The run-up to the 4th of July holiday brought increased demand for refrigerated truckload shipments, and reefer freight volumes hit their peak. That pushed prices higher, with reefer rates rising on 46 of the top 72 reefer lanes last week.

Leading the push was California, where reefer volumes and rates were up in the four largest markets in the state. Outbound rates from Los Angeles rose 9% in June. In the Southeast, Atlanta rates climbed 11% last month. In Florida, rates and volumes increased coming out of Miami, but declined from Lakeland.

June ended with the highest monthly average rate since January, hitting $2.25/mi.

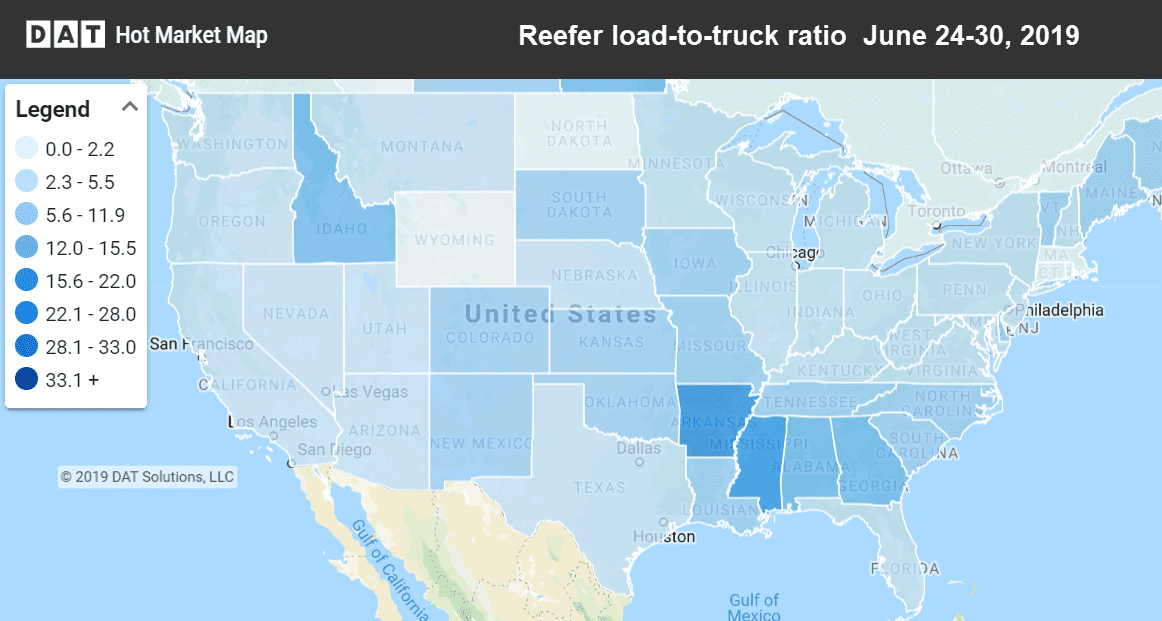

Last week trucks were hardest to find in Arkansas, Mississippi and Idaho. Hot Market Maps are available in DAT Power and DAT RateView.

Rising rates

The region with the largest price gains was the Midwest. There are currently a number of lanes above the $3/mi. mark.

- Grand Rapids, MI, to Philadelphia surged 41¢ to $3.14/mi.

- Green Bay to Philadelphia jumped 31¢ to $3.03/mi.

- Chicago to Philadelphia increased 26¢ to $2.99/mi.

- The Northeast’s top lane: Elizabth, NJ to Boston added 31¢ to $4.01/mi.

- Out west: Sacramento to Salt Lake City gained 29¢ to $2.89/mi.

- Twin Falls, ID, to Phoenix added 30¢ to $1.99/mi.

Falling rates

In the lanes where prices fell, most declined just a few pennies. We did, however, see falling rates coming out of the border towns of Nogales, AZ and McAllen, TX.

- Nogales to Dallas dropped 33¢ to 2.67/mi., after rising 49¢ the previous week

- Nogales to Los Angeles fell 30¢ to $2.41/mi., also moving down from a recent high

- Green bay to Minneapolis slipped 18¢ to $2.39/mi. This is an example of regional lane moving opposite of the seasonal pattern.

Find loads, trucks and lane-by-lane rate information in DAT load boards, including rates from DAT RateView.