the flatbed

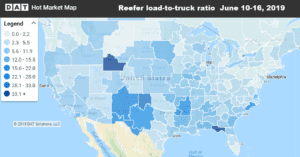

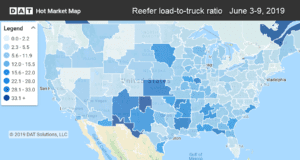

Just as we saw with van freight, reefer rates and load-to-truck ratios cooled down last week after rising sharply the

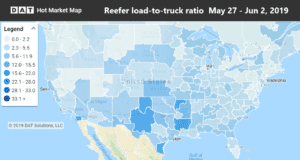

What do you get when you combine produce season with International Roadcheck week? You guessed it: a jump in both rates

Although van freight got a nice boost last week because of the shortened Memorial Day week, the news was a

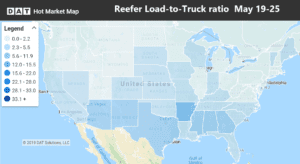

Reefer carriers finally got some good news last week. Demand for refrigerated trailers has been relatively soft this year, but

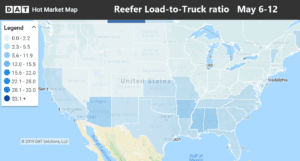

First the bad news: Refrigerated truckload freight took a step back last week due to weakness in Florida and some

Reefer loads saw a sharp increase last week, but just as we saw with vans, there appeared to be enough capacity