Reefer freight hits its stride as summer produce arrives

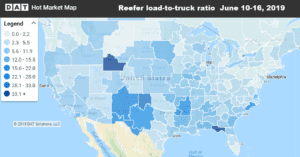

After a slow start, reefer freight is finally hitting its stride. We’ve seen a uptick in both rates and freight

After a slow start, reefer freight is finally hitting its stride. We’ve seen a uptick in both rates and freight

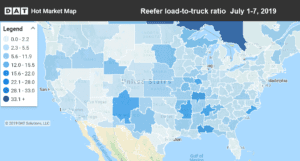

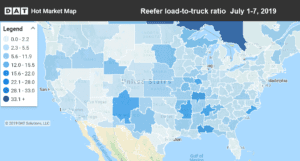

The run-up to the 4th of July holiday brought increased demand for refrigerated truckload shipments, and reefer freight volumes hit

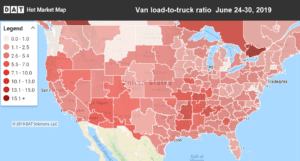

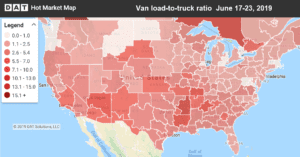

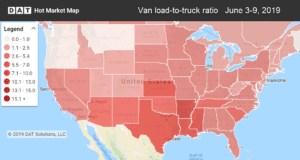

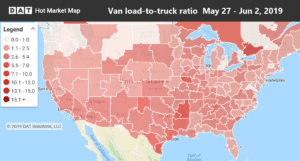

June freight volumes finished the month strong, and rates responded to close Q2. Over the past six weeks, van rates

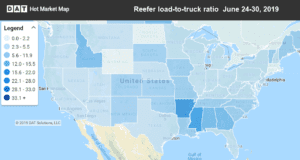

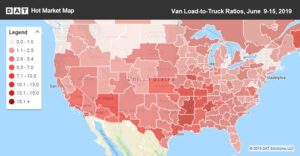

June freight volumes have been rising the past two weeks, ever since International Roadcheck took some capacity off the road during

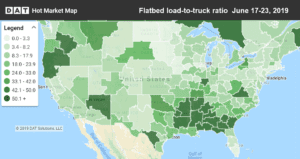

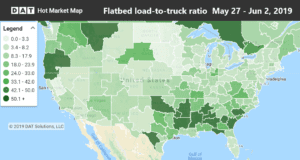

While van prices have remained fairly stable in the past couple weeks, we’ve seen some huge swings in the flatbed

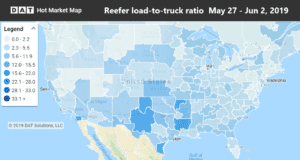

Summer freight is on its way, just as spring has finally sprung — and it’s not all about Roadcheck. The

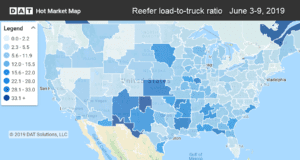

Just as we saw with van freight, reefer rates and load-to-truck ratios cooled down last week after rising sharply the

For many motor carriers, June couldn’t get here fast enough. This is typically the busiest time of the year for spot

What do you get when you combine produce season with International Roadcheck week? You guessed it: a jump in both rates

Although van freight got a nice boost last week because of the shortened Memorial Day week, the news was a

What a difference a year makes. Last year at the end of May there were about 90 flatbed load posts for

Carriers have been waiting for good news for awhile now, and spot market rates finally started picking up steam last